India will adopt the Organization for Economic Cooperation’s (OECD) Crypto-Asset Reporting Framework (CARF) by 1 April 2027. This will not only enable automatic cross-border sharing of crypto transaction data but also tighten tax oversight on offshore holdings.

Indian crypto exchanges and service providers will now collect and report customer and transaction data to local tax authorities. Data flows are expected to reveal crypto assets and activity on foreign exchanges and wallets held by Indian residents, hashing out compliance and transparency issues.

India is known for its high crypto adoption, but it is struggling to put together an effective regulatory framework. New Delhi is looking for standardized crypto tax transparency. Yes. But the Indian government is also planning to sign a Multilateral Competent Authority Agreement tailored to CARF next year, in 2026, to legally enable these exchanges, separate from India ‘s existing 2015 pact for traditional financial accounts.

According to local media reports published on 1 September 2025, legislative updates and systems integration are underway to meet the 2027 go-live timeline.

BIG BREAKING:

India is set to rewrite the CRYPTO Tax Rulebook!

From April 2027, all Indian Crypto holders, domestic & abroad, will come under OECD’s CARF framework.

A global tax pact (MCAA) will be signed in 2026.

Huge step for Crypto transparency & accountability.

Source:… pic.twitter.com/Hy0wiXZCVG

— Sapna Singh (@earnwithsapna) September 2, 2025

EXPLORE: Top 20 Crypto to Buy in 2025

India, US Lead Cryptocurrency Adoption – Chainalysis Report

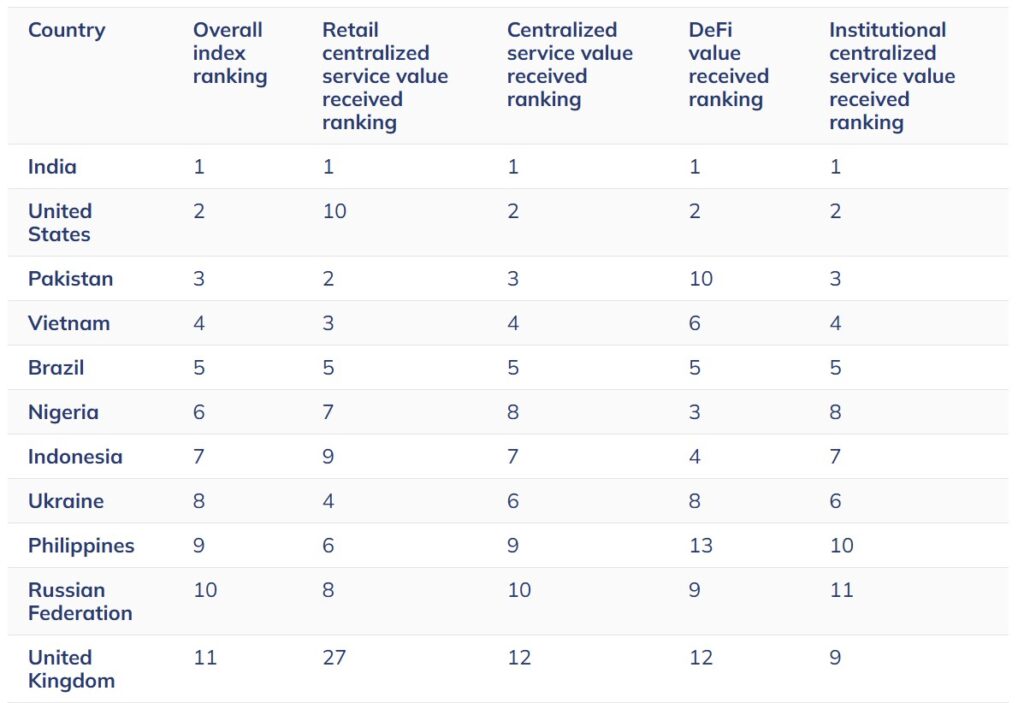

According to Chainalysis’ recent study published on 2 September 2025, India stood first and the US stood second in crypto adoption across the world.

“In 2025, APAC furthered its status as the global hub of grassroots crypto activity, led by India, Pakistan, and Vietnam, whose populations drove widespread adoption across both centralized and decentralized services,” the report stated. According to the study, total crypto transaction volume in APAC grew from $1.4 trillion to $2.36 trillion. It driven by robust engagement across markets like India, Vietnam, and Pakistan.

Meanwhile, North America climbed to the second-highest regional position in the presence of regulatory momentum. This includes the approval of spot bitcoin ETFs and clearer institutional frameworks, that helped legitimize and accelerate crypto participation across traditional financial channels.

According to the study, North America and Europe continue to dominate in absolute terms, receiving over $2.2 trillion and $2.6 trillion, respectively, in the past year.

EXPLORE: Top Solana Meme Coins to Buy in 2025

India’s Crypto Tax Talks Add Momentum To Asian Crypto Policy Reforms

The Central Board of Direct Taxes (CBDT), India’s direct tax authority, has reportedly consulted domestic crypto platforms regarding its current virtual digital asset (VDA) framework.

Industry insiders revealed that the CBDT questioned the effectiveness of the current taxation system on crypto and sought input on whether they require a standalone legal regime.

The focus seems to be on the 1% tax that authorities deduct at source (TDS) on crypto trades, the restrictions on loss offsetting, and the ambiguity around offshore transactions.

The CBDT further requested inputs regarding the shortlisting of government agencies that would oversee the development of the new crypto framework.

Read More: Asian Crypto: Policy Shifts and Blockchain Moves

Key Takeaways

-

India’s adoption of CARF follows years of tightening oversight of digital assets, now extending to offshore holdings that have historically been difficult to track.

-

Reports indicate CARF will extend to exchanges, brokers, and relevant wallet providers, and cover assets such as stablecoins, derivatives, and some NFTs, aligning with OECD technical guidance for comprehensive reporting.

The post India Joins OECD: Will Begin Sharing Crypto Transaction Data By 2027 appeared first on 99Bitcoins.