Key Takeaways

- Strategy purchased 22,048 Bitcoin for approximately $1.9 million between March 24 and 30.

- The company’s total Bitcoin holdings now amount to 528,185 BTC, making it the largest corporate holder globally.

Share this article

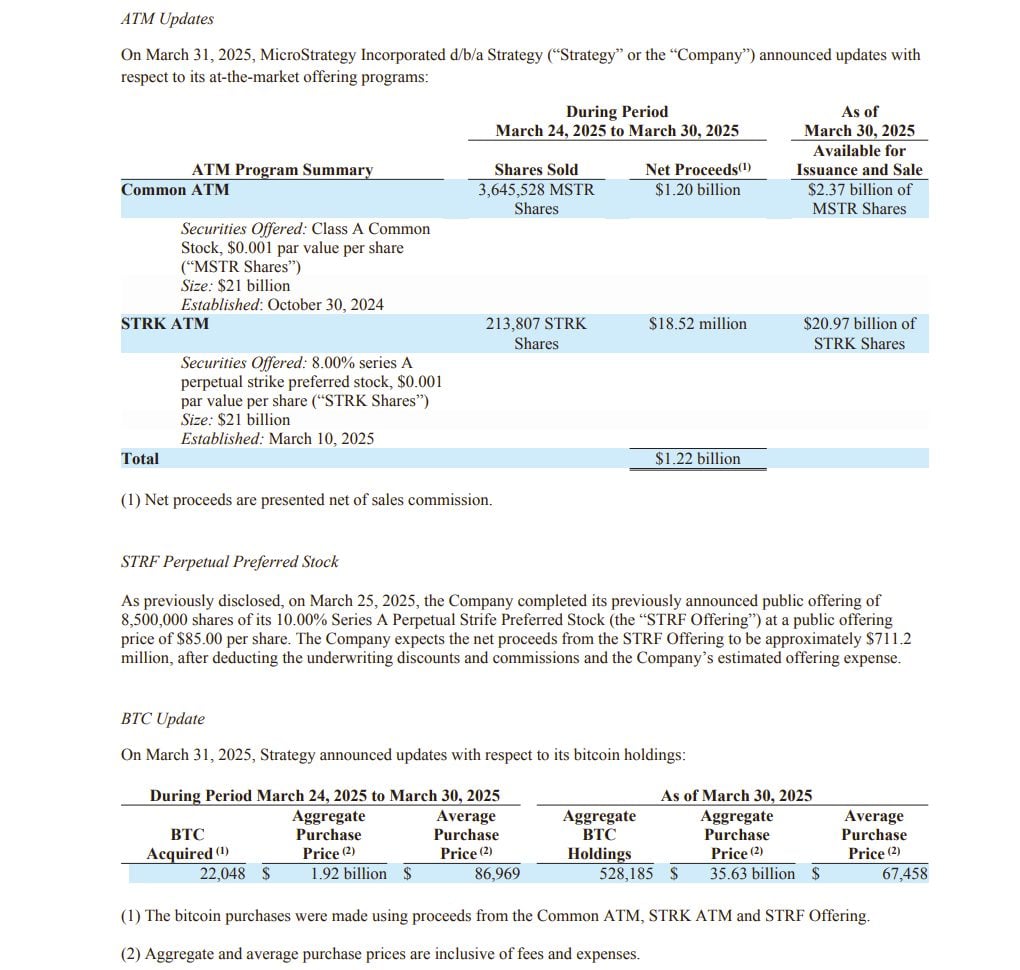

MicroStrategy, recently rebranded itself as Strategy, said Monday it had acquired 22,048 Bitcoin worth around $1.9 billion between March 24 and 30. The purchase was completed at an average of $86,969 per coin.

The announcement comes after Michael Saylor, Strategy Executive Chairman, hinted at an impending Bitcoin purchase yesterday, a move that often precedes an acquisition disclosure.

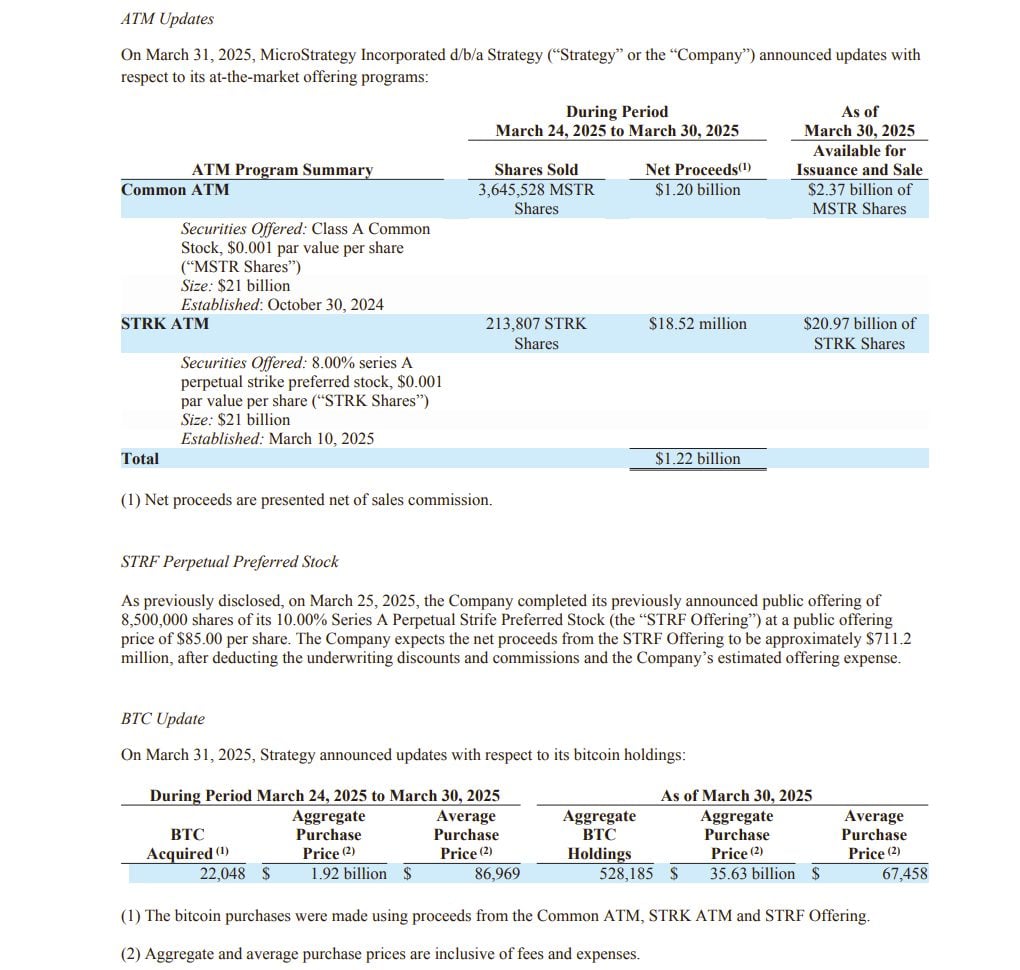

According to a Monday disclosure to the SEC, the Tysons, Virginia-based company financed its latest acquisition using proceeds from Common ATM, STRK ATM and STRF Offering.

As updated, during the week ending March 30, Strategy sold 3,645,528 shares of its Class A Common Stock, generating $1.2 billion in net proceeds. The firm still has $2.3 billion worth of MSTR shares available for issuance and sale.

The Nasdaq-listed company also sold 213,807 shares of its 8.00% Series A Perpetual Strike (STRK) Preferred Stock, securing $18.52 million, with $20.97 billion in STRK shares still available.

Strategy’s offering of 8.5 million shares of its 10.00% Series A Perpetual Strife (STRF) Preferred Stock, which was unveiled earlier this month, was also completed on March 25, according to the firm. The company estimates that the net proceeds from this offering will be approximately $711 million.

The new purchase boosts the company’s total Bitcoin holdings to over 528,000 BTC, solidifying its position as the world’s largest Bitcoin corporate holder.

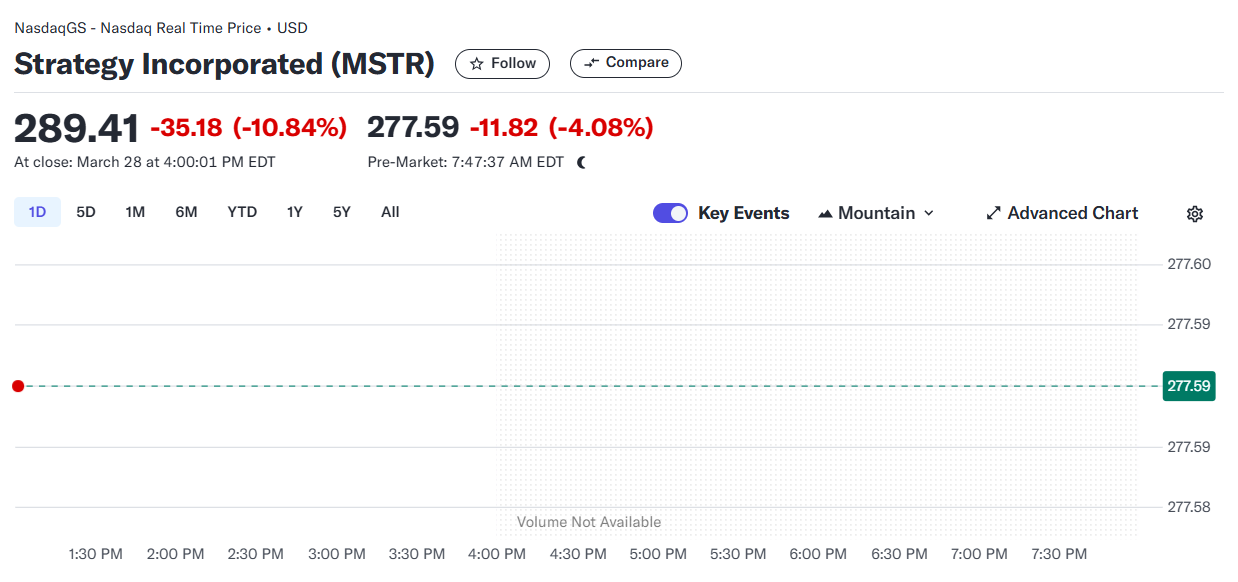

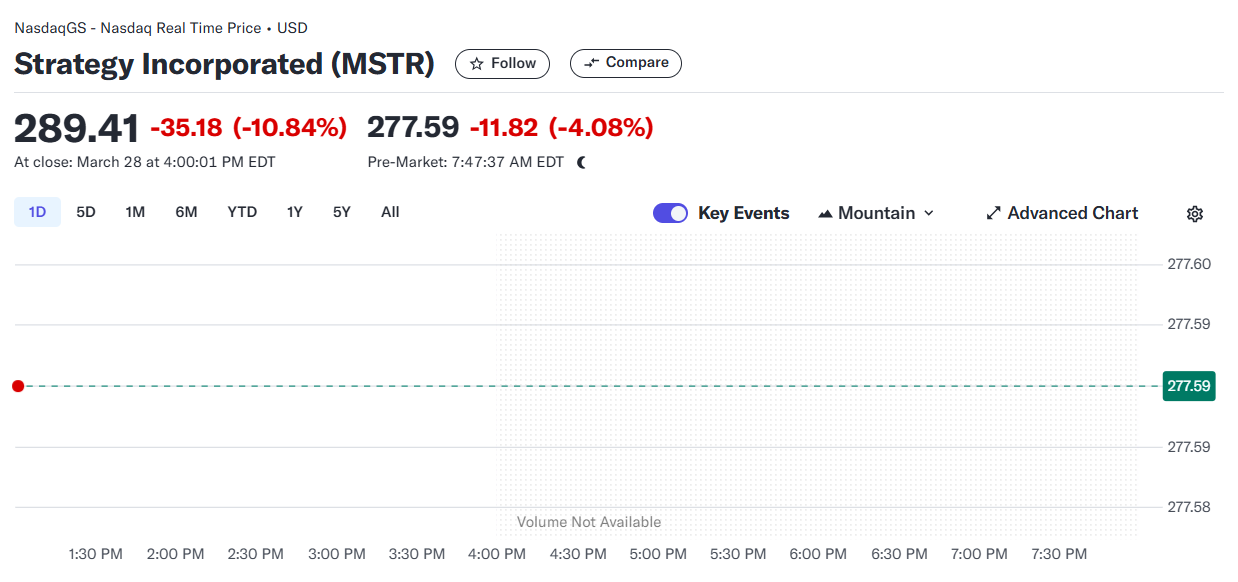

According to Yahoo Finance data, Strategy (MSTR) shares closed down nearly 11% on Friday and traded around $277 in Monday’s pre-market session.

The stock’s performance is closely tied to Bitcoin’s price movements. Bitcoin trades at around $82,100 at press time, down 4.5% in the past week, per TradingView.

Share this article