Ripple CEO Brad Garlinghouse pushed back hard against a fresh XRP manipulation claim after the token slid to $1.77 before rebounding toward $1.88 during a choppy December. The move capped a 5% weekly drop. Even though XRP still trades in a higher range since Ripple’s courtroom win over the SEC.

The comments arrive in a market where new XRP futures, ETFs, and a Ripple-backed stablecoin are all reshaping how money flows around the beloved community asset.

What Exactly Did Ripple’s CEO Say About XRP Price Control?

Garlinghouse told CNN that “nobody is in a position to manipulate XRP prices.” he noted that XRP trades with multi‑billion‑dollar daily volume and tracks the crypto market rather than Ripple’s internal decisions. He said XRP is now too big and too liquid for one actor, Ripple’s backend included, to move it like a tiny micro‑cap coin.

XRP CANNOT BE MANIPULATED.

Brad Garlinghouse, CEO of Ripple, says there is nobody in a position to manipulate #XRP price. Transparent markets. Real UTILITY. Organic DEMAND.

The game is cleaner than they want you to believe. pic.twitter.com/78uNNs3JEq

— John Squire (@TheCryptoSquire) December 19, 2025

Think of liquidity like the size of the swimming pool. A small bucket of water can change the level in a kiddie pool, but not in an Olympic one. Garlinghouse said low‑liquidity tokens are vulnerable to pump‑and‑dump games, but XRP’s scale makes that far harder.

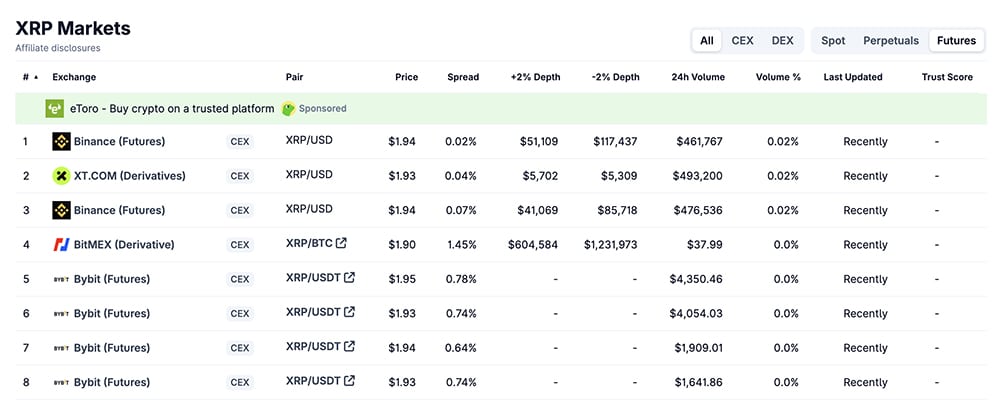

According to CoinDesk, XRP futures volume alone recently ran toward $4 billion during a sharp move, which is not the profile of a thin, easily pushed market. Although it’s dropping now, so does the crypto market.

(source – Ripple Future Volume Today, CoinGecko)

He also emphasized that banks using Ripple’s payment technology purchase XRP on the open market, not through undisclosed sweetheart deals. These large buyers often agree to lockup terms so they cannot instantly flip all their tokens back into cash, which helps smooth out sudden dumps. For a beginner, this means institutional players usually face guardrails that you, as a small trader, do not see but still benefit from.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

How Do Escrow and Regulation Shape XRP’s “Manipulation” Risk?

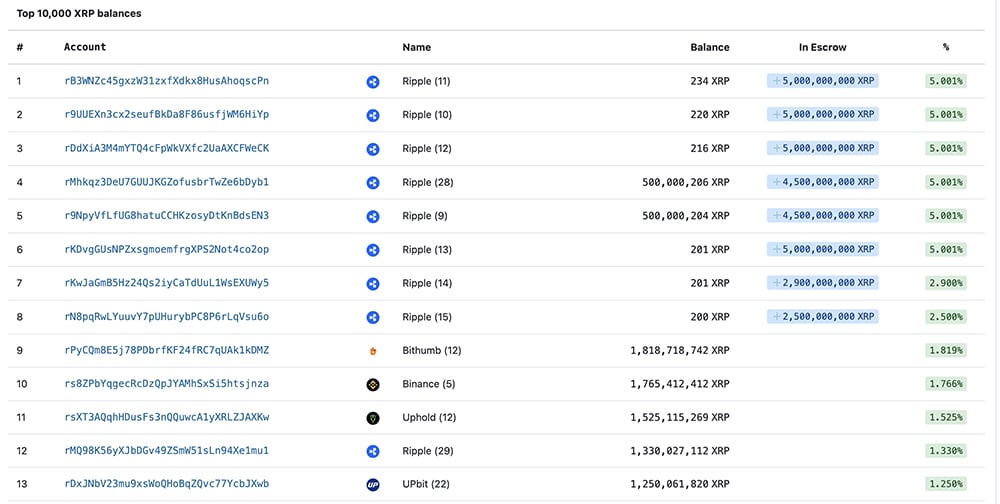

One long‑running fear in the XRP community: Ripple owns a huge stash and might “dump” it on the market. Ripple now keeps around 34.4 billion XRP in escrow and 5.1 billion in spendable wallets, releasing 1 billion each month, then relocking most of it. That schedule informs you in advance how much XRP might enter the market, which is important because sudden selling is what usually scares prices the most.

(Source – XRPSCAN)

Garlinghouse said Ripple usually keeps only about 200 million XRP per month for operations and returns the rest to escrow. He admitted in an older Financial Times quote that Ripple would not be cash-flow positive without XRP sales, but he argued that those sales now follow a predictable and transparent pattern. As a beginner, you do not need to love that model, but you at least know the faucet is on a timer, not a random fire hose.

Regulation also shifted in Ripple’s favor this year. The SEC dropped its appeal in the long XRP securities case in March 2025, which Garlinghouse called “the moment we’ve been waiting for,” according to Finance Magnates. New York regulators then approved Ripple’s dollar‑pegged stablecoin RLUSD, as reported by Barron’s, and XRP futures and XRP Futures products expanded on major venues. More regulated venues, more watchdogs, and more professional money usually mean less room for old‑school manipulation tricks.

This December marks five years since the SEC lawsuit against @Ripple began. Back then, many in the crypto community laughed and didn’t expect it would lead to real legal clarity for #XRP. But here we are, half a decade later, witnessing how that challenge helped shape a more… pic.twitter.com/bIpXrBP0qU

— X-Art

(@Dogeh8er) December 5, 2025

What does this mean for XRP buyers worried about getting “dumped on”?

For everyday buyers, the real risk is not a secret Ripple switch that nukes the price. The risk is plain old crypto volatility. XRP still dropped around 8% in a week, despite all the structure surrounding it, and sharp wicks down to levels like $1.77 will continue to occur. XRP trades on emotion, news, derivatives, and ETF flows like any large crypto, not on a guaranteed up‑only script.

New ETF products and XRP ETF Flows bring more institutional buyers and sellers into the game. That can tighten spreads and improve price discovery, but it also means big funds can exit fast when conditions change. More volume does not remove risk. It just changes who sits across the table from you.

If you already hold XRP, this story should reassure you about transparency, not convince you to double down. Treat XRP like a high‑risk altcoin with improving regulation, not like a bank deposit. Size positions modestly, avoid margins, and never use money you need for the next 3–6 months of living costs. The XRP story now revolves less around courtroom drama and more around how it behaves as a large, liquid asset in a still‑wild crypto market.

The next phase for XRP will hinge on how new futures, ETFs, and stablecoin products shape demand during the next crypto cycle. If you stay curious, size your bets carefully, and track how Ripple sticks to its escrow rules, you can ride that story without handing the market a chance to wreck your budget.

DISCOVER: 10+ Next Coin to 100X In 2025

Follow 99Bitcoins onX For the Latest Market Updates and subscribe on YouTube For The Expert Market Analysis

The post Ripple CEO Rejects XRP Manipulation Claims as Price Swings Hit appeared first on 99Bitcoins.