Bitcoin’s hashrate has reached a historic 1 Zettahashes per second milestone, at a time when its price is taking a hit, demonstrating a remarkable show of strength.

The Bitcoin network’s total computing power has surpassed 1 Zettahashes per second (ZH/s) for the first time in its 16-year history. That is 1,000 Exahashes per second, a 1,000-fold increase since 2016, when Bitcoin first hit 1 EH/s.

This kind of growth is a testament to just how far the network’s infrastructure has come—despite the current market turmoil.

That kind of growth shows just how much the infrastructure behind Bitcoin has evolved. Even as the price takes a hit in the current market, the network’s computing power is still pushing forward.

Hashrate is a measure of how much computational power is being used to mine and secure the network. A higher hashrate means the network is more secure, more decentralized—and a lot harder to attack.

A higher hashrate also makes Bitcoin more resistant to 51% attacks. It signals that miners are committed to the long-term growth of the asset.

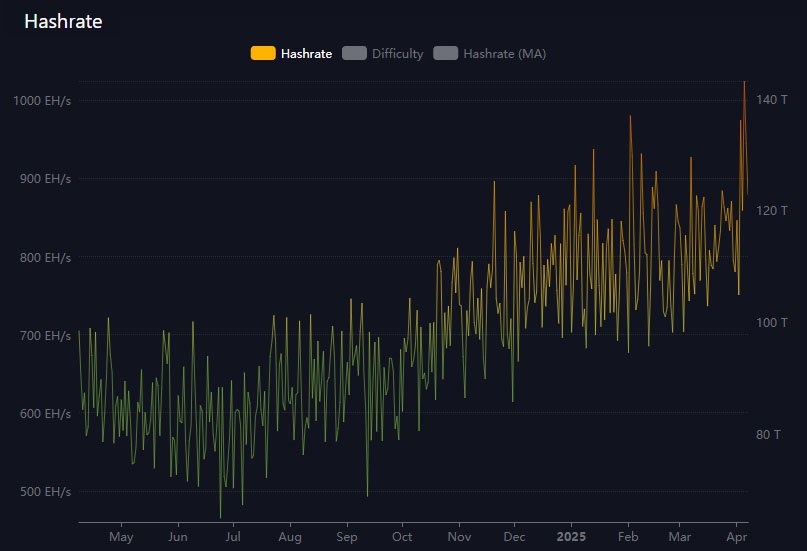

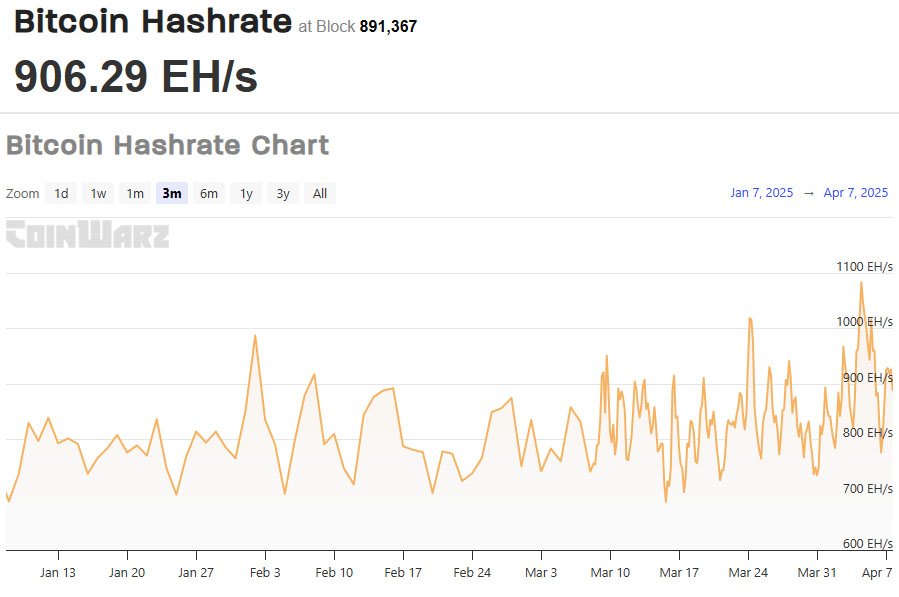

Data from mempool.space shows that the hashrate peaked at 1.025 ZH/s on April 5. Coinwarz recorded an even higher peak of 1.1 ZH/s at block height 890,915. Those variations are due to the different methods platforms use to measure hashrate.

That’s a pretty small difference when you consider the impact of using a shorter or longer timeframe to calculate hashrate, according to Bitcoin expert Jameson Lopp. Sometimes, that can lead to reported values differing by as much as 40 EH/s.

The price drop while hashrate soars is a pretty interesting irony. After trading near $109,000 in mid-January, bitcoin has dropped nearly 30%.

Some exchanges saw the price dropping below $76,000-and in some reports, as low as $74,460. That comes amid broader market turmoil, with U.S. markets losing $6.6 trillion over two days. Some of that is due to recession fears sparked by President Trump’s tariff announcements.

Despite the downturn, mining activity has continued to grow. Analysts say that’s because large-scale miners are betting on bitcoin’s long-term value.

Blockware Solutions head analyst Mitchell Askew said, “Miners are doubling down: expanding sites and plugging in more efficient machines.”

However, these low prices could force less efficient miners out.

The Bitcoin hashrate surge is being driven by the latest generation of mining equipment. That means miners are using more efficient and powerful machines like Bitmain’s S21 and MicroBT’s M60 series, as older models just aren’t competitive anymore.

Miners are also increasingly turning to cleaner, cheaper energy sources. Hydro and solar power are becoming the norm in regions like Texas, Iceland and Norway, where sustainable mining operations are thriving.