- Whale wallets increased holdings by 190 million XRP, even as bearish chart patterns persist.

- Market eyes June 16 SEC deadline and $2.20 breakout level as pressure builds around XRP.

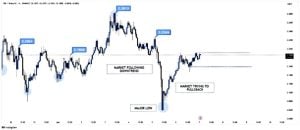

XRP has been under pressure since early June, with sellers in control. A death cross appeared on the four-hour chart on May 30, where the 50-day simple moving average (SMA) crossed below the 200-day, suggesting downside pressure. The last time this pattern showed up—on March 30—the price dropped by 23% in just a week, reaching $1.67.

At the moment, XRP trades around $2.18. Charts suggest more downside is possible. An inverted cup and handle is forming—commonly linked with bearish price setups. If XRP breaks below $2.06, the next levels to watch are $1.71 and $1.68. The $2.06 mark is now acting as a key short-term support.

On the other hand, momentum indicators hint at possible changes. The MACD is showing early signs of convergence between its main line and signal line, which could point to a shift in direction if confirmed. If the 50-day SMA flattens or starts turning up, the bearish outlook may lose strength. For now, though, traders are watching the support zones closely.

Whale Action Offsets Market Uncertainty

Large holders of XRP have been increasing their positions despite weak chart indicators. Over one week, wallets holding between 1 million and 10 million tokens added 190 million XRP, raising their total from 6.08 billion to 6.27 billion. The activity was tracked by Santiment.

XRP ETF Odds Fuel Market Interest

Confidence around XRP is not limited to the courtroom. Trading platform Polymarket has shown that 88% of its users now expect a spot XRP ETF to be approved before year-end. This optimism is feeding into broader sentiment and could help balance the bearish price structure seen on the charts.

Analyst Bitguru weighed in, pointing out that XRP has bounced off a major low and is now testing resistance around $2.20. If it breaks cleanly above that level, bulls could regain control. Until that happens, though, there’s still a risk of a breakdown, especially with the bearish death cross pattern still in play.

In short, $2.20 is the level to watch. A clear push above it would shift sentiment and likely trigger fresh buying. If not, the current downtrend may continue.