Financial markets worldwide tumbled this weekend in response to what is popularly being called the “Trump Tariff Crash.” The Associated Press reported Monday that markets fell sharply “on worries about President Donald Trump’s tariffs …

“All told, the S&P 500 fell 45.96 points …. The Dow dropped 122.75 … and the Nasdaq composite sank 235.49 … ” additionally citing drops in London, Paris, Frankfurt, South Korean and Japanese markets.

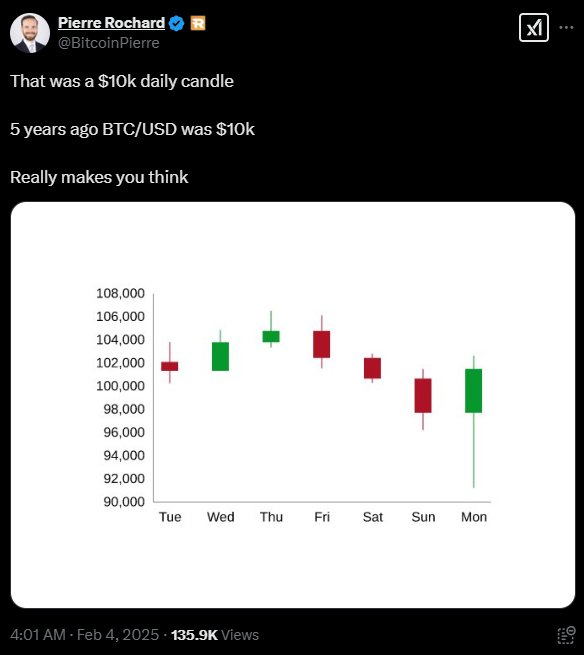

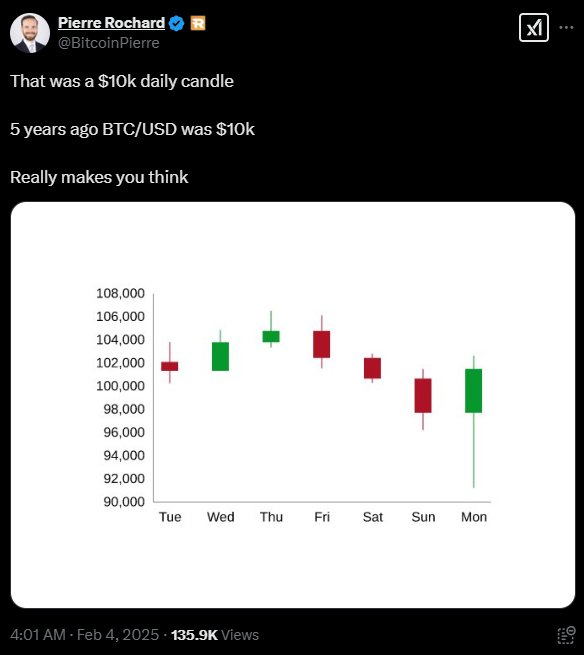

Bitcoin also fell dramatically, dropping from well over $105,000 Friday morning, to the $93,000 range by Sunday night, temporarily erasing gains which some ironically also called the “Trump Pump.”

But the AP also stated on Monday that “Bitcoin proved more resilient than other cryptocurrencies.” Indeed, Riot Platform’s VP of Research, Pierre Rochard pointed out that bitcoin quietly celebrated a new milestone yesterday.

For the first time ever, bitcoin’s price rose over $10,000 in a single 24-hour period. Rochard also noted that bitcoiners should pause to consider that only five years ago one bitcoin cost $10,000; now it can swing that much in a day.

The definition of a God candle is completely colloquial at present, sometimes confused with “Omega candle,” a $100,000 daily increase.

Neither term is recognized or in popular use by mainstream financial resources at present, but is solely the creation of #bitcointwitter discussions among popular thought leaders.

In a brief video short, Swan CEO Cory Klippenstein affirms the definition of a God candle as “Broadly, we’re just talking about a $10,000 move in a day …”

It’s not surprising that no other asset has had this discussion. Reflecting on Rochard’s observation above, bitcoin’s current price of around $100,000 could “gradually then suddenly” rise 100k in a single day, creating bitcoin’s first Omega candle.

Bitcoiners remained nonplussed, not even noticing as the milestone came and went. This same near-malaise was depicted in bitcoiners’ collective lack of over-excitement, when bitcoin’s rise to $100,000 was approaching.

Phil Geiger, community and strategic growth advisor for Unchained, humorously captured this sentiment, posting

“I was hoping it (God candle) would be $10k into ATH territory but all we got was this crummy v shaped recovery(!)”

Prior to Trump’s election, the largest one-day gain in bitcoin’s price was marked by an over $7,000 increase in about an hour, still not topping $10,000 for that day, however.

As of 8:40 a.m. ET Tuesday morning, charts displayed double-digit losses for all top 10 cryptocurrencies except bitcoin and “stable” coins, which were charting a 3% loss for the last seven days. At the same time, ETH was -10.8%, XRP was down 16.7%, Solona -10.1%, BNB – 12.5%, DOGE -17.2% and ADA -20.2%.

Well-known bitcoiner and tech leader Michael Saylor coincidentally celebrated his 60th birthday today, marking the occasion with orange cake and, appropriately enough, green candles.

As a side note to historians, Feb. 2 is Groundhog’s Day and Feb 4. is Saylor’s birthday; so what shall we forever remember Feb. 3 as, the day that bitcoin experienced its first $10,000 green candle?

Happy Honeybadger Day, anyone?