The U.S. is moving forward with integrating bitcoin into the financial system. Senators Cynthia Lummis (R-WY) and Nick Begich (R-AK) have reintroduced the BITCOIN Act, which would establish a national bitcoin reserve by purchasing 1 million BTC over the next 5 years.

This follows President Donald Trump’s recent executive order to create a federal bitcoin reserve to make bitcoin a strategic asset for the country.

The BITCOIN Act has backing from multiple Republican lawmakers and outlines a plan to buy bitcoin without using taxpayer money.

Instead, the purchases will be funded through Federal Reserve remittances and gold certificates. According to Senator Lummis this is crucial for America’s financial future.

Related: Senator Lummis Proposes Selling Gold to Bolster Bitcoin Reserves

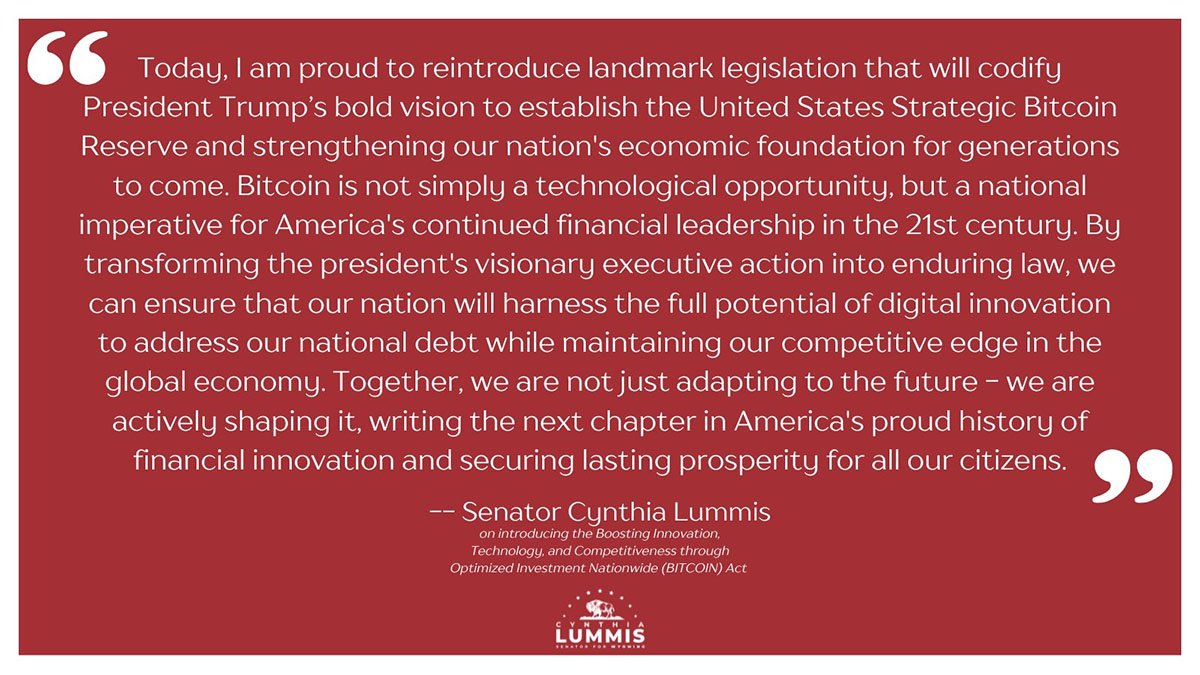

“By turning the president’s executive action into permanent law we can ensure our nation takes full advantage of digital innovation to pay off our national debt while staying ahead of the global economy,” Lummis said.

The bill proposes the following to create and maintain the bitcoin reserve:

- The U.S. government will buy 1 million BTC over 5 years using Federal Reserve earnings and gold certificate revaluations.

- The bought bitcoin will be stored in secure, decentralized facilities across the U.S.

- All BTC held in the reserve must not be touched for at least 20 years to prevent rapid liquidation of assets.

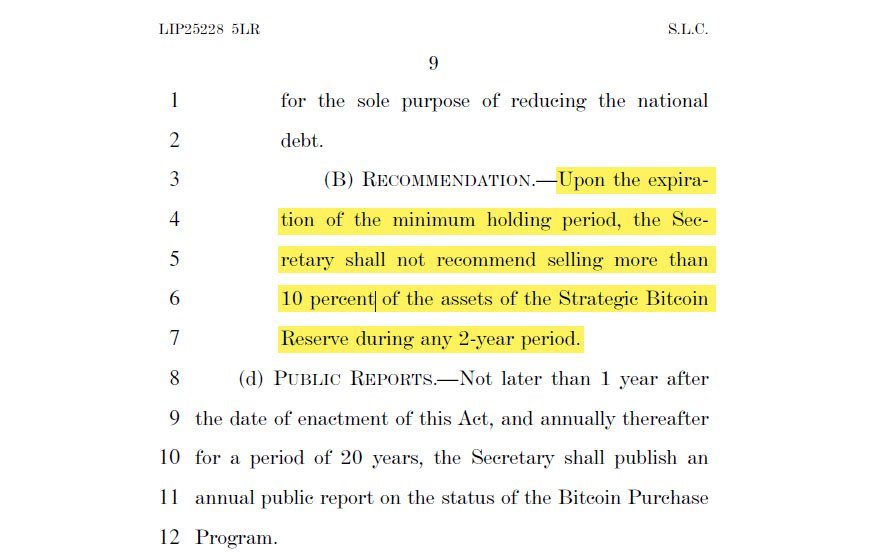

- No Treasury Secretary can sell more than 10% of the reserve in any 2-year period.

- The bill explicitly states private bitcoin ownership won’t be affected, so individuals can continue to own, hold and transact BTC freely.

Congressman Nick Begich who introduced the House companion bill said that bitcoin is a financial umbrella for the U.S.

“America can’t afford to fall behind in this financial revolution. A Strategic Bitcoin Reserve makes the U.S. an economic powerhouse, using digital assets to counter adversarial monetary policies and keep our global leadership,” Begich said.

This bill differs from the federal one, as President Trump’s executive order deals with bitcoin that has been seized through legal actions.

Reports say federal agencies have around 200,000 BTC from criminal and civil cases. The order tells the Treasury and Commerce Departments to find “budget neutral” ways to buy more bitcoin for the reserve.

The BITCOIN Act goes further.

Instead of only using seized bitcoin, it introduces an active buying strategy using Federal Reserve funds. This would add a lot more bitcoin to the U.S. government’s balance sheet over time.

The bill has support from several Republican Senators—Jim Justice (WV), Tommy Tuberville (AL), Roger Marshall (KS), Marsha Blackburn (TN), and Bernie Moreno (OH)—but it’s still uncertain.

Some lawmakers question the feasibility and long-term impact of a national bitcoin reserve. However, Bitcoin advocates have been pushing hard for this legislation.

With both Senate and House versions of the BITCOIN Act introduced, lawmakers will now focus on building more support in Congress.

As the political momentum for Bitcoin grows, the BITCOIN Act has a better chance of moving through Congress than it did in previous sessions.