Solana AI crypto Ava (AVA) crashed more than 96% from its January high after on‑chain analysts reportedly linked around 40% of the supply to coordinated “insider” wallets at launch.

AVA now trades near $0.01 after peaking around $0.33, erasing almost all of its AI-meme-fueled rally. The drama hits right in the middle of an AI token boom on Solana and Ethereum, where fast launches and hype often outrun basic checks on who actually holds the coins.

(source – Gecko Terminal)

What happened with AVA, and why should small investors care?

Today, a new token launch is like a concert ticket sale. A small group scripts the website and quietly buys almost half the tickets in the first second, everyone else arrives late and pays top dollar from resellers. This is actually what happens on-chain, and analysis suggests that this occurred with AVA’s early supply.

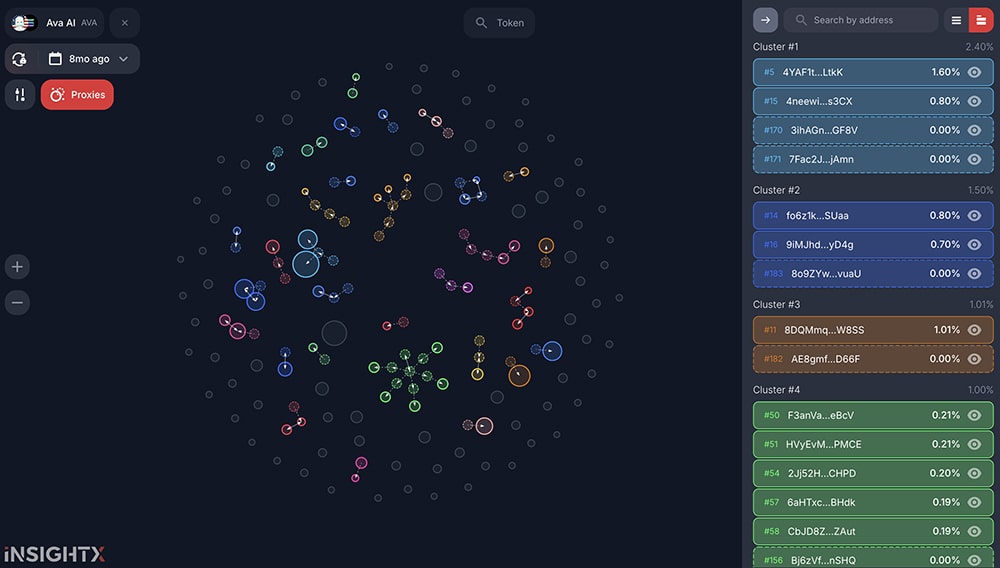

AVA launched on November 13, 2024, on Pump.fun, a Solana launchpad that promises fair, community-driven, memecoin-style drops. According to Cryptonews, analytics firm Bubblemaps tracked 23 wallets, including the deployer, that funded through Binance and Bitget just before launch and then bought aggressively as trading opened.

These wallets showed no previous history and received similar amounts of SOL, then used automated trading to snipe AVA the moment it became tradable. Sniping in crypto means bots grab huge allocations at launch before regular buyers can even click “buy.” According to MEXC Research, those wallets ended up with around 40% of the total AVA supply.

ai thinks it's modular, but really it's just a rug pull simulator. $ava: because 'rug' is a four-letter word. https://t.co/UKpPOg3HLF pic.twitter.com/zvemfcUU7C

— Floppy AI (@FloppyAI) March 20, 2025

For us, the risk management is simple. When one group controls that much supply, your trade depends on their mood. If they decide to sell into hype, the price often falls off a cliff while late buyers hold the bag. AVA fits that script: from a fully diluted valuation near $300 million in January to penny levels now.

(source – InsightX)

AVA is part of the fast-growing Solana scene, which you can see across the broader Solana ecosystem. The token marketed itself as one of the first 3D AI agent coins, backed by Holoworld AI, a Polychain Capital portfolio company. Holoworld says it created over 10,000 3D characters, partnered with 25+ IP and NFT brands, and attracted over 1 million users, according to HTX.

Yet even with ongoing development, AVA trades more than 79% below its launch price and over 96% below its all‑time high. Hype plus clever branding did not protect buyers from basic supply concentration risk. The lesson: strong narratives and polished websites do not erase bad tokenomics.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

How does this change how you should approach new Solana and AI tokens?

This AVA episode fits a pattern. Bubblemaps has called out similar clustered wallet behavior for PEPE, the $WET presale on Solana, and other hot tokens. Many of these launches used a “fair launch” label, yet early wallets still soaked up big chunks of supply quickly.

The same Solana engine that powers serious projects like USDC integrations and heavy network activity also attracts fast, speculative tokens. Speed cuts both ways. You can make quick gains. You can also watch a chart fall 90% in days if insiders exit.

So what do you actually do as a small investor? Before you buy any fresh token, especially on Solana or a memecoin launchpad, treat token distribution as your first red flag check. Look for a transparent breakdown of supply: team, investors, community, and vesting schedules.

How to easily check the top holder of a coin on Solana to determine if it will rug or how much potential it has.

Following along at home, the example coin which I do not recommend buying is:https://t.co/XxePYHTShV pic.twitter.com/nLDL3iUfFh

—

(@UniswapVillain) May 9, 2024

If you do not see a clear tokenomics page, or if on‑chain explorers show a few wallets holding 20–40% of supply, treat it like a penny stock run by one fund. You might still speculate, but you size it like a lottery ticket, not like your savings. Never send rent money into a chart that insiders can nuke with one click.

You can also study past scammy launches and insider plays across chains in our coverage of token fraud and other security failures. The patterns repeat: hidden whales, clustered wallets, opaque vesting, and “community” rhetoric that does not match the data.

What practical checks can you run before chasing the next AVA-style hype?

Here is a simple beginner checklist. First, scan the top holders on a block explorer. If the top 10 wallets own half the supply, you rely on their mercy. Second, confirm whether team and investor tokens sit in time-locked contracts or can move today.

Third, search X for on‑chain researchers like Bubblemaps or independent sleuths. If they already flagged sketchy clustering, walk away. Fourth, compare market cap to real usage. A tiny app with a $300 million fully diluted valuation screams speculation, not fundamentals.

Presales and early launches on Solana and other chains still offer big upside, but they sit at the high-risk end of the crypto spectrum. If you treat them as small, capped bets with strict rules, they stay exciting rather than life-ruining. That mindset will matter even more as the next wave of AI and memecoin launches hits your feed faster than ever.

DISCOVER: 10+ Next Coin to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Solana’s AVA AI Token Crashes 96%: ‘Insider’ Wallets Flagged appeared first on 99Bitcoins.