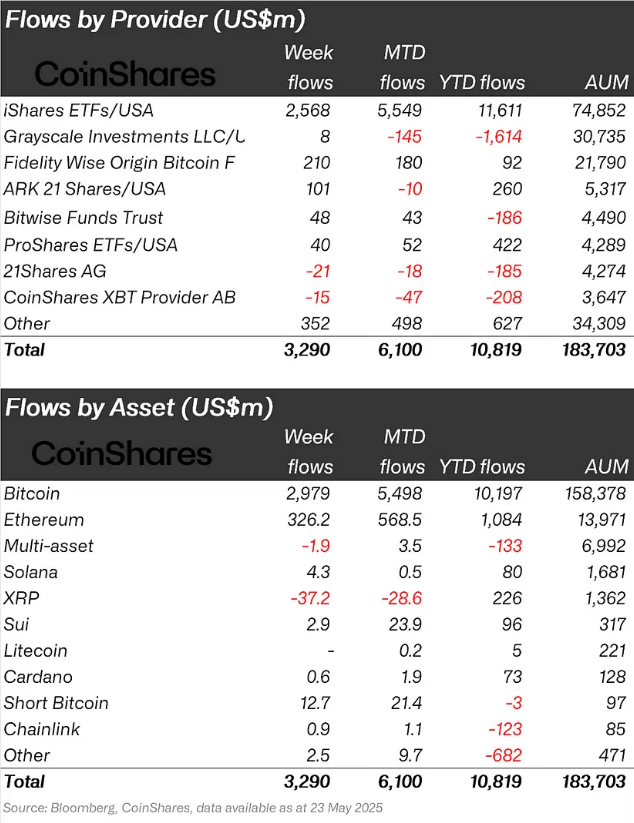

Digital asset products saw $3.3 billion in inflows last week in the market. This surge of capital brought the total year-to-date inflows to a record-breaking $10.8 billion.

According to CoinShares‘ latest digital asset fund weekly report, both year-to-date flows and total assets under management recorded historical peaks in the prior week of trading. Marking the sixth consecutive week of positive flows, digital asset investment products recorded $3.3 billion in capital flow last week.

This drove up its total year-to-date flows to a new record high of $10.8 billion. The number jumped from $6.7 billion in the previous week. Meanwhile, total assets under management for digital asset funds briefly reached an all-time high of $187.5 billion in the past week. This indicates a renewed interest from investors.

CoinShares head of research James Butterfill said that investors have sought out alternative assets due to the shifting conditions of the U.S. market, more specifically

“We believe that growing concerns over the U.S. economy, driven by the Moody’s downgrade and the resulting spike in treasury yields, have prompted investors to seek diversification through digital assets,” said Butterfill.

As a result, most of the funds continue to come from U.S. investors, contributing as much as $3.2 billion in capital. Moreover, other countries like Germany, Australia and Hong Kong saw relatively modest capital flows compared to the U.S., reaching inflows of $41.5 million, $10.9 million, and $33.3 million respectively.

On the other hand, Swiss investors were able to take advantage of the recent price surge as an opportunity to secure gains, resulting in $16.6 million of outflows. Sweden and Brazil also experienced outflows amounting to $12.1 million and $1.9 million.

Bitcoin (BTC) continues to dominate with inflows of $2.9 billion, equal to 25% of the total inflows achieved in 2024. Amidst the ongoing rally that has catapulted the price of BTC to a new all-time high of $111,814, investors saw it as an opportunity to invest in short-Bitcoin products. In the past week, short-Bitcoin saw $12.7 million in flows, its highest recorded weekly inflow since December 2024.

In addition, Ethereum (ETH) saw $326 million in capital flow, marking the cryptocurrency product’s fifth consecutive week of gains and the token’s highest recorded amount in the past 15 weeks. In contrast, XRP (XRP) broke its 80-week-long inflow streak with $37.2 million in outflows, the largest ever recorded for XRP.