The crypto sell-off continues, and top altcoins, including Bitcoin, Ethereum, and Solana, are feeling the heat. SOL holders are already exiting, cashing out, and fueling the sell-off toward the $100 psychological level.

Amid this development and fast-fading optimism, it is emerging that a large portion of transactions on Solana—which is among the coins analysts say will explode in 2025—could, after all, be bot-driven.

Are Most Solana Transactions Fake?

In a post shared on X, one observer noted that onchain activity on Solana may not be as organic as it seems and could be driven by aggressive bots.

This observation, in turn, raises questions about the authenticity of onchain activity on the popular smart contract network and its possible impact on network health.

In his findings, the analyst notes that 122 unique addresses were responsible for posting at least 100,000 daily transactions in the past week alone. Compared to other addresses, these few accounts contribute a staggering 44.2% of all transactions on the modern chain.

(Source)

That only a few addresses are responsible for nearly half of all transactions on an otherwise busy network is suspicious and could suggest possible manipulation attempts. Usually, the activity and health of any public ledger are judged by the number of addresses and transactions posted.

When there are more transactions, validators running to secure the platform get paid and, thus, invest even more to enhance security and keep up with rising demand. However, if transactions begin falling, users may seek alternatives, which, in turn, may negatively impact prices.

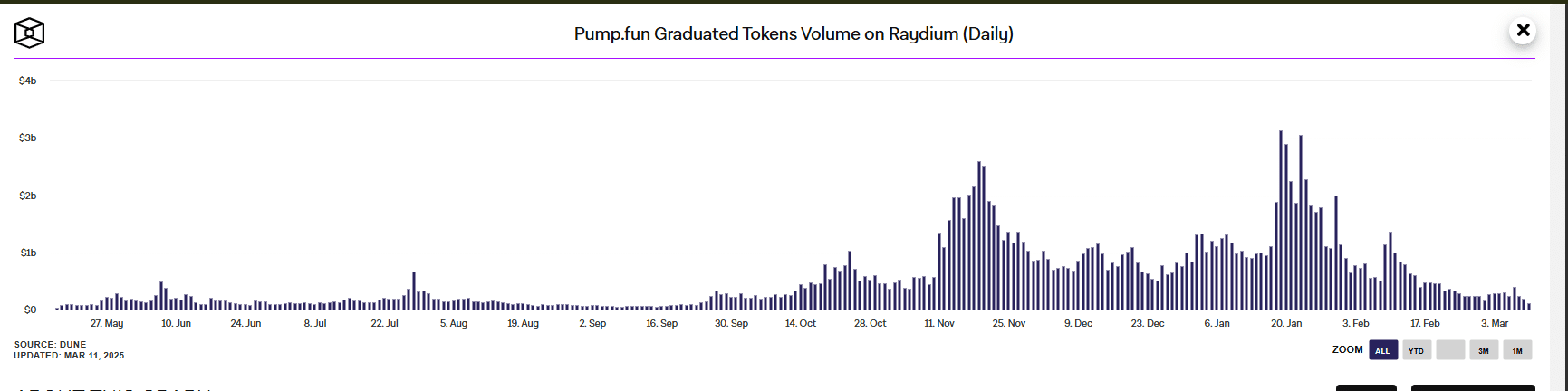

Falling Meme Coin Activity Dents SOL Prices

Trading activity and volume are subdued, following SOL prices and meme coin activity. At its peak, Solana posted hundreds of thousands, if not millions, of daily transactions as traders scrambled to pick out the next PNUT or some of the best meme coins to trade.

During this time, it was normal for speculators to strike big, making 100X returns and churning millions from their small investments. This is now changing as fewer meme coins are launched, and speculators tighten their purses, expecting more losses and a drop in activity as crypto prices slump.

High-profile scams and rug pulls, in some instances promoted by world leaders, have eroded trust in Solana and its popular meme coin launchpad, Pump.fun.

(Source)

The scalable nature of Solana and the ability to post transactions cheaply allow bots to deploy and manipulate the true level of onchain engagement.

Unlike Ethereum, users can transfer coins or post contracts on-chain while paying only a fraction of the fees. While this may boost activity, it is a double-edged sword, as it may turn the chain into a hub for bots, bloating the network and manipulating trading volumes via wash trading, for example.

Most of these bots are used for high-frequency trading, exploiting arbitrage opportunities, and even sniping some of the best meme coins to buy in 2025.

Key Takeaways

- Solana is a popular chain powering meme coins

- Are bots responsible for most transactions onchain?

- Meme activity falling on Solana

The post Are Transactions on Solana Mostly Bot-Driven? When Will SOL Recover? appeared first on 99Bitcoins.