Key Takeaways

- Bitcoin proxy Strategy resumes Bitcoin buying spree after a brief pause.

- The firm has increased its Bitcoin holdings to 531,644 BTC after purchasing 3,459 more BTC.

Share this article

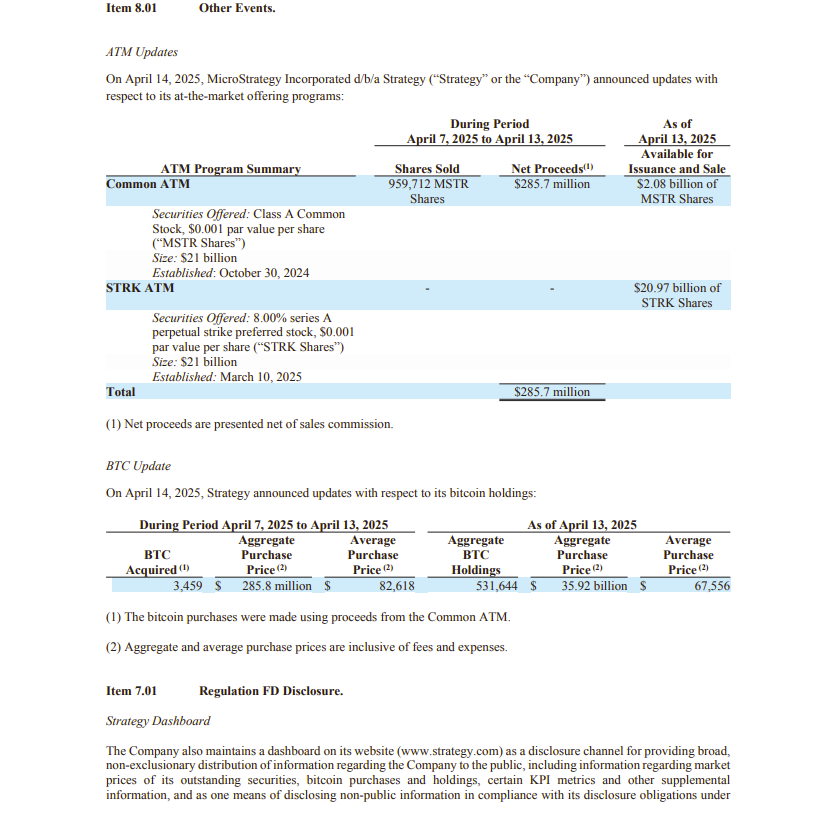

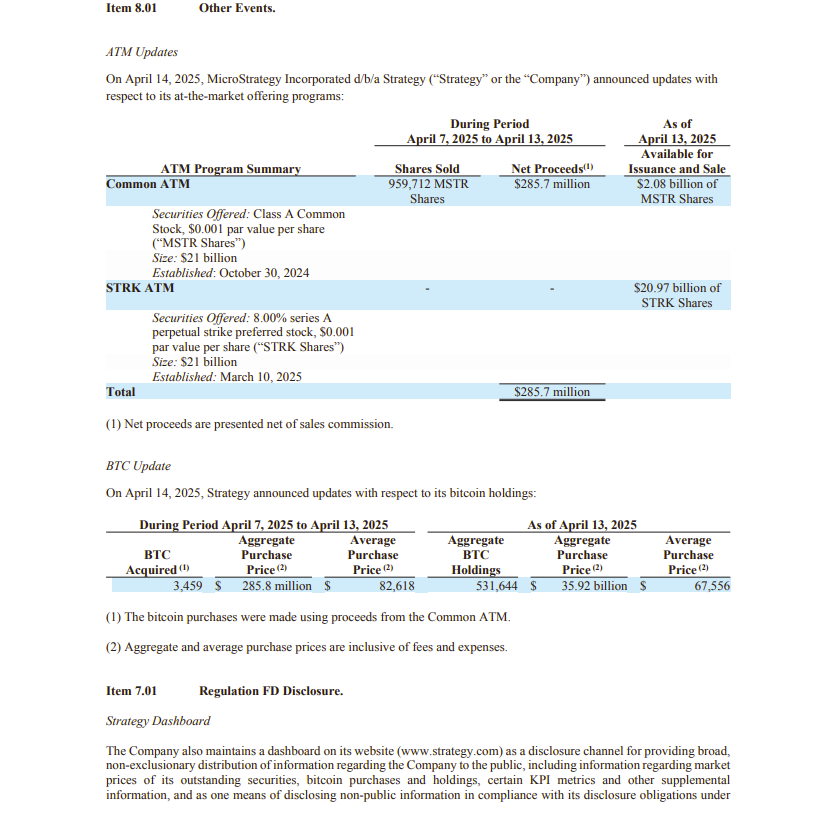

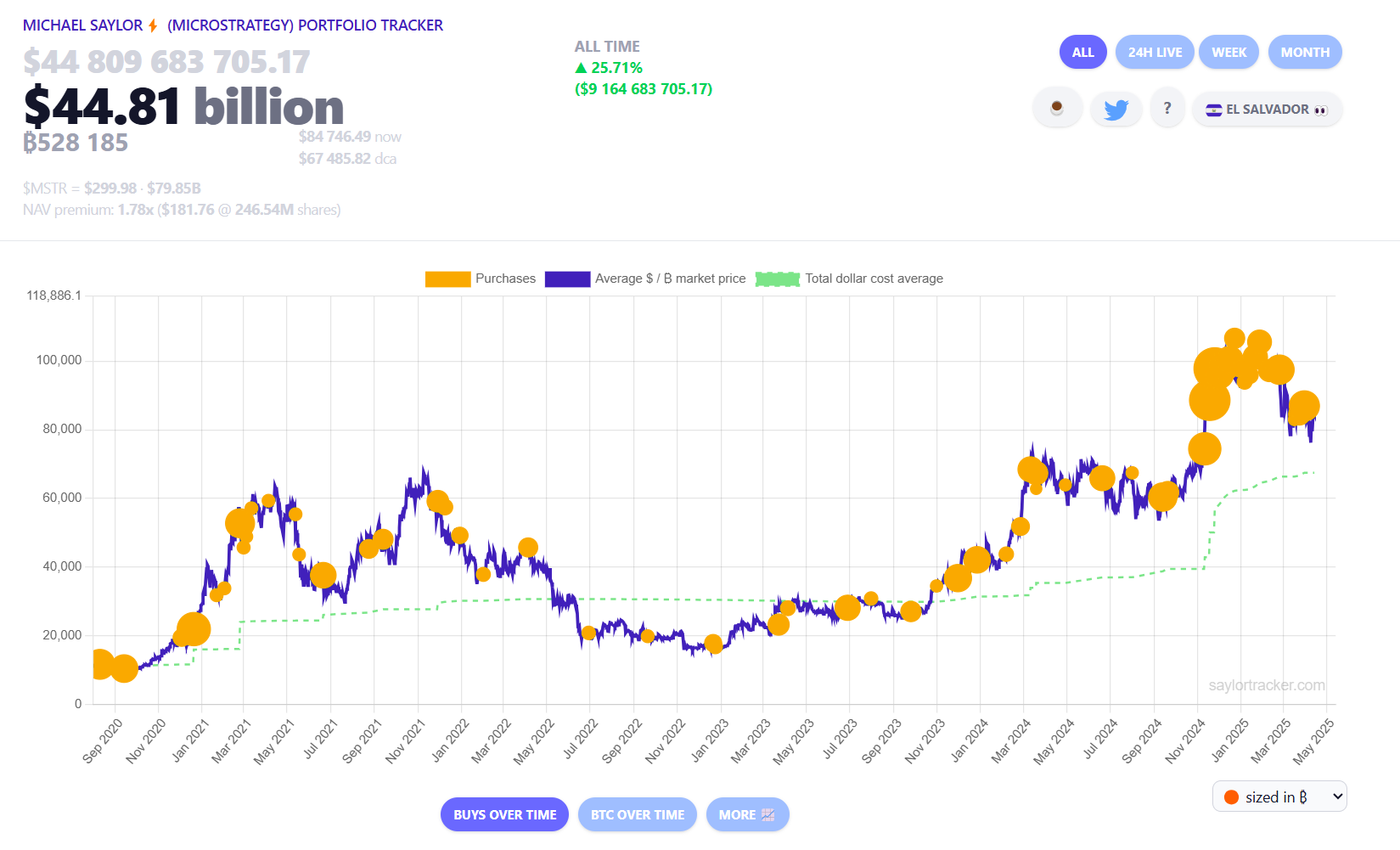

Michael Saylor’s Strategy announced today that the company purchased 3,459 Bitcoin between April 7 and 13 at an average price of $82,618 million. The acquisition brings the firm’s total holdings to 531,644 BTC, valued at nearly $45 billion at current prices.

Strategy has acquired 3,459 BTC for ~$285.8 million at ~$82,618 per bitcoin and has achieved BTC Yield of 11.4% YTD 2025. As of 4/13/2025, we hodl 531,644 $BTC acquired for ~$35.92 billion at ~$67,556 per bitcoin. $MSTR $STRK $STRFhttps://t.co/hJCquZc5HJ

— Strategy (@Strategy) April 14, 2025

According to a Monday SEC filing, the company funded its latest Bitcoin purchase using proceeds from its Common ATM equity offering. Between April 7 and 13, Strategy sold 959,712 MSTR shares, raising approximately $286 million in net proceeds.

As of April 13, Strategy still has over $2.08 billion in MSTR shares and nearly $21 billion in STRK shares available for future issuance and sale.

The latest purchase follows a one-week pause, during which the company reported an unrealized loss of nearly $6 billion in its Bitcoin holdings.

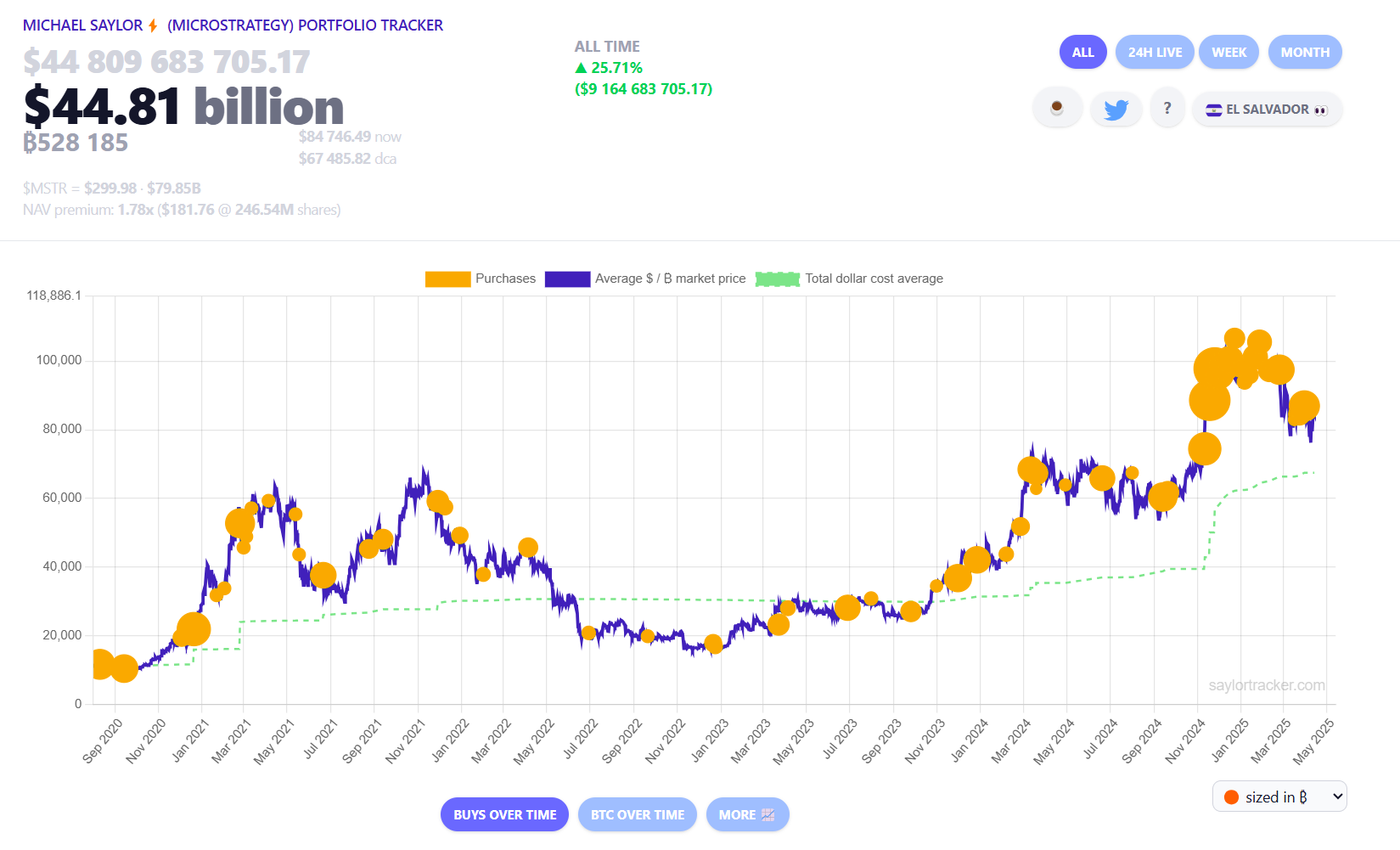

Yet despite being hit by the recent market downturn, Saylor has not indicated any intention to sell. On Sunday, the Bitcoin advocate posted the company’s portfolio tracker on X — a move that often precedes a purchase announcement.

Currently, Strategy’s Bitcoin holdings still show approximately $9 billion in unrealized gains, as Bitcoin trades above $84,500 at press time, according to data from the Michael Saylor Portfolio Tracker.

The purchase further cements Strategy’s position as the largest corporate Bitcoin holder. The Nasdaq-listed firm now controls around 2.5% of the total BTC supply, with MARA Holdings, Riot Platforms, and Galaxy Digital Holdings following behind.

Separately, another Bitcoin-centric firm, Metaplanet — often dubbed “Asia’s Strategy” — also announced a new round of Bitcoin accumulation on Monday.

The Japanese investment company acquired an additional $26 million worth of Bitcoin, bringing its total holdings to 4,525 BTC.

Despite recent market volatility triggered by former President Donald Trump’s proposed tariff policies, Metaplanet is still well on track to reach its target of 10,000 BTC by the end of 2025.

It currently ranks as the ninth-largest publicly listed corporate holder of Bitcoin globally and the largest in Asia.

Share this article