Key Takeaways

- South Carolina has proposed a bill to allow state investments in Bitcoin and other digital assets with a cap of one million Bitcoins.

- The proposed legislation mandates secure custody, transparency, and regular audits of digital asset holdings.

Share this article

South Carolina lawmakers on Thursday introduced the “Strategic Digital Assets Reserve Act,” a bill that would allow the state treasurer to invest in Bitcoin and other digital assets up to specific limits.

The bill, also known as H4256, permits the state treasurer to invest unexpended funds from the General Fund, Budget Stabilization Reserve Fund, and other state-managed investment funds in digital assets.

Investment would be capped at 10% of total funds under management, with a maximum Bitcoin reserve limit of one million Bitcoins.

Under the proposed legislation, digital assets must be held either directly by the state treasurer through a secure custody solution, by a qualified custodian, or in exchange-traded products issued by regulated financial institutions. The bill prohibits lending of digital assets.

“Bitcoin, as a decentralized digital asset, and other digital assets offer unique properties that can act as a hedge against inflation and economic volatility. It also helps to diversify the state’s funds,” the bill states.

The legislation requires biennial reporting of digital asset holdings and their US dollar value.

For transparency, the public addresses of all digital assets must be published on an official state website. The state treasurer must also implement regular independent testing and auditing of digital asset management processes.

The bill allows South Carolina residents to make donations of digital assets to the reserve through an approved vendor process. If enacted, the legislation would remain in effect until September 1, 2035.

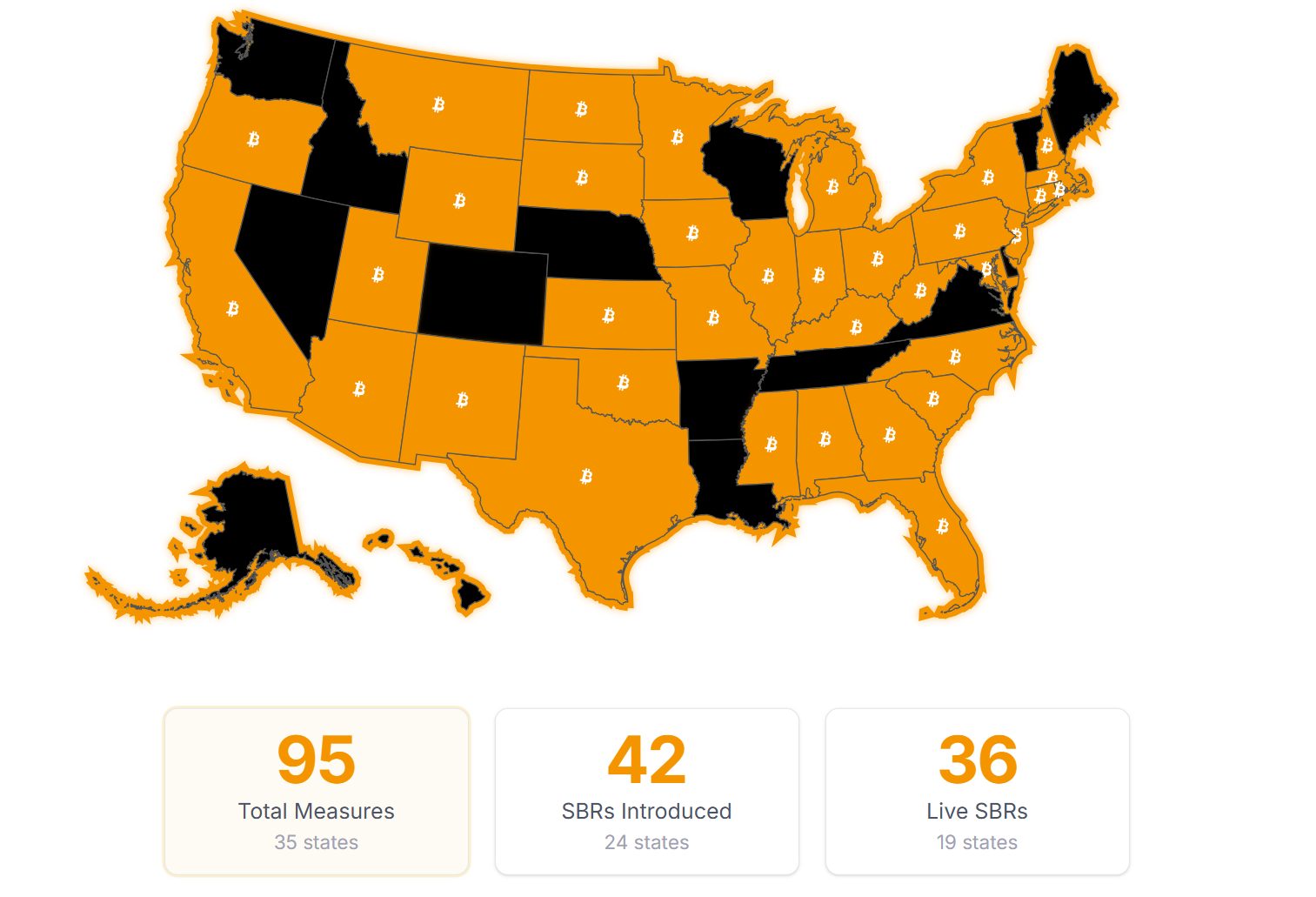

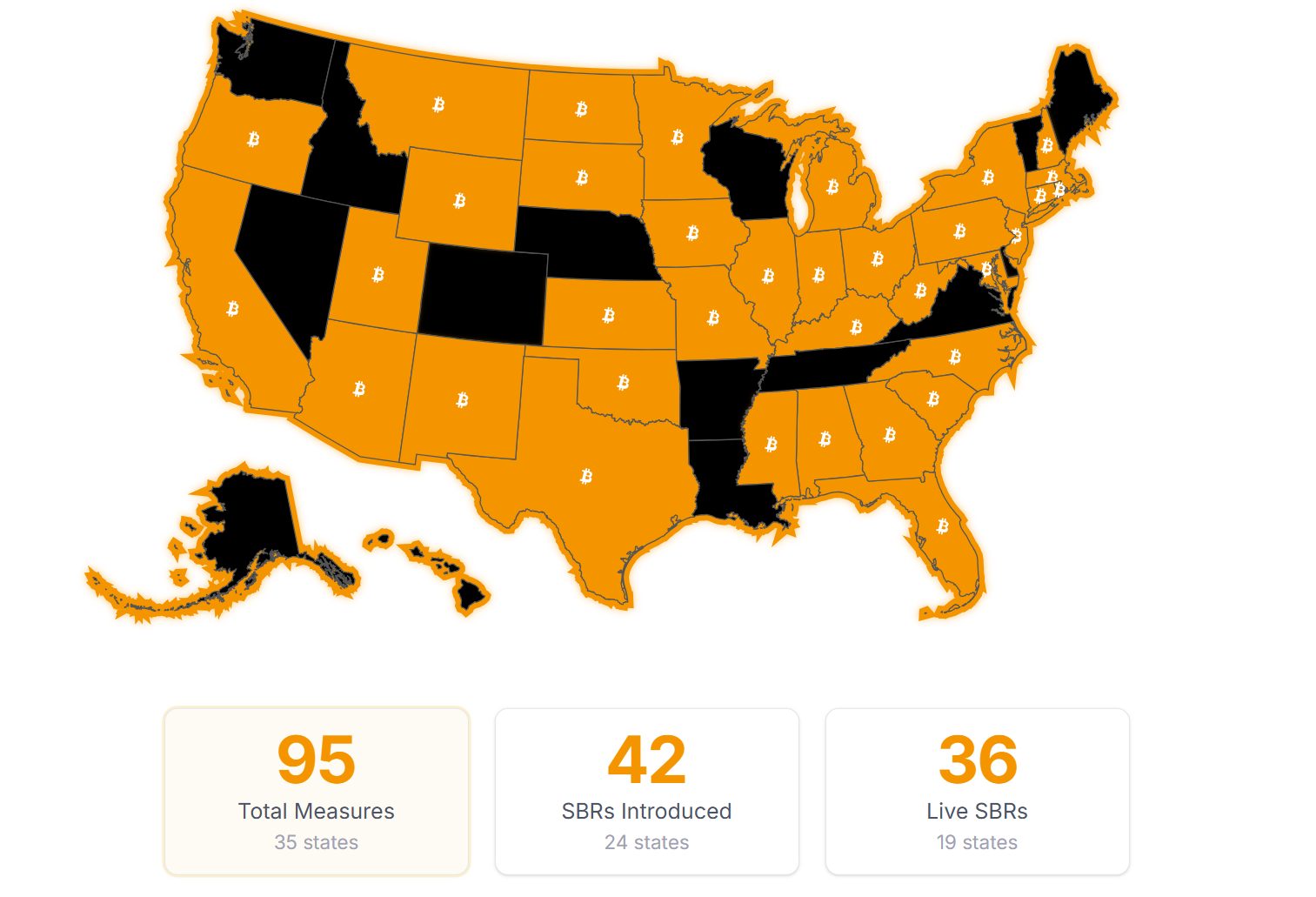

With this move, South Carolina joins a growing list of US states exploring the establishment of strategic crypto reserves. Currently, 24 out of 50 US states have introduced Bitcoin reserve bills, according to Bitcoin Law.

Before H4256, South Carolina lawmakers introduced S0163, a bill focusing on digital asset regulation. This bill aims to prevent government bodies from accepting or requiring central bank digital currency (CBDC) payments.

It would also allow the use of digital assets for transactions without specific crypto mining taxes or zoning limitations.

Furthermore, S0163 addressed cryptocurrency mining concerns like energy use and noise, while also seeking to promote rural development through mining activities.

Share this article