The largest cryptocurrency made the headlines on numerous occasions in December and January by blowing off the $100,000 level and charting new all-time highs.

After that, Bitcoin traded in a sideways channel with extreme volatility between $92,000 and $106,000. However, the 75-day rangebound trend ended this week with an abrupt crash to below $80,000.

Bitcoin Prices Crash In Trump Dump

Even Bitcoin whales are offloading supplies as selling pressure mounted in the final week of February while the network activity and hash rate plunged.

But crypto asset isn’t alone amid a global macro Trump dump in prices across the board. The economy is pulling back to reset as an aggressively pro-reform White House administration takes the reigns in Washington.

Stocks plunged over the week with a 3.5% fall in the NASDAQ Composite. Gold futures fell 2.92%. Meanwhile, the US saw its first drop in consumer spending in two years. So crypto’s woes appear to be due to shifting macro tides.

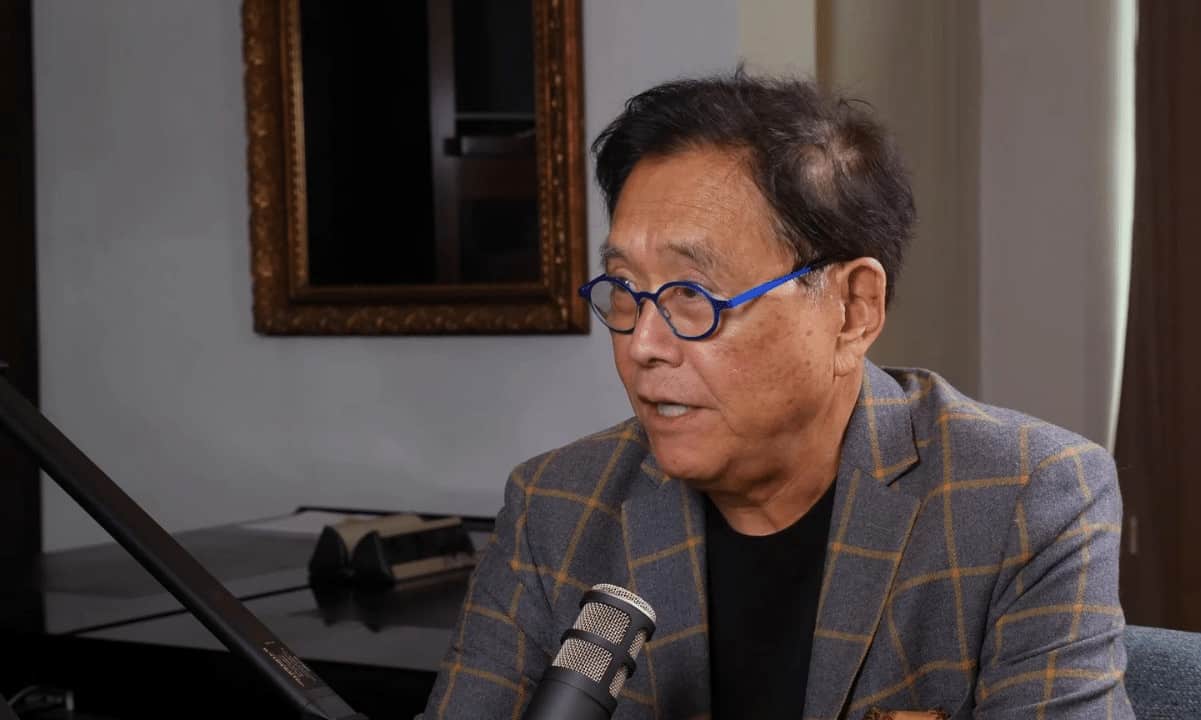

Robert Kiyosaki FOMOs Bitcoin Macro Hedge

BITCOIN CRASHING

Bitcoin is on SALE

I AM BUYINGWHY: The problem is not BITCOIN

THE PROBLEM is our Monetary System and our criminal bankers.America’s bankrupt. Our debt including social programs, such as Medicare and Social Security, including our $36 trillion debt is…

— Robert Kiyosaki (@theRealKiyosaki) February 27, 2025

Robert Kiyosaki isn’t alone in his positive outlook for BTC. Several blockchain market analysts say there is a recovery in view for crypto markets. BitMEX founder Arthur Hayes on Thursday predicted another “violent wave” down to $80,000 before this market clears out all the sellers.

That wave materialized on Thursday, and Bitcoin markets bounced off support at $78,200 and back to above $86,000 by Sunday. Meanwhile, trade volume increased as the asset made its rapid recovery, and searches and mentions of “buy the dip” spiked on social media.

That may be a signal that bears went too far and attracted Bitcoin bulls to the market with the smell of fresh blood on exchanges. On Wednesday, Kiyosaki exclaimed in a post on X that “Bitcoin is on SALE.”

“The problem is not Bitcoin,” the author of “Rich Dad, Poor Dad” said. “The problem is our Monetary System and our criminal bankers,” he added.

Calling US Treasury bonds “a joke,” Kiyosaki referenced the $36 trillion US national debt and $230 trillion in unfunded obligations for more bloated spending in pay-as-you-go social welfare programs.

“Bitcoin is money with integrity,” the bestselling financial author wrote.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!