Kentucky is the latest state to bet on bitcoin as it introduces a bitcoin reserve bill. The bill, HB376, was filed by State Representative Theodore Joseph Roberts on February 6, 2025.

If passed, the State Investment Commission would be able to invest up to 10% of excess state funds into “eligible” digital assets.

The bill states that only digital assets with a market cap above $750 billion would be qualified for investment. Right now, only Bitcoin meets that requirement with a market cap of $1.9 trillion. So, basically, bitcoin is the only candidate.

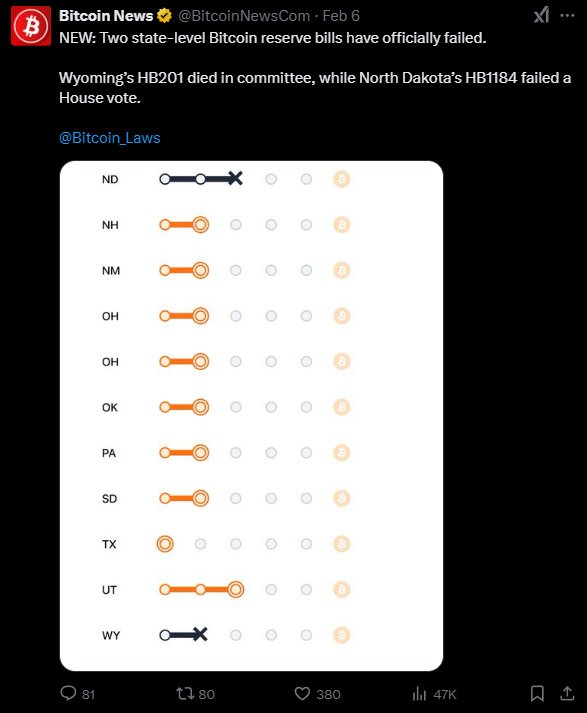

Kentucky follows Arizona, Texas and Florida which have already introduced similar legislation. Missouri and Iowa have also proposed bitcoin reserve bills. Utah’s bitcoin reserve law (HB230) has passed the House and is now in the Senate, being the farthest along.

Related: Utah Poised to Be First US State with a Bitcoin Reserve

Some experts believe Kentucky’s move could be the catalyst for federal action. They believe that as more states adopt bitcoin, federal regulators will have to take a stance.

If the states introducing the bills succeed in passing them as laws, then the SEC, the Fed, and even Congress cannot close their eyes to bitcoin any more.

The federal agencies will have to come to a decision about it, mainly their stance on its nature — is it a commodity? A security? Something entirely new?

Also, the risks of bitcoin’s volatility cannot be ruled out. Consumer protection is something that these laws will have to consider. If bitcoin’s price drops significantly, taxpayers’ money could be at risk. This raises questions that should be answered.

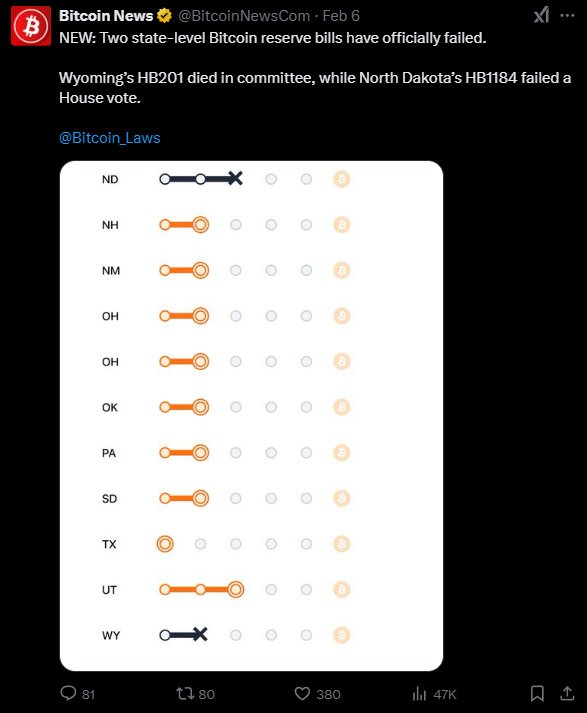

Not all states are on board though. While more are jumping on the Bitcoin bandwagon, not all bills have passed. In North Dakota and Wyoming, similar bills failed to pass committee and House votes.

Wyoming’s HB201 and North Dakota’s HB1184 both died, so the idea of bitcoin reserves is still controversial in some parts of the country.

The national bitcoin reserve bill is still up in the air. But according to Polymarket, a decentralized prediction platform, many think there’s a 45% chance the US government will have a bitcoin reserve by the end of 2025.

This shows there is growing support but also indicates the uncertainty around federal digital-asset regulations.

Bitcoin enthusiasts see Kentucky’s move as a sign of digital assets being accepted in mainstream finance, with some calling it a “massive vote of confidence” in Bitcoin.

Setting up a bitcoin reserve isn’t just about buying the digital asset. States need to have strong security, safe custody solutions and an strategy about volatility of bitcoin’s price.

As more states explore this option, the questions around risk management and regulatory oversight will get even more important.