Key Takeaways

- Teucrium is launching the first leveraged ETF linked to XRP in the US, trading under the ticker XXRP.

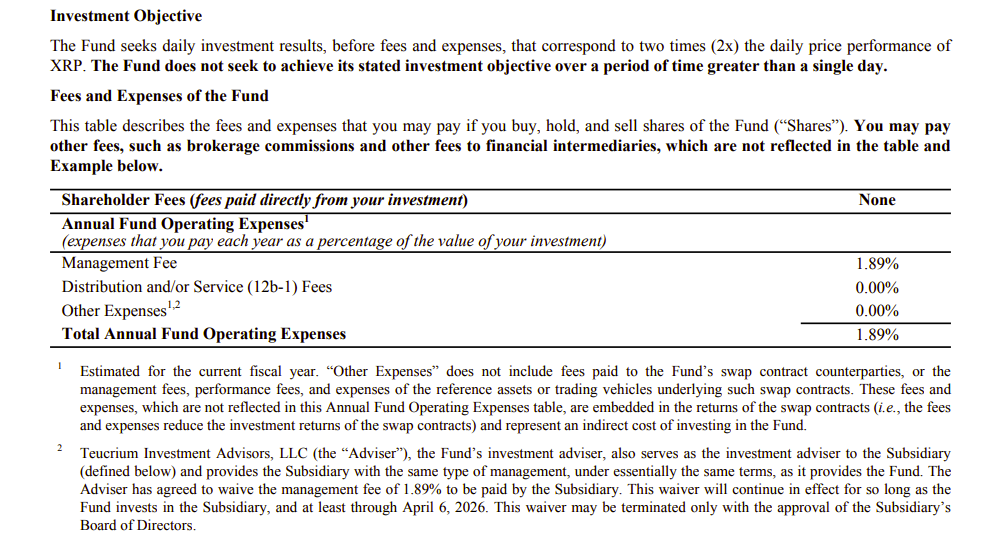

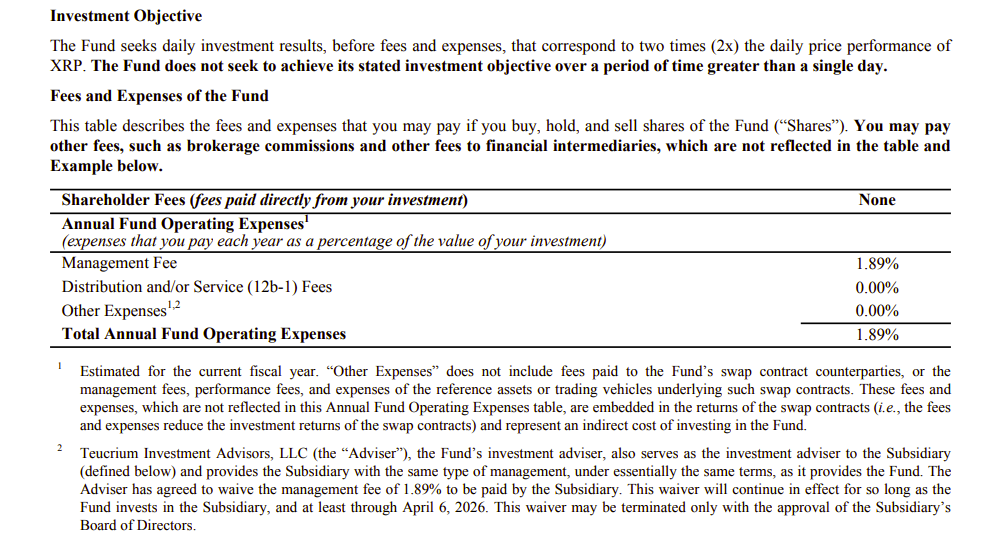

- The ETF aims to deliver twice the daily return of XRP and has a 1.85% expense ratio.

Share this article

Teucrium Investment Advisors is set to launch the first-ever leveraged exchange-traded fund linked to XRP, the fourth-largest crypto asset by market cap, Bloomberg reported Monday.

The fund, called the Teucrium 2x Long Daily XRP ETF, will trade on NYSE Arca under the ticker XXRP. The exchange has certified its approval of the listing and registration of the fund.

The ETF aims to offer investors a leveraged way to bet on the daily price movements of XRP. The fund seeks to deliver returns that are double the daily return of XRP through the use of swap agreements.

The XXRP ETF will charge a management fee of 1.89%, according to its prospectus.

To determine the price of XRP for the swap agreements, the fund will reference several benchmarks, including the CME CF XRP-Dollar Reference Rate, the CME CF XRP-Dollar Real Time Index, and spot XRP ETFs.

However, since there are no US-listed spot XRP ETFs suitable for the fund’s investment or as a reference asset, the XXRP ETF will initially base its XRP swaps on several XRP ETPs listed on European exchanges. These include 21Shares XRP ETP, Bitwise Physical XRP ETP, Virtune XRP ETP, WisdomTree Physical XRP ETP, and CoinShares Physical XRP ETP.

Teucrium Investment Advisors, currently managing $311 million in assets, specializes in providing ETFs focused on alternative investments, such as agricultural commodities and other niche markets.

Prior to the XXRP fund, Teucrium had already launched a Bitcoin futures ETF, called the Teucrium Bitcoin Futures Fund. The product launched in April 2022 after being approved by the SEC under the Securities Act of 1933.

According to its prospectus, Teucrium is also seeking to launch a short version of the Teucrium 2x Long Daily XRP ETF, dubbed the Teucrium 2x Short Daily XRP ETF. The leveraged inverse ETF would allow investors to potentially profit from daily declines in the price of XRP.

The launch comes as the years-long legal battle between the SEC and Ripple Labs, the company behind XRP, approaches the final line, as confirmed by Ripple CEO Brad Garlinghouse last month.

Garlinghouse, speaking in a recent interview with Bloomberg, said that he anticipates the launch of multiple XRP ETFs in the US during the second half of 2025.

The favorable settlement with the SEC immediately boosted market optimism, pushing the odds of XRP ETF approval to 86% and increasing XRP’s value by 14%.

According to Sal Gilbertie, founder and CEO of Teucrium ETFs, the decision to launch the leveraged XRP ETF at this time was influenced by attractive low prices.

He also noted that there was considerable investor demand for XRP, which he expects would be heightened by the fund’s leverage.

XRP was trading at $1.9 at press time, up 1% in the last 24 hours, according to CoinGecko.

Share this article