Key Takeaways

- Bluebird Mining Ventures Ltd. plans to convert gold revenues into Bitcoin, marking a new treasury management strategy.

- The company believes Bitcoin will reshape financial markets and is seeking a CEO with experience in digital assets.

Share this article

UK-listed gold mining company Bluebird has announced plans to convert gold revenues into Bitcoin as part of a new strategy to hold digital gold as a long-term treasury reserve asset.

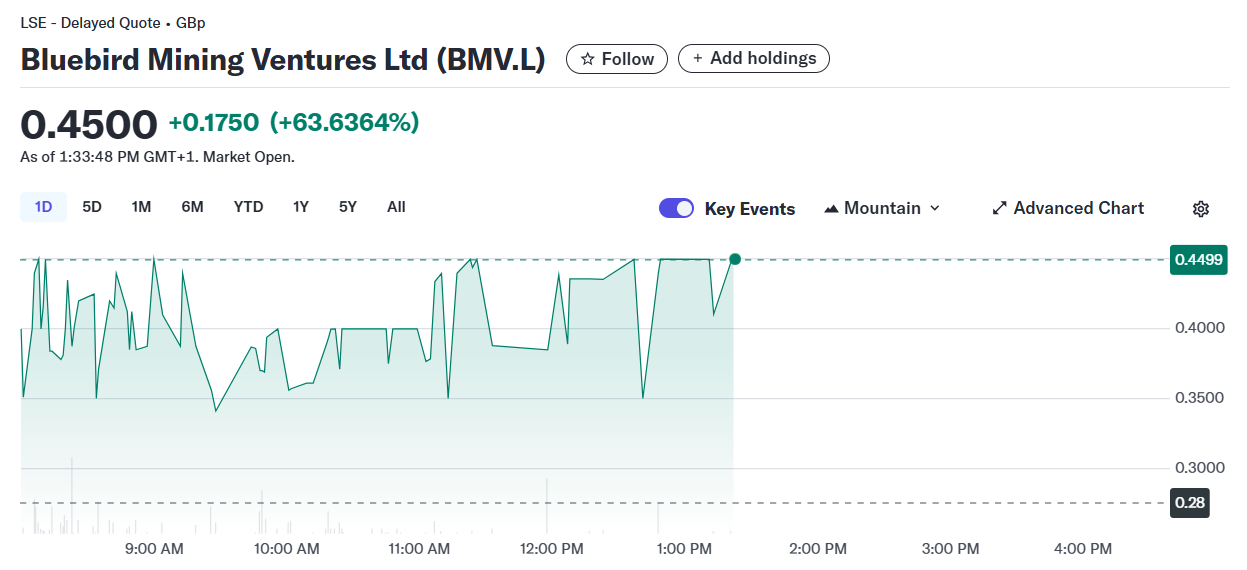

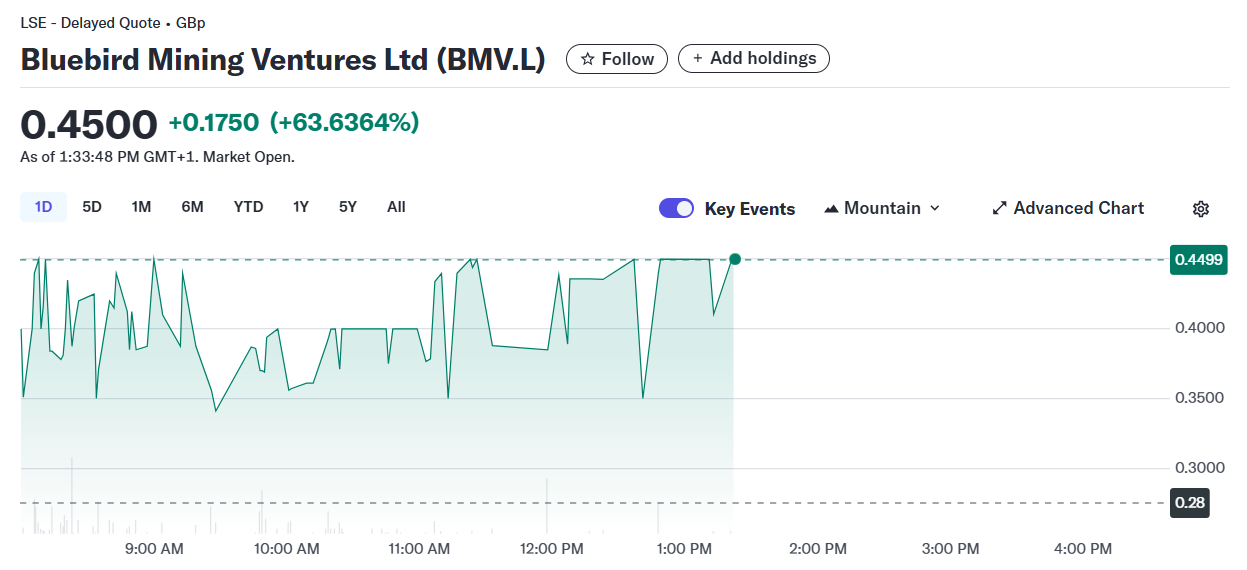

Shares of Bluebird soared 63% on Thursday after the company unveiled its Bitcoin treasury strategy, Yahoo Finance data shows. Year-to-date, the stock is still down around 14%.

As detailed, BlueBird intends to monetize the income generated from its gold mining projects and redirect those proceeds to Bitcoin. The firm said the pivot would make it the first publicly traded mining firm in the UK to implement a Bitcoin treasury approach.

Strategy shift to covert gold into digital gold – #bitcoin #goldmining #goldequities #investinbitcoin #investingold

“Combining income streams from gold mining projects and recycling these revenues into a proactive “Bitcoin in Treasury” management approach, whilst maintaining a… pic.twitter.com/BpJA6hFU9Y— Bluebird Mining Ventures Ltd (LSE:BMV.L) (@bluebirdIR) June 5, 2025

In addition to adopting a Bitcoin treasury strategy, Bluebird has renewed its mining permit in the Philippines and is nearing a deal with its local partner to extend its free carry through to production, the company said in a June 5 press release.

Gold has long been valued both for its practical uses and for its role as a store of value. However, this traditional role is now being challenged by Bitcoin. BlueBird stated that the strategic shift comes as the firm recognizes Bitcoin’s growing role as a store of value amid an uncertain economic climate.

“Some of the reasons for the rising adoption of Bitcoin are as a response to expansive monetary policy by central banks, high debt-to-GDP ratios globally, rising geopolitical tensions, and continued concerns about persistent inflation,” BlueBird noted.

Bluebird Executive Director and Interim CEO Aidan Bishop stated that global markets are experiencing a “tectonic shift,” and Bitcoin is poised to redefine financial markets at every level.

“By adopting a ‘gold plus a digital gold’ strategy, it offers the Company an opportunity to turn the page and look to the future and seek to attract a new type of shareholder,” he added.

Share this article