Key Takeaways

- Franklin filed an S-1 with the SEC to launch an ETF focused on XRP.

- A final decision is expected by October 2025 for most filings.

Share this article

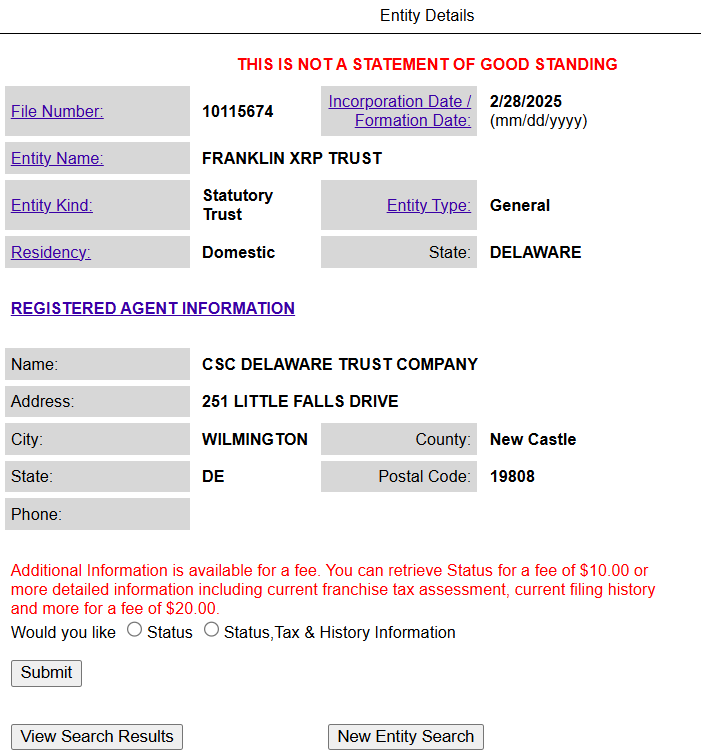

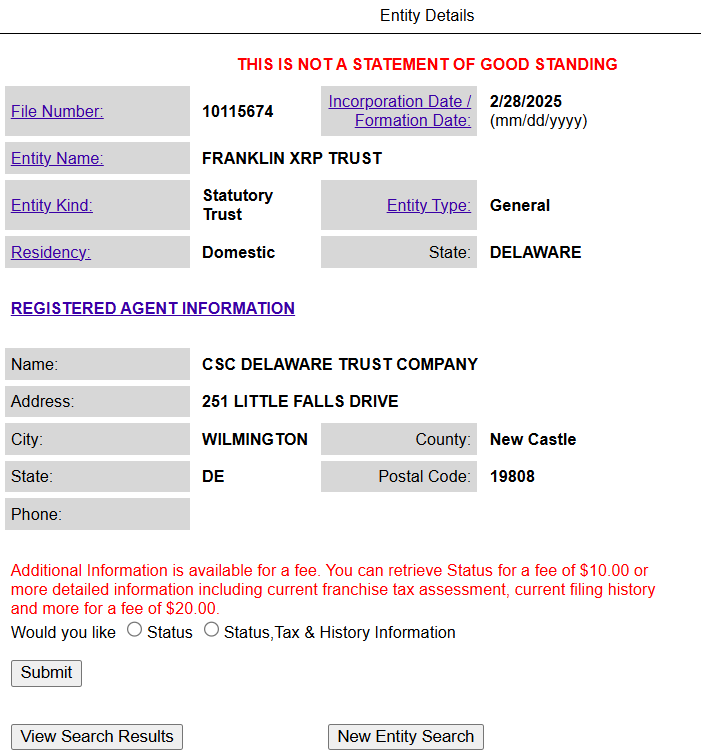

Franklin Templeton has filed an S-1 registration form with the SEC for an XRP ETF, following the February registration of the Franklin XRP Trust in Delaware.

The new filing with the SEC formally places the entity among a growing number of asset managers vying for an XRP ETF, including Bitwise, 21Shares, Canary Capital, Grayscale, and WisdomTree.

The proposed fund, which would trade on the CBOE BZX Exchange, aims to provide investors exposure to XRP, currently the fourth largest crypto asset by market cap. The ETF’s ticker symbol has yet to be determined, according to a Tuesday filing.

Coinbase Custody would serve as the custodian for the fund’s XRP holdings, while Coinbase would act as the prime broker. CSC Delaware Trust Company would serve as trustee.

The shares would be offered continuously at net asset value, with only authorized participants able to create or redeem creation units. The fund would use the CME CF XRP-Dollar Reference Rate to determine its net asset value.

Franklin Holdings will sponsor the fund and has agreed to pay most ordinary operating expenses in exchange for a sponsor’s fee. The trust is structured as an emerging growth company under the JOBS Act.

The filing marks the latest attempt to launch a spot crypto ETF following previous Bitcoin and Ethereum ETF approvals. The SEC will need to review and approve the filing before the fund can begin trading.

The SEC acknowledged multiple XRP ETF filings in recent weeks, starting with Grayscale’s XRP ETF application on February 14, initiating a 240-day review period.

This was also the first time the SEC responded to a request to launch an investment product that directly holds XRP, the crypto asset that is still under regulatory scrutiny due to the SEC’s ongoing legal battle with Ripple Labs over its classification as a security

Other filings, including those from WisdomTree, Canary Capital, and CoinShares, were also formally accepted for review. These filings are now in the public commentary phase, which is part of the SEC’s review process.

Share this article