Strategy announced that the company is planning to raise up to $21 billion through the sale of preferred stock. This is part of the company’s long-term plan to buy more bitcoin (BTC) and improve its position as the world’s largest corporate holder of the scarce digital asset.

Strategy’s plan is to issue 8% Series A perpetual strike preferred stock which will be sold through an at-the-market (ATM) program. This allows the company to sell shares over time as they consider stock prices and market conditions.

In a recent filing with the U.S. Securities and Exchange Commission (SEC), Strategy said it would use the proceeds for “general corporate purposes, including the acquisition of bitcoin and for working capital.”

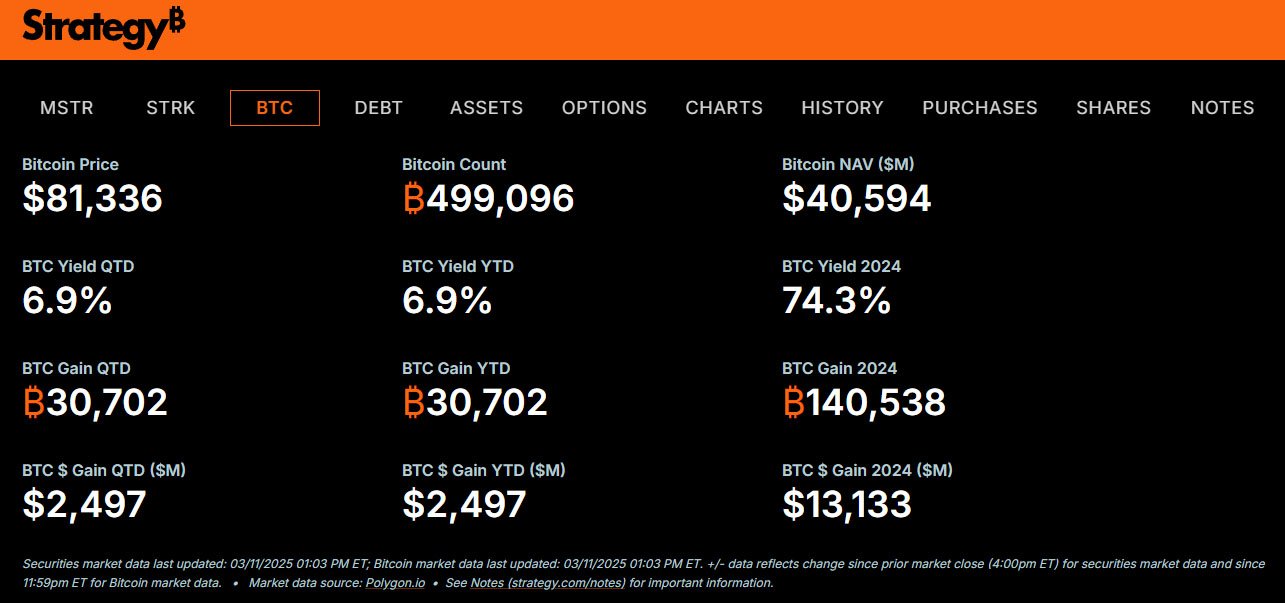

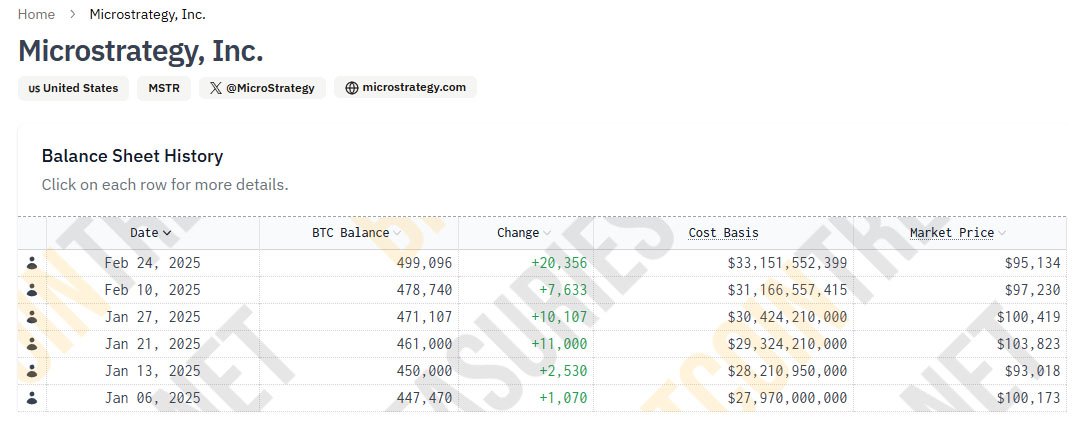

Strategy currently holds 499,096 BTC worth around $41 billion at current prices. It has been buying bitcoin aggressively since August 2020 and is positioning itself as a major player in the Bitcoin space.

This stock sale is part of Strategy’s broader “21/21 plan” to raise $21 billion in equity and another $21 billion in fixed-income securities over 3 years. The company will continue to buy more bitcoin and believes BTC will be a valuable asset in the long run.

So far in 2025, Strategy has announced 6 bitcoin purchases, adding 52,696 BTC since January 6. The bitcoin yield for 2024 was 74% and for 2025 is 6.9% so far.

Despite Strategy’s big bitcoin plans, the announcement of this stock sale didn’t boost investor confidence. The stock (MSTR) is down over 14% in the last month and 5% since the news, as bitcoin briefly hit $76,700 before correcting.

Analysts say since Strategy buys bitcoin through OTC transactions, the impact of their purchases on public market price is limited.

Despite the falling prices, on-chain data shows large investors (whales) have been accumulating bitcoin, buying over 22,000 BTC in the last 72 hours.

Since 2020, Michael Saylor has been a vocal Bitcoin advocate. Under his leadership, Strategy has gone from being a software company to what many see as a leveraged bitcoin investment vehicle. Saylor always says bitcoin is the most powerful asset in the world.

He’s even influenced the government.

Recently, US President Donald Trump signed an executive order to create a US bitcoin reserve, which will be funded by the BTC seized in legal proceedings.

He also hosted the first-ever “White House Crypto Summit”. Saylor was one of the industry leaders who attended the event.

Since Strategy started buying bitcoin, the stock has gone up 2,200% and Bitcoin has gone up 600%. So even with all the volatility, the long-term bet on bitcoin is paying off.