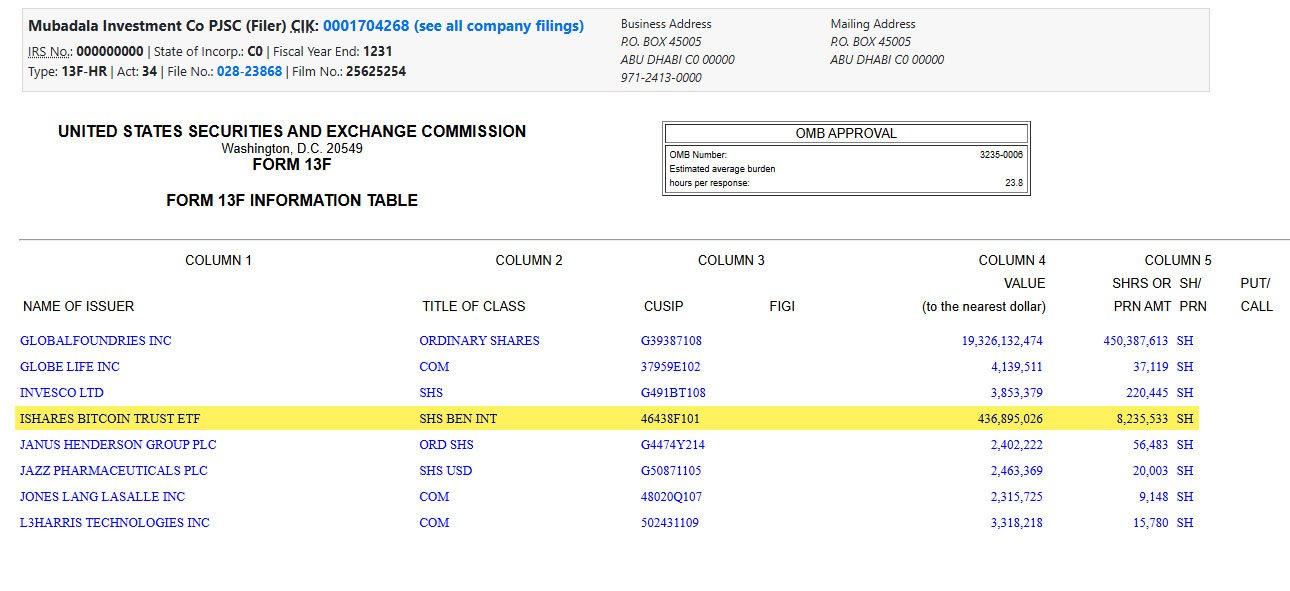

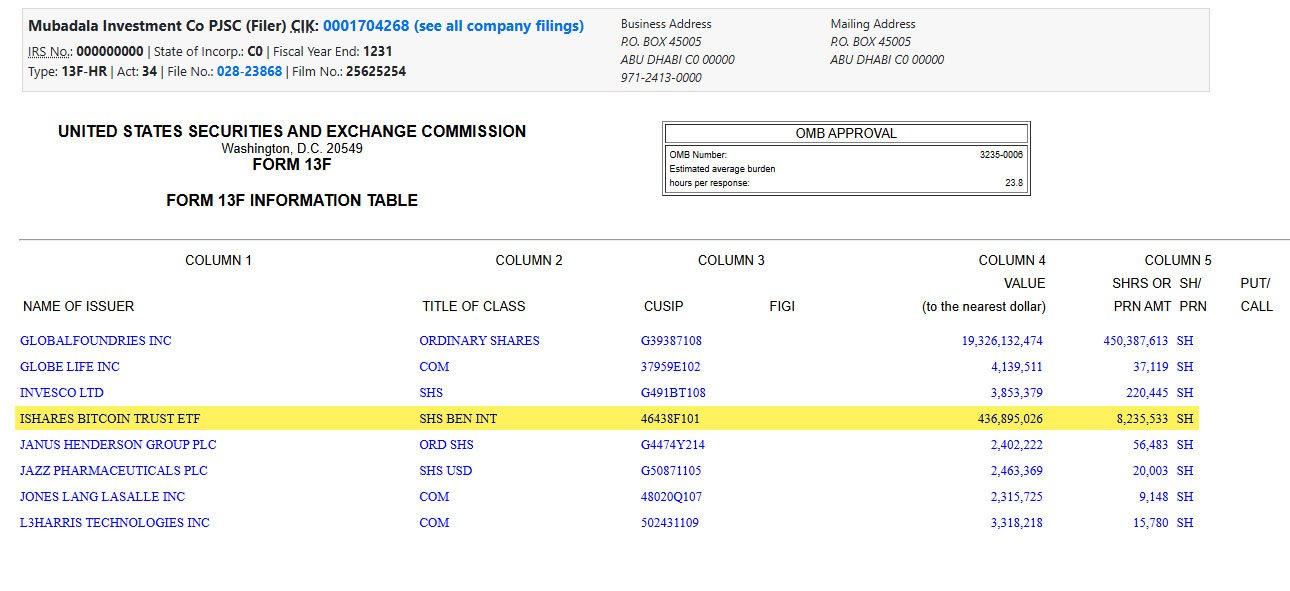

Abu Dhabi has made a big move into digital assets by investing $436.9 million into BlackRock’s iShares Bitcoin Trust (IBIT) through Mubadala Investment Company, one of Abu Dhabi’s top sovereign wealth funds. This is a major first for institutional investors.

The 13F filing with the U.S. Securities and Exchange Commission (SEC) shows Mubadala bought over 8.2 million shares of BlackRock Bitcoin ETF by the end of 2024. This is the first time a sovereign wealth fund has invested directly in a Bitcoin ETF.

Abu Dhabi is now the leader in Bitcoin adoption in the Middle East. The region has been very accommodating to Bitcoin and blockchain technology, and its government and financial institutions are exploring ways to integrate digital assets into their systems.

According to Sina, co-founder of 21st Capital, this signals a new era of bitcoin adoption, saying he believes the race between nation-states has officially begun.

Mubadala’s investment fits with broader institutional money flowing into bitcoin.

BlackRock’s IBIT has now become the largest spot Bitcoin ETF with over $56 billion in assets. Many see this as a sign that bitcoin is becoming a mainstream financial asset rather than just a speculative investment.

Related: BlackRock’s IBIT Sets Record as “Greatest Launch in ETF History”

Former Binance CEO Changpeng Zhao says Mubadala’s investment will encourage other sovereign wealth funds to follow. “Other countries will start moving,” said Steven Lubka, Head of Private Clients and Family Offices at Swan.

Mubadala which manages over $280 billion in assets has been diversifying its portfolio and this is part of a bigger financial transformation.

Abu Dhabi has been increasing its involvement in digital assets, including a big investment in Bitcoin mining in 2023. That year Marathon Digital and Abu Dhabi-based Zero Two partnered to build a large-scale Bitcoin mining facility, further solidifying the emirate’s commitment to Bitcoin.

The news of Abu Dhabi’s Bitcoin ETF investment hit the market hard, but its impact on bitcoin’s price was underwhelming. Bitcoin went from $96,700 to $97,700.

Nevertheless, some experts think this could set a precedent for other sovereign wealth funds to consider bitcoin as a long-term store of value.

Anthony Pompliano tweeted, “Abu Dhabi’s sovereign wealth fund just revealed they are buying hundreds of millions of dollars in Bitcoin, and people still think the United States won’t buy Bitcoin? The Strategic Bitcoin Reserve is happening.”

Abu Dhabi has already started to integrate digital assets with the introduction of Tether’s USDT stablecoin and welcoming global exchanges like Coinbase and Chainlink. Now with the latest move into Bitcoin ETFs, Abu Dhabi is becoming a major player in the region.