Bitcoin is currently trapped within a tight price range, bounded by the ascending channel’s lower boundary at $78K and the 200-day moving average at $83K. A breakout from this range will likely determine the next significant market trend.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin has been maintaining a bearish market structure, recently experiencing increased bearish momentum that pushed the price below the critical $80K mark.

This breakdown triggered the significant sell-side liquidity below this crucial juncture, leading to a sharp bullish rebound, likely due to smart money executing large buy orders.

Additionally, the move caused a substantial long liquidation, effectively cooling down the futures market. Despite the recovery, Bitcoin remains confined within a decisive price range, with $78K as a key support level and the 200-day moving average at $83K as a crucial resistance. A breakout from this range will determine the next directional move.

The 4-Hour Chart

On the lower timeframe, the liquidity hunt below $80K is evident, as Bitcoin dipped into this liquidity zone before staging a swift bullish rebound. However, after breaking below the ascending channel, the price has been forming a descending wedge pattern, suggesting further potential consolidation.

In the short to mid-term, Bitcoin is likely to continue moving within this wedge while staying above the $78K support. A breakout from this pattern, either above the wedge or below the $78K mark, will likely result in a significant price move in the direction of the breakout.

On-chain Analysis

By Shayan

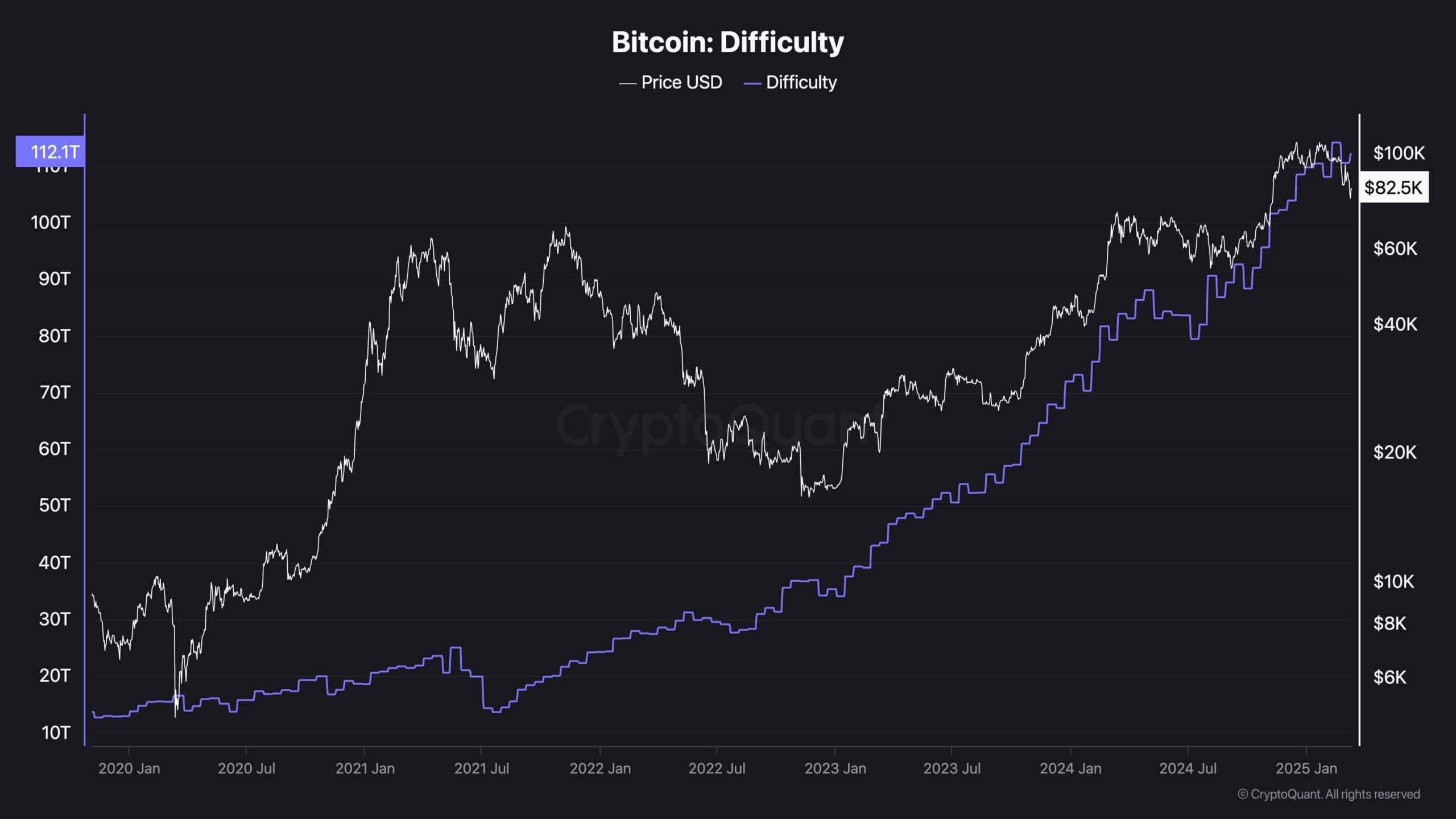

Bitcoin’s mining difficulty remains in an uptrend despite the ongoing market correction. During the extended correction phase that began in March 2024, mining difficulty experienced a temporary drop. However, Bitcoin’s price rebounded sharply, contradicting bearish predictions. Although the market is now undergoing a 30% correction, mining difficulty continues to rise.

A decline in mining difficulty typically indicates miner capitulation, where less efficient mining rigs are shut down. So far, there are no signs of such behaviour. However, if the correction extends further, we could see mining difficulty decrease due to miner capitulation.

Miners appear to be maintaining a holding strategy, which suggests that the broader uptrend remains intact. This phase requires patience rather than premature conclusions as market dynamics continue to evolve.

The post Bitcoin Price Analysis: Can BTC Reclaim $90K This Week? appeared first on CryptoPotato.