The price of Pepe Coin remains in a bear market after crashing by double digits from its highest level in May.

Pepe (PEPE), the second-largest Ethereum (ETH) meme coin, has dropped to $0.000010 — down 40% from its highest point in May. Here are the top three reasons why it will bounce back soon.

Pepe Coin price forms falling wedge

The first main reason why the Pepe token may rebound soon is that it has formed a falling wedge, a popular bullish reversal pattern. A falling wedge comprises two descending and converging trendlines, which have neared their confluence levels. A wedge is one of the most bullish patterns in technical analysis.

Pepe price has also remained above the ascending trendline that connects the lowest swings since March this year. It has also remained above the ultimate support of the Murrey Math Lines at $0.000005960.

Therefore, the token is likely to experience a strong bullish breakout, with the following key point to watch being at $0.00001625, representing an increase of over 70% from the current level. A drop below the weak, stop-and-reverse level at $0.000007450 will invalidate the bullish view.

High volume and open interest

There are signs that Pepe’s demand and popularity is still high. CoinGecko data shows that its 24-hour volume was over $400 million on Sunday, July 6. While this volume was lower than its historical levels, it was significantly higher than that of other popular meme coins. For example, Shiba Inu (SHIB) had a 24-hour volume of less than $70 million.

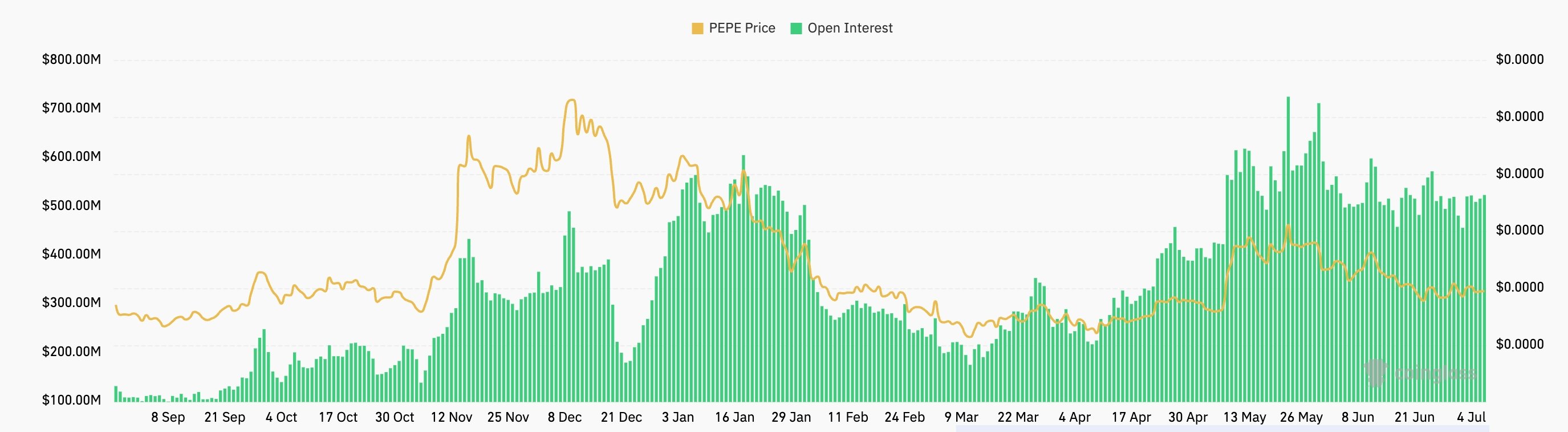

CoinGlass data shows that Pepe’s futures open interest has remained steady in the past few weeks. It had a 24-hour open interest of $522 million, higher than the year-to-date low of $173 million. A high open interest is a bullish catalyst for an asset because it indicates increased demand.

Pepe’s exchange balances in a free fall

Further data shows that investors are not selling their Pepe Coins despite their recent crash. Santiment data shows that Pepe’s reserves on exchanges have dropped to a multi-year low of 101.7 trillion. This is a significant decline from the year-to-date high of 158.9 trillion tokens.

The falling exchange supply and the rising whale accumulation mean that the token may rebound soon. According to Nansen, the number of Pepe tokens held by whales has increased by 4.1% over the last 30 days to 7.6 trillion.