Key Points

- US Inflation Surge – US CPI jumped 0.5% in January, exceeding forecasts, with core CPI hitting 3.3% YoY, raising concerns about persistent inflation.

- Bitcoin & Ethereum Drop – Bitcoin fell from $97,173 to $94,200, while Ethereum lost $99, contributing to market downturns.

- Market Reaction – US stock indices dropped 1%, and 10-year Treasury yields spiked to 4.63%, signalling investor caution.

- Fed’s Stance – Jay Powell ruled out rate cuts, stating inflation and economic conditions don’t support easing monetary policy.

- Future Uncertainty – Rising China trade war fears, AI-driven market concerns, and economic strength could delay expected rate cuts into 2025.

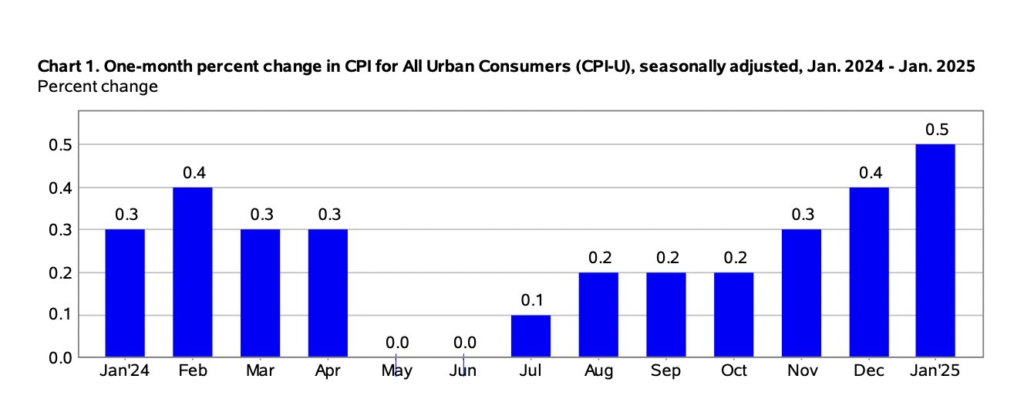

The consumer Price Index rose by 0.5 percent in January versus an expected 0.3 percent and December’s CPI by 0.4 percent. On a year-over-year basis, CPI was Higher by 3 percent and 2.9 percent in December.

So-called CPI which excludes Food and energy costs expected to rise by 0.3 percent but rises by 0.4 percent in January. Year-over-year, core CPI was higher by 3.3% versus 3.1% expected and 3.2% in December.

This week Market trading downwards, and the price of Bitcoin and Ethereum has sharply down in the last 24 hours. Bitcoin was priced the highest today at 97173.24 dollars but during the period it downwards to 94200 dollars. The same happened with Ethereum’s price the Highest at a price range of 2668.87 but over time its price lost by 99 dollars and reached 2569 dollars.

US stock index fell About 1 percent on the news, and 10-year annual interest rose by 10 points to 4.63 percent After Donald Trump’s victory in November month last year Bitcoin burst through $100,000, and Bitcoin had traded rangebound $90,000 and $109,000.

Artificial intelligence drove China’s worry, threats of a trade war, higher interest rates due to continued strength in the Economy, and inflation all of these are the main factors tempering prices.

Making a statement before Congress yesterday, Federal Reserve Chairman Jay Powell reiterated that “additional central bank rate cuts are likely to be off the table for the foreseeable future, barring unexpected downturns in either the economy or inflation.”

This inflation data could set the stage for markets to price hikes in 2025.