Key Takeaways

- Trump’s tariff push on the EU and tough talk on Apple suddenly sent Bitcoin below $108,000 in early Friday trading.

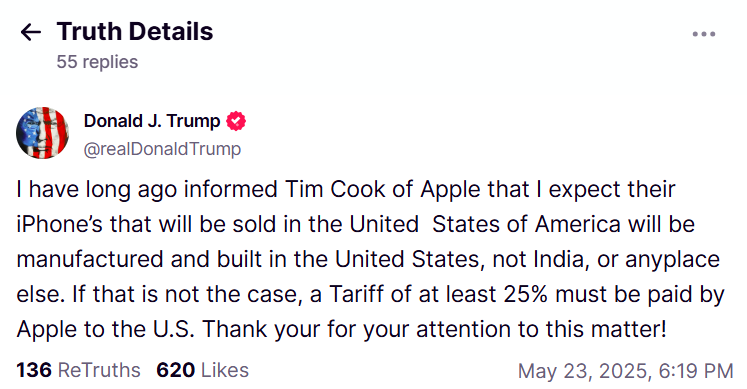

- Apple must build iPhones in the US or face a 25% tariff, Trump warned.

Share this article

The price of Bitcoin (BTC) fell below $108,000 early Friday after President Donald Trump called for steep tariffs on EU imports and threatened Apple with similar measures. The digital asset briefly touched $107,300 on Binance, pulling back from session highs above $111,000 as traders responded to fresh geopolitical tensions.

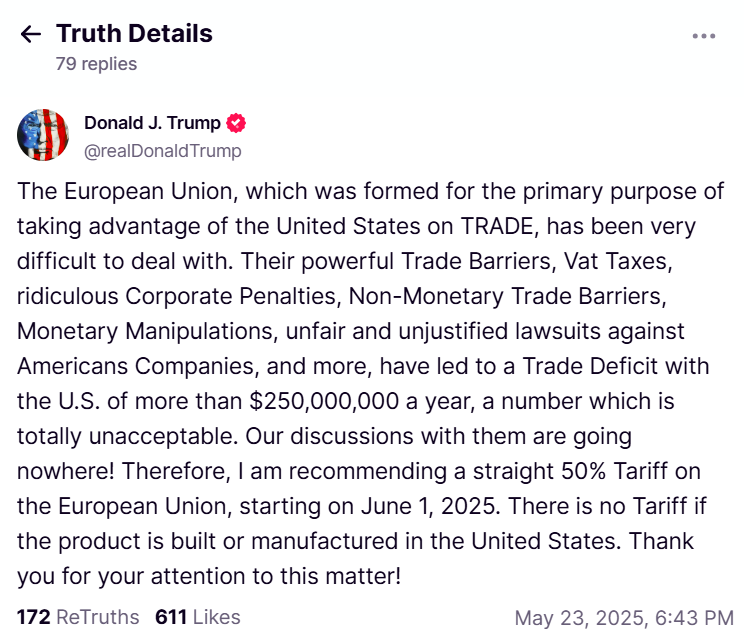

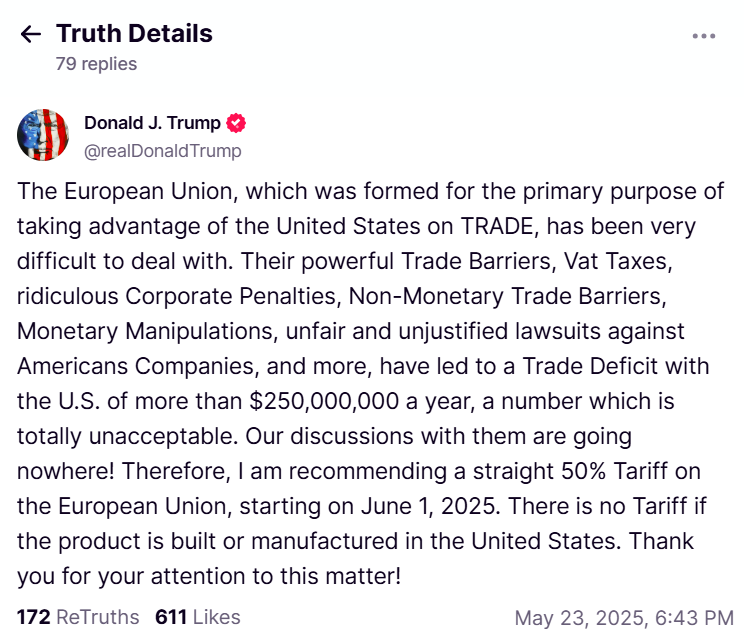

The US president on Friday proposed a 50% tariff on all EU imports starting June 1, 2025, in a post on Truth Social. He cited trade imbalances and regulatory frictions as rationale for the move, declaring current EU-US trade dynamics “totally unacceptable.”

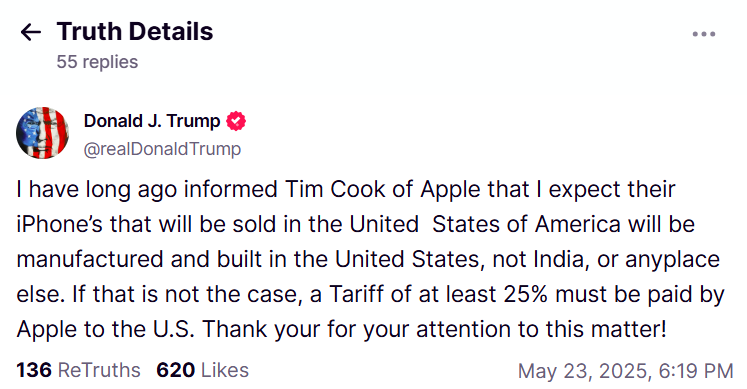

Trump also issued a direct warning to Apple this morning, stating that iPhones sold in America must be built domestically or face a 25% tariff. The ultimatum to Apple CEO Tim Cook appeared aimed at the tech giant’s extensive overseas manufacturing footprint.

Bitcoin’s pullback came less than 24 hours after it hit a new all-time high of $111,980, surpassing the previous record of $109,588 set in January. The digital asset was trading at around $108,200 at press time, down 2.5% in the past 24 hours.

Demand for Bitcoin has been driven by its increasing correlation with gold, perceived safe-haven assets, and heightened concerns about Japan’s and the US’s fiscal health.

Furthermore, increased corporate and institutional support, including acquisitions by entities like Strategy and MARA Holdings, alongside robust investments in US-listed spot Bitcoin ETFs, further bolsters Bitcoin’s market position.

Bitcoin’s recent decline has reflected cautious market sentiment. The crypto market’s response suggests that digital assets remain sensitive to macroeconomic and political developments.

Share this article