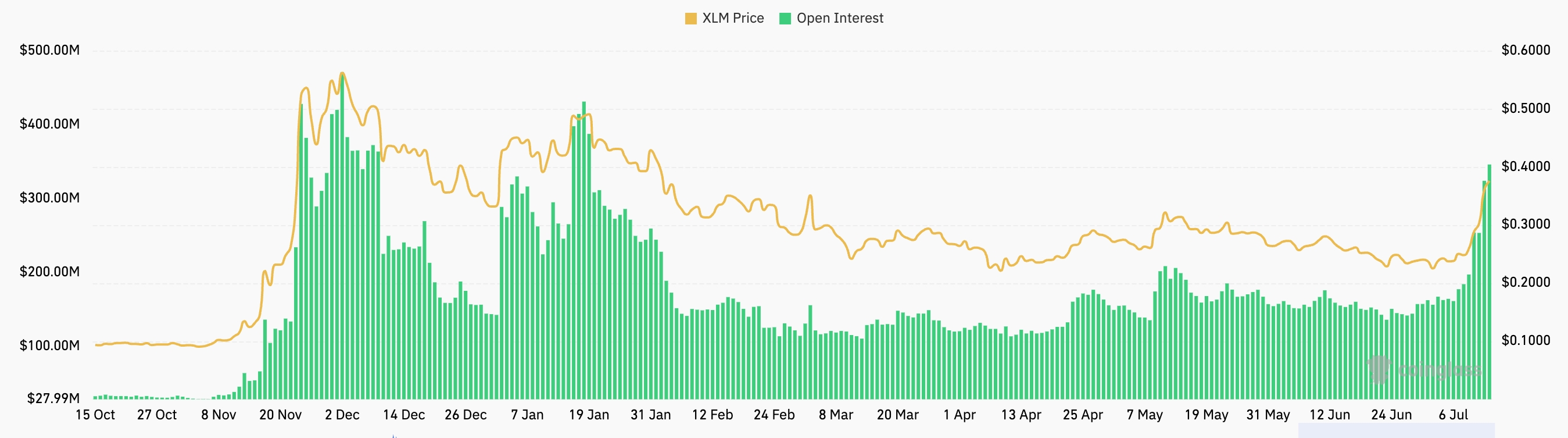

Stellar Lumens token surged this week, reaching its highest level since February as its futures open interest jumped during the crypto market rally.

Stellar (XLM) rose to a high of $0.4045, continuing a trend that started on June 25 when it bottomed at $0.2187. It has rebounded by over 72% from its lowest level in June.

The surge happened as the futures open interest soared to $345 million, the highest level since January. It has been in a gradual increase after bottoming at $135 million in June. Surging futures open interest is a sign of increased liquidity and demand.

Stellar Lumens token also jumped after DeFi Llama, a popular platform, updated its ecosystem stablecoins. Its data shows that the stablecoin supply in its network jumped to a record high of $627 million, up from the year-to-date low of $44 million.

However, the change was because the platform included the Franklin Onchain US Government Money Fund, which has over $446 million in its calculation. Excluding these assets, Stellar has $181 million in stablecoin supply, most of which are USD Coins.

XLM price also rose as the number of active addresses, transactions, and fees jumped.

Data compiled by Nansen shows that Stellar’s active addresses jumped by 13% in the last seven days to 158,329, while transactions rose by 16% to 18.5 million.

XLM price technical analysis

The daily chart shows that the XLM price jumped after forming a highly bullish pattern, known as a double bottom, as we wrote about here. Its lower side was at $0.2180, while the neckline was at $0.3331. This gave it a depth of $0.115.

In a double-bottom pattern, the price target is established by adding the height to the neckline. This sets a target of $0.45, which is approximately 20% above the current level. This price target is a few points above the 38.2% Fibonacci Retracement level.

Another potential scenario is where Stellar’s price drops and retests the neckline at $0.3331 and then resumes the uptrend.