OKX trading bots offer an efficient way for traders to automate crypto trading using AI-powered strategies. These bots are designed to execute trades based on predefined parameters, helping traders manage risks and capitalize on market movements.

As AI trading becomes more popular in the crypto space, OKX is stepping up its game by offering various trading bots and the option for users to create their own in a few simple steps.

What Are OKX Trading Bots?

OKX trading bots use AI-powered automation to execute trades based on predefined strategies like spot DCA, swing grid, and grid sniper strategies. Users can tweak specific parameters to select an existing bot, or create their own bot parameters.

These bots monitor market trends and place orders without requiring manual intervention. By leveraging these intelligent algorithms, traders can benefit from market opportunities around the clock, even when they’re not online to execute manual trades.

One primary benefit of using OKX trading bots is their ability to execute trades with exceptional speed and efficiency, eliminating the delays often associated with manual trading. Additionally, these bots remove emotional decision-making from the equation and ensure a disciplined approach to trading.

Another advantage is their ability to participate in the market 24/7, continuously analyzing data and executing trades even when the user is not actively monitoring the market.

Main Features of OKX Trading Bots

There are several reasons to choose OKX trading bots over other trading solutions. First, using these bots is completely free for OKX users. Additionally, there are more benefits to consider, including their AI-powered algorithms and multiple strategy options.

AI-Powered Smart Trading

OKX integrates AI and machine learning to enhance trading efficiency. The AI bots analyze market trends and historical data to optimize trade execution, making real-time adjustments to maximize potential profits while minimizing risks.

Multiple Strategy Options

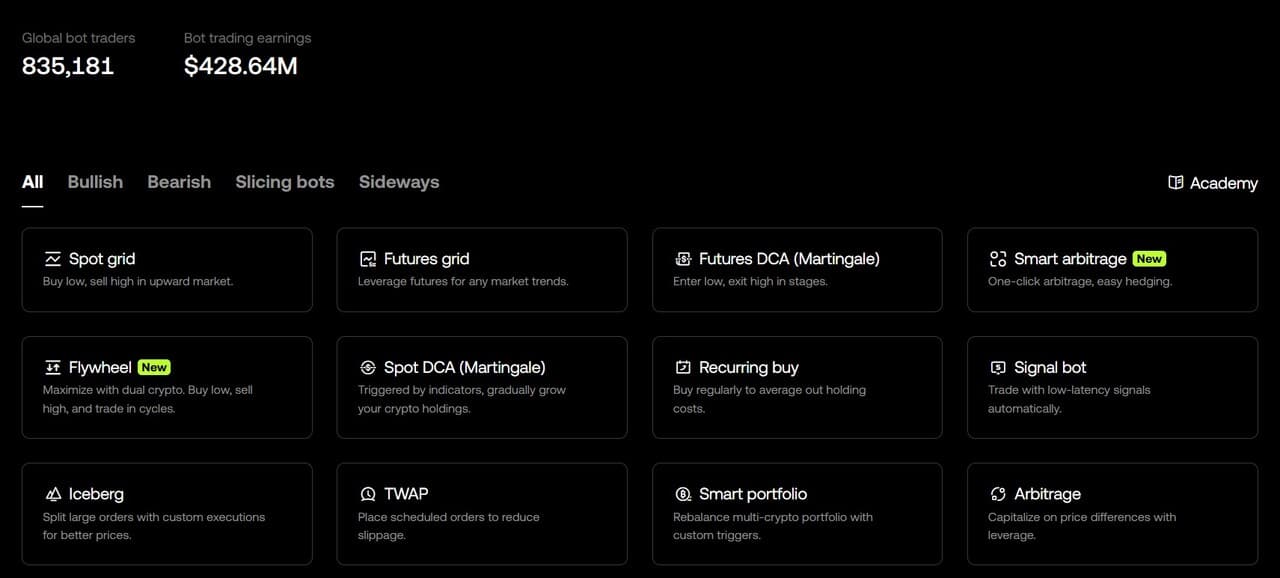

OKX offers various trading strategies tailored to different market conditions. Here are all bots offered by OKX:

- Spot grid

- Futures grid

- Futures DCA (Martingale)

- Smart arbitrage

- Spot DCA (Martingale)

- Recurring buy

- Signal bot

- Iceberg orders

- TWAP (Time-Weighted Average Price) orders

- Infinity grid

- Smart portfolio

- Arbitrage

For example, grid trading is designed to capitalize on market fluctuations by placing buy and sell orders within a predefined price range.

The arbitrage strategy generates profits by exploiting price differences across markets. The Dollar-Cost Averaging (DCA) strategy allows investors to allocate fixed amounts at regular intervals, helping mitigate the impact of market volatility.

Futures bots enable traders to automate leveraged trades in the futures market, enhancing opportunities for profit in both rising and falling markets.

Customization & Risk Management

Traders can customize their bot settings based on risk tolerance and trading goals. This includes setting stop-loss and take-profit levels to manage risk effectively, defining entry points to optimize trade execution, and adjusting various strategy parameters to ensure adaptability to market conditions.

Real-Time Market Adaptation

OKX trading bots continuously monitor market movements and adjust their strategies accordingly. This adaptability ensures that trades are executed in response to changing conditions, improving overall performance and reducing the likelihood of losses due to sudden market shifts.

How to Use OKX Trading Bots

Using OKX trading bots is straightforward. Here’s how to do it:

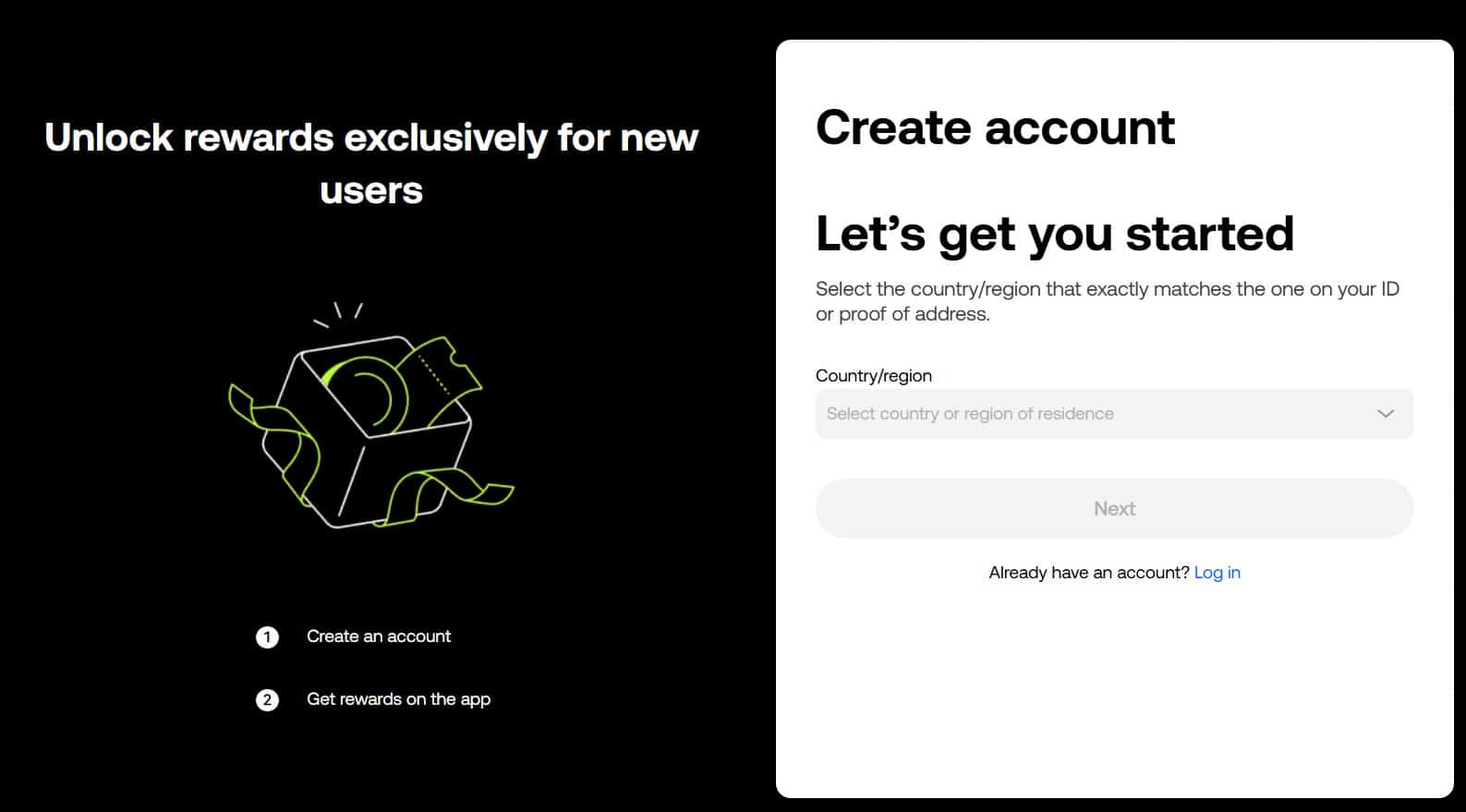

Step 1: Visit OKX and select your country of residence to sign up.

Step 2: Activate your email using the verification code and verify your phone number.

Step 3: Use a unique and strong password and select “Next”.

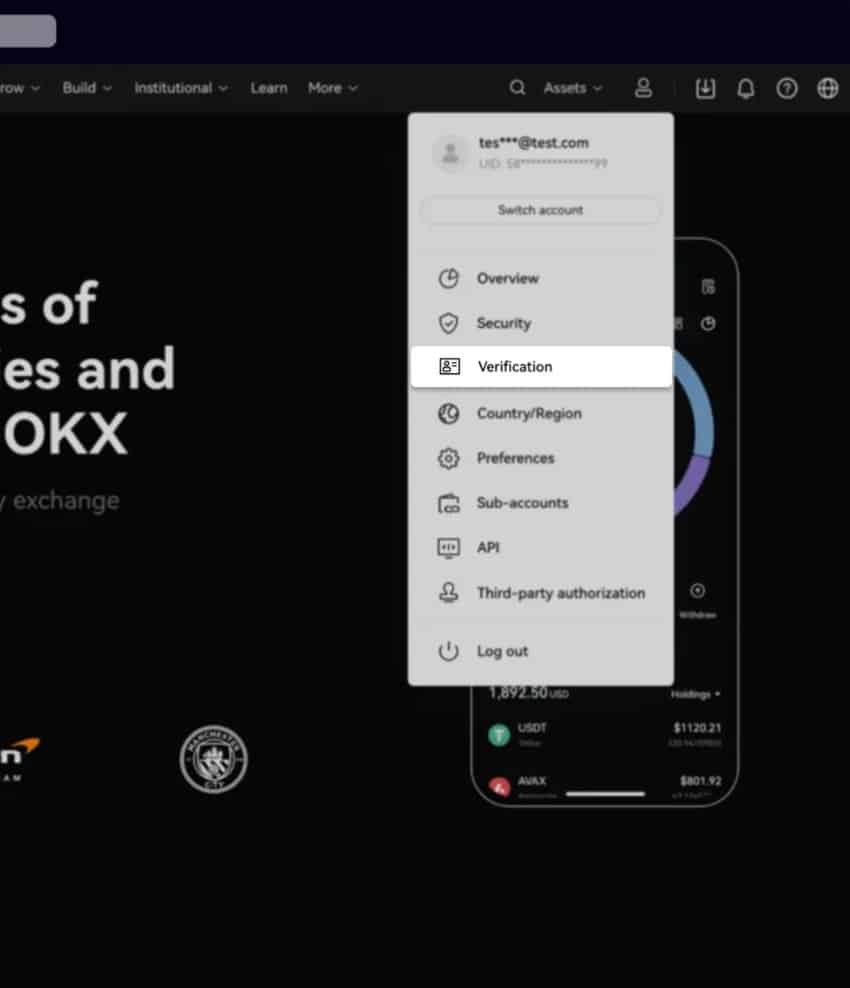

Step 4: Log in to your account and verify your ID.

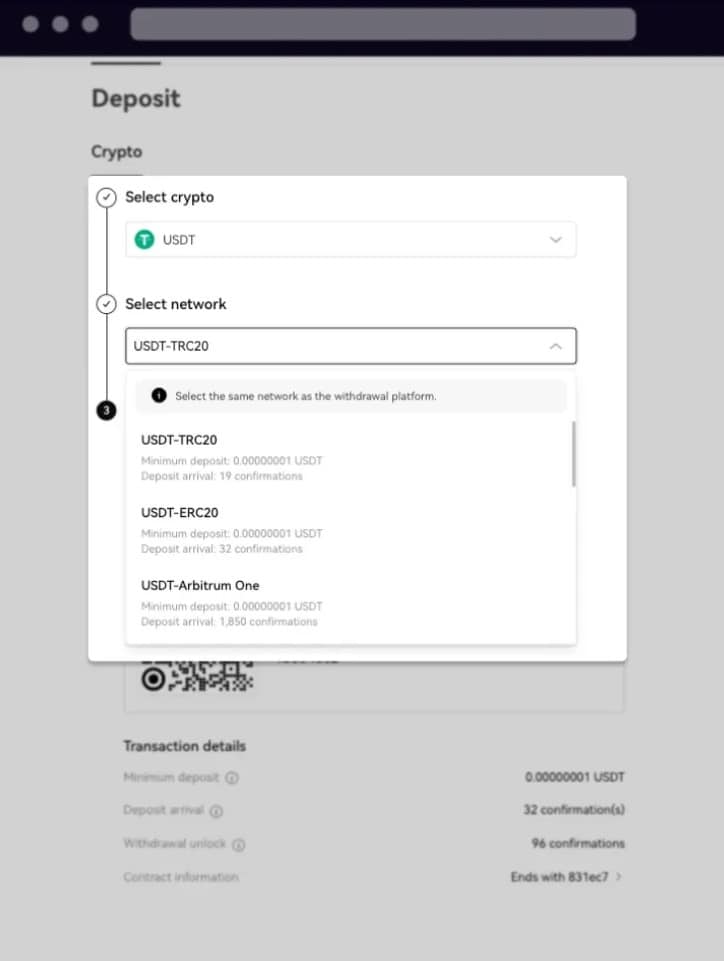

Step 5: Log in once you have set up your account and deposit funds via the “Assets” section.

Step 6: Select the crypto and network you want to deposit.

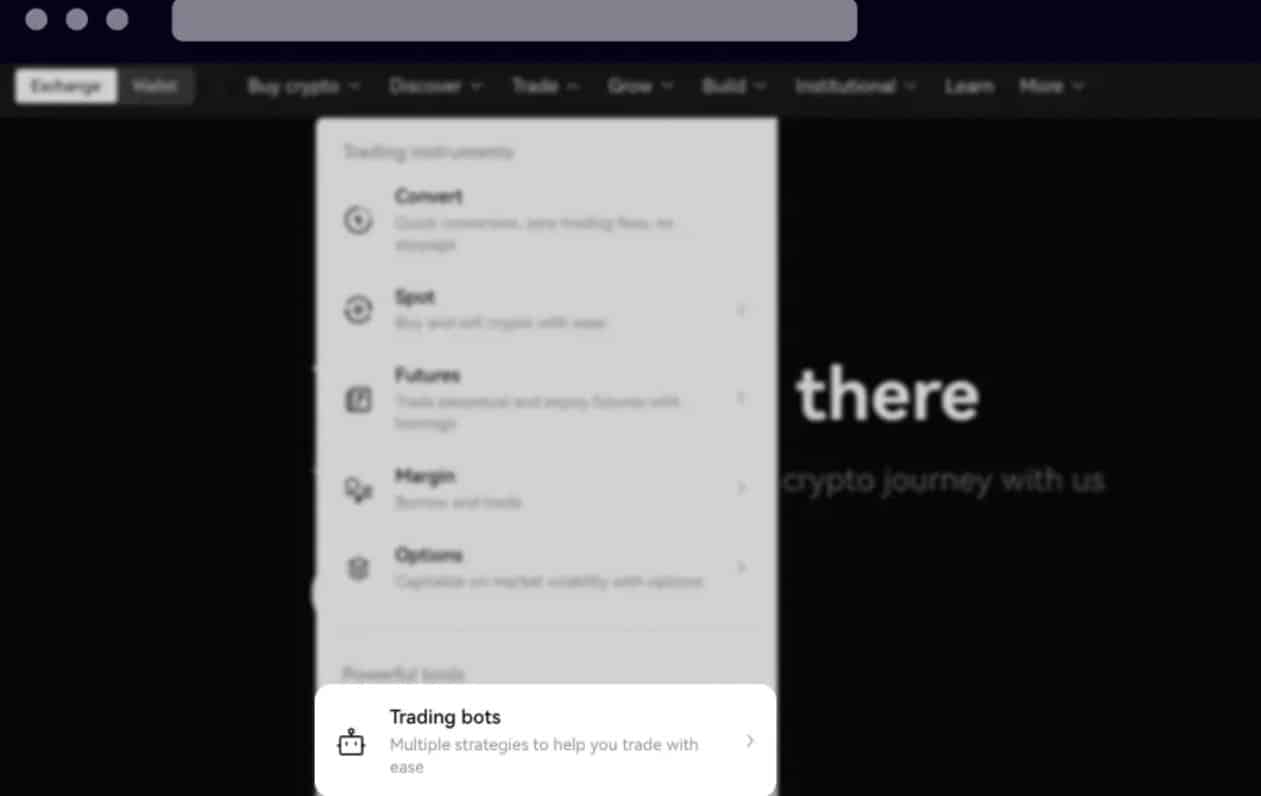

Step 7: Once your deposit lands, hover over the “Trade” section at the top and select “Trading bots.

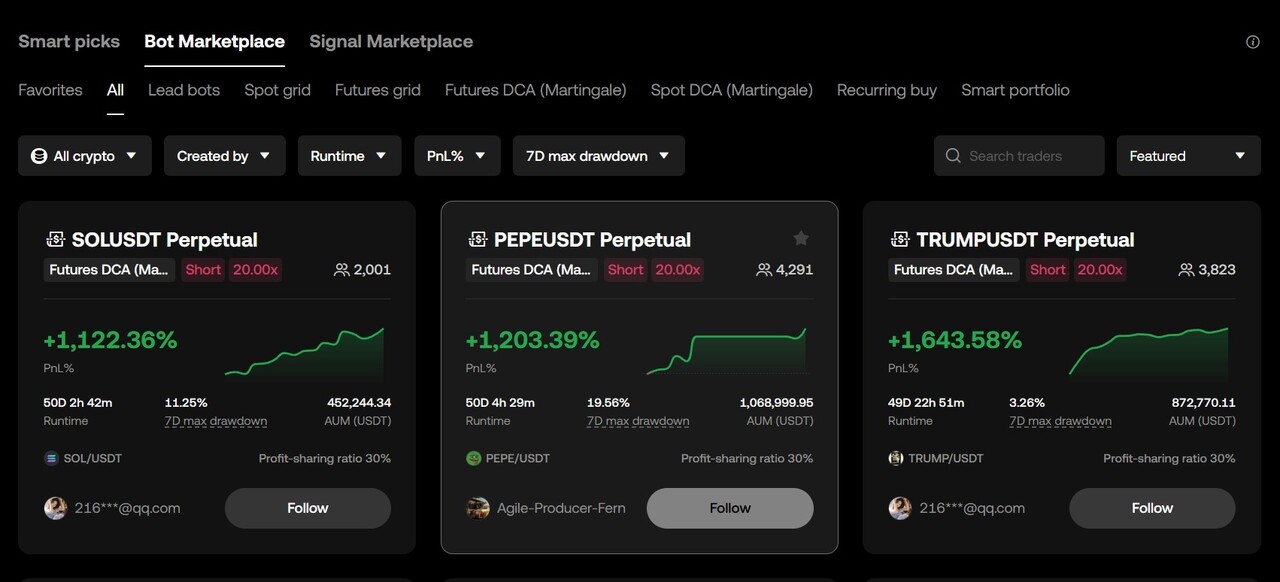

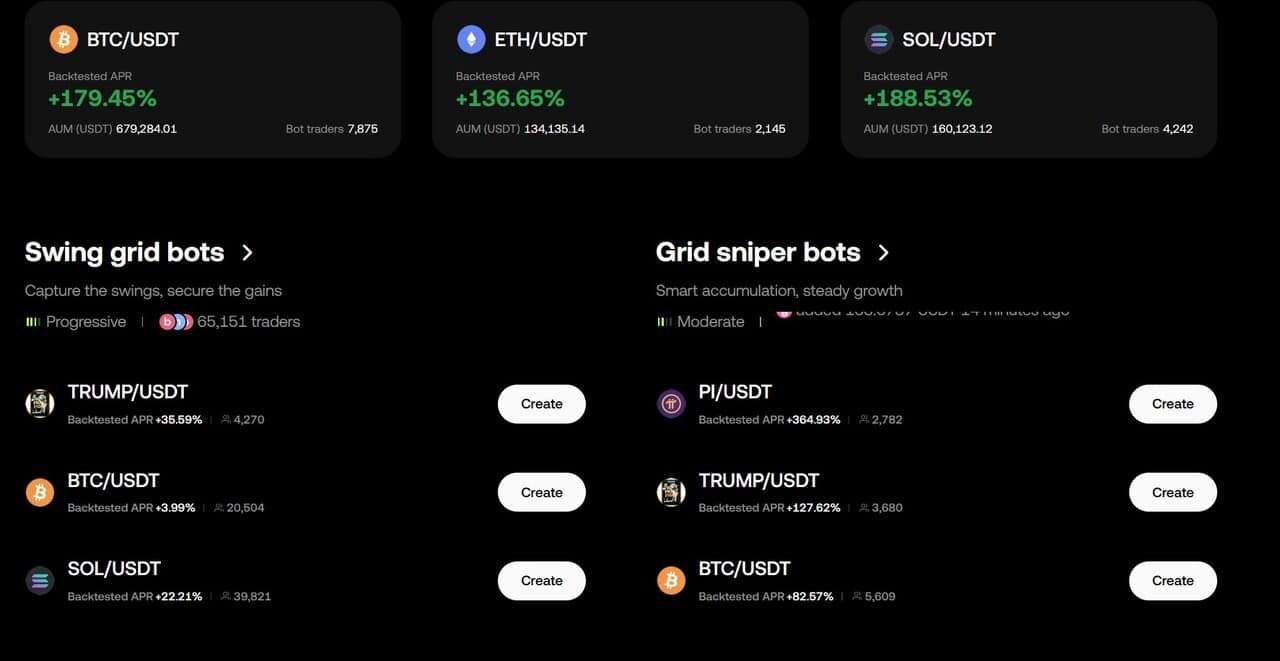

Step 8: Look for the bots you want to use, including bullish or bearish bots, grid bots, DCA bots, and more.

Step 9: Select the bot you want and customize the parameters. Update stop loss, take profit, and the amount you wish to use.

Why OKX Is the Go-To Choice for Automated Trading

OKX is a preferred platform for automated trading due to its competitive trading fees of 0.08% (maker) and 0.10% (taker) for the spot market, which ensure cost-effective transactions, and the variety of bots it offers.

The platform also offers deep liquidity, allowing smooth trade execution without significant price slippage. Security is another major advantage, as OKX employs robust measures to protect user funds and data.

Additionally, the seamless integration of trading bots within the OKX ecosystem ensures a hassle-free experience for users looking to automate their trades efficiently.

Comparing OKX Trading Bots to Other Crypto Bots

OKX trading bots stand out due to their AI-powered strategies, diverse trading options, and robust risk management features. Below is a comparison of OKX with other major automated trading platforms:

| Feature | OKX | Binance | Pionex | KuCoin |

|---|---|---|---|---|

| Bot Types | Grid (Spot/Futures), DCA, Arbitrage, Signal Bot, Infinity Grid, and more | Spot Grid, Futures Grid, Arbitrage, Rebalancing, Futures TWAP, and more | Grid, Infinity Grid, Martingale, Reverse Grid, DCA, Arbitrage, and more | Spot Grid, Futures Grid, DCA, Martingale, Smart Rebalance, Infinity Grid |

| Customization | High (Bot Marketplace, custom bots) | Moderate (pre-set strategies) | High (Multiple bots, PionexGPT) | Moderate (AI-driven adjustments) |

| Spot Trading Fees | 0.08% maker / 0.10% taker | 0.10% maker / 0.10% taker | 0.05% maker / 0.05% taker | 0.10% maker / 0.10% taker |

| Futures Trading Fees | 0.02% maker / 0.05% taker | 0.02% maker / 0.05% taker | 0.02% maker / 0.05% taker | 0.02% maker / 0.06% taker |

| Bot Cost | Free (only trading fees) | Free (only trading fees) | Free (only trading fees) | Free (only trading fees) |

| User Interface | Sleek, intuitive, Web3-focused | Accessible, slightly cluttered | Minimalist, bot-focused | Clean, beginner-friendly |

| Unique Selling Point | Bot Marketplace, AI-powered bots | Ecosystem depth, liquidity | 16 free bots, PionexGPT | AI-driven dynamic strategies |

| Best For | Versatile traders, Web3 enthusiasts | Beginners, high-volume traders | Automation enthusiasts | Beginners, AI strategy users |

Bottom Line – Is OKX Worth it?

OKX trading bots provide an efficient and user-friendly solution for automating crypto trades. By integrating AI-driven strategies, offering multiple trading options, and prioritizing security, OKX stands out as an excellent choice for traders seeking to optimize their trading experience.

Sign up on OKX today and start automating your trades with AI-powered strategies!

The post Automate Your Crypto Trading With OKX Trading Bots appeared first on 99Bitcoins.