Bitcoin halving is a major event in the crypto world. It is a pre-programmed occurrence that reduces mining rewards and the amount of Bitcoin in circulation. It is embedded into Bitcoin’s protocol and occurs approximately every four years or after every 210,000 blocks are mined.

These events exist to control the supply of new bitcoins and potentially lead to increased value. Given that Bitcoin is the most dominant asset in the crypto space, these halving events could affect miners, traders, and investors alike.

Therefore, to be successful in the crypto space, it is important to know the details of major events that can impact token prices and other factors. Which is why this article provides a comprehensive guide to Bitcoin halving events and why they matter. It also explains how halving affects miners, blockchain projects, and investors. Let’s dive in!

What Is Bitcoin Halving?

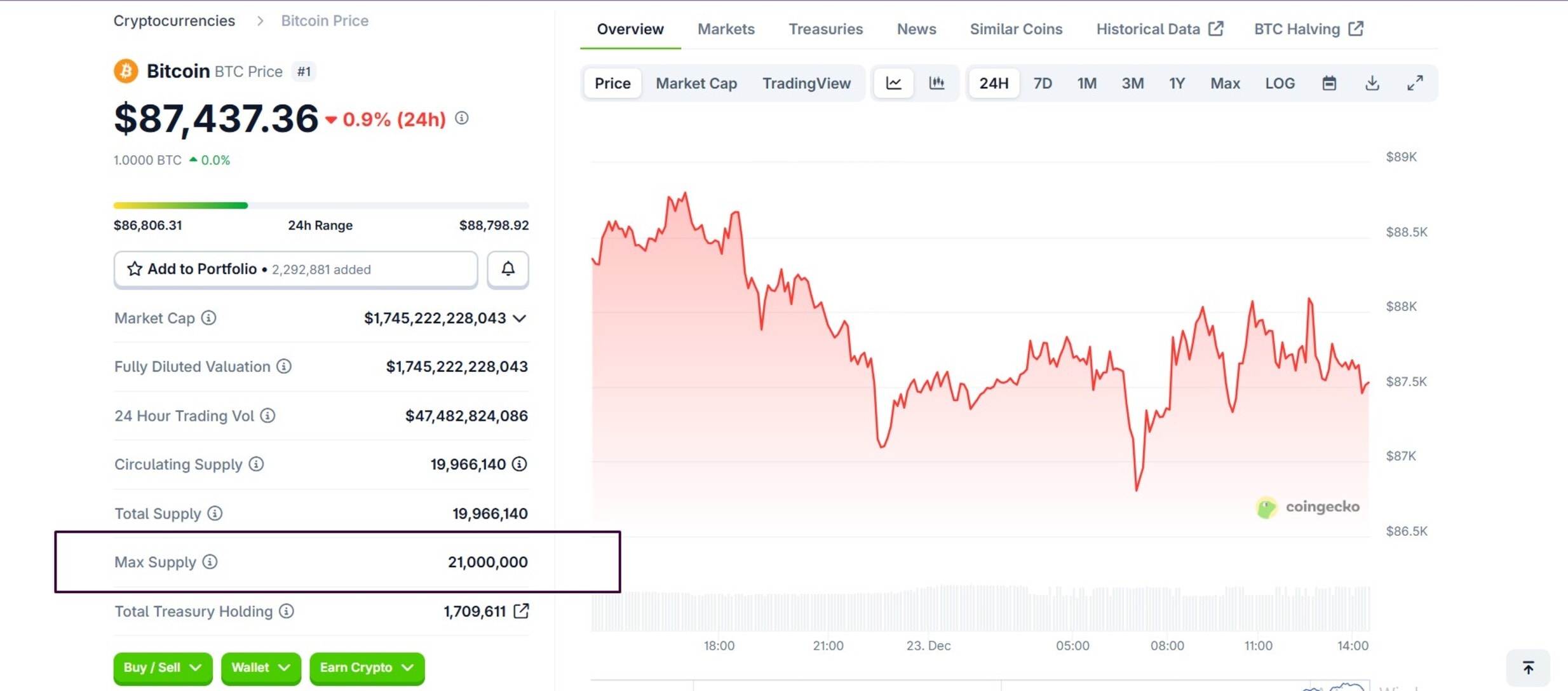

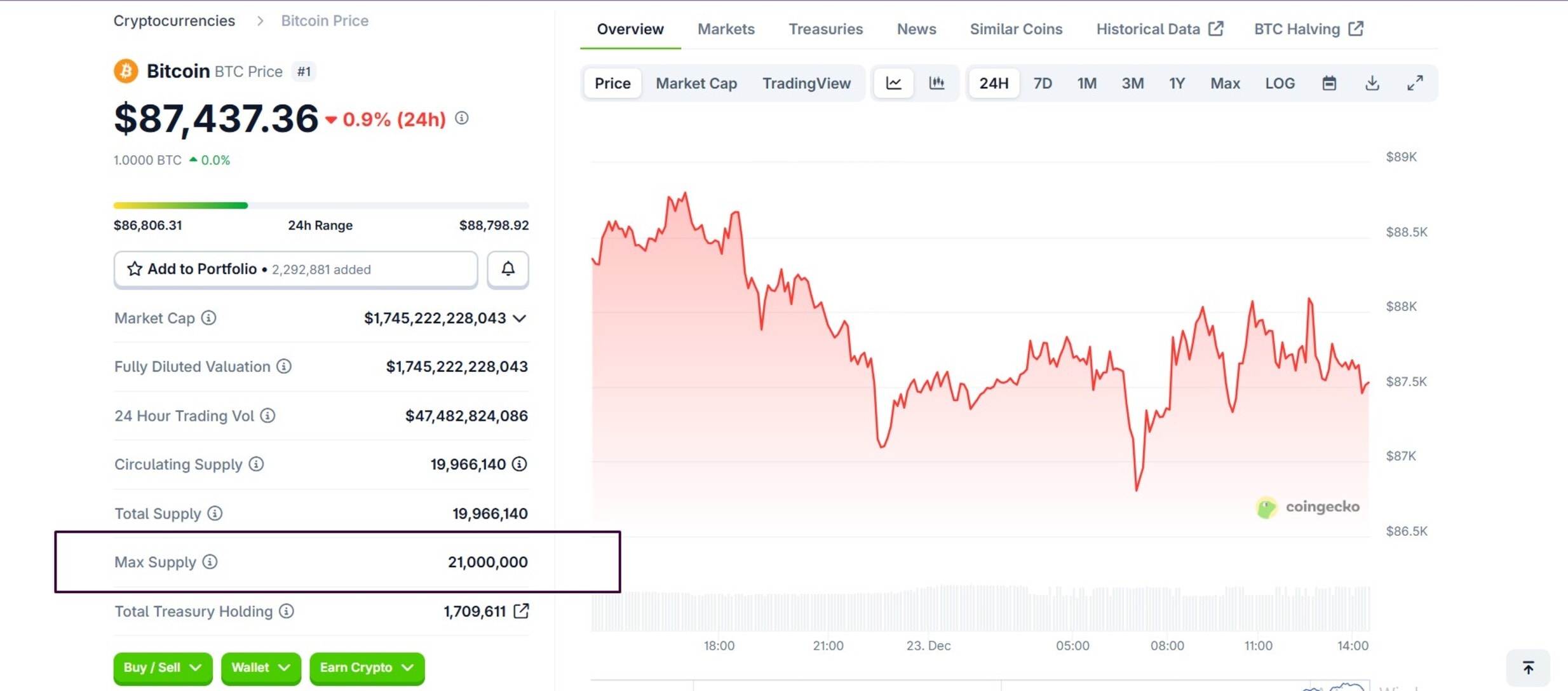

Bitcoin halving is a pre-programmed event that halves mining reward when miners add new blocks to the blockchain. Bitcoin has a permanent maximum supply of 21,000,000 BTC. This fixed limit is a core feature that prevents inflation and increases its potential value over time.

To introduce more Bitcoin into circulation, miners use high-performing machines to solve cryptographic puzzles. Through this, new Bitcoin is created as rewards for miners who validate Bitcoin transactions and add blocks to the Bitcoin blockchain.

Bitcoin halving events occur approximately every four years, or after every 210,000 blocks are mined, to control the supply of new bitcoins and enforce the 21 million total cap. The Bitcoin network automatically halves this reward and updates the cycle. There have been four halving events so far and they include:

- First (2012): Reduced reward from 50 to 25 Bitcoin per block.

- Second (2016): From 25 to 12.5 BTC per block.

- Third (2020): From 12.5 to 6.25 BTC.

- Fourth (2024): From 6.25 to 3.125 BTC.

Since halving events occur every 4 years, the next halving is expected in around 2028. This upcoming event will reduce Bitcoin mining rewards from 3.125 BTC to 1.5625 BTC.

Why Does Bitcoin Halving Happen?

Bitcoin halving occurs to enforce Bitcoin’s fixed supply cap of 21 million coins. It is achieved by progressively reducing the rate of new bitcoin issuance. The halving events were coded by Satoshi Nakamoto to mimic the scarcity of precious metals like gold.

The primary goal is to control supply and prevent inflation by reducing the available BTC. By halving block rewards, BTC developers have ensured a gradual distribution over about 140 years until all Bitcoins are mined.

This mechanism promotes Bitcoin as a deflationary asset, potentially increasing value. And, encouraging users to invest in Bitcoin before halving events by taking advantage of Bitcoin price spikes.

How Do Bitcoin Halving Work?

Bitcoin halving is implemented as a pre-programmed rule in the token’s protocol. It automatically reduces the block reward for miners by 50% every 210,000 blocks. For new BTCs to be created, miners compete to solve complex cryptographic puzzles.

When they solve these puzzles, they validate transactions and add a new block to the Bitcoin blockchain. During this process, the successful miner receives the current block reward in newly minted Bitcoin plus transaction fees.

Since the halving process is pre-programmed, the Bitcoin network tracks block height. Upon reaching multiples of 210,000, it automatically halves the subsidy (from 50 BTC initially to 25, then 12.5, and so on).

History of Bitcoin Halving Events

Bitcoin halvings have occurred four times since the token’s launch. Each reducing the block reward by half at predetermined block heights.

Bitcoin halvings began with the network’s genesis in 2009. At the time, miners received 50 Bitcoins per block, with the reward halving every 210,000 blocks to cap maximum supply. Here is the breakdown of last Bitcoin halving dates:

| Date | Block Height | Reward Before | Reward After | Avg. BTC Price at Halving | Avg. Price 1 Year Later |

| Nov 28, 2012 | 210,000 | 50 BTC | 25 BTC | $12 | $964 |

| Jul 9, 2016 | 420,000 | 25 BTC | 12.5 BTC | $663 | $2,550 |

| May 11, 2020 | 630,000 | 12.5 BTC | 6.25 BTC | $8,740 | $58,250 |

| Apr 20, 2024 | 840,000 | 6.25 BTC | 3.125 BTC | $64,000 (pre-halving peak) | $82,000 |

First Halving (2012): Bitcoin adoption

On November 28, 2012, at block 210,000, the reward dropped from 50 to 25 BTC when BTC traded around $12. This marked the protocol’s first real-world test of scarcity mechanics. By the following year, the price climbed to $229 in April 2013 and $1,100 by November.

Second Halving (2016): Crypto awareness

The second halving was on July 9, 2016, at block 420,000. This event reduced rewards from 25 to 12.5 BTC with BTC market price at $663. Despite a short-term dip after halving, it rose to nearly $20,000 by December 2017, coinciding with broader crypto awareness.

Third Halving (2020): Institutional interest

After the second halving, the third one happened four years later, on May 11, 2020. At the time, the block was at 630,000, cut from 12.5 to 6.25 BTC with BTC selling at $8,740. After this event, the surge hit $69,000 in 2021. This spike was amplified by institutional interest and pandemic stimulus.

Fourth Halving (2024): Global integration

Four years later, at block 840,000, BTC halved to 3.125 BTC. The price was around $64,000 pre-event. About a year later, in October 2025, Bitcoin hit an all-time high of over $126,000.

This spike came especially from more investor interest and Bitcoin ETF (exchange-traded fund) approvals. Accessibility and diversity also played a crucial role as many top crypto exchanges now provide these ETFs for trading.

What Happens After Bitcoin Halving?

Bitcoin halving triggers an immediate reduction in new BTC supply, cutting miner block rewards by half and slowing the supply rate. While there are many effects, short-term effects often include minor adjustments and potential price volatility, while long-term trends have historically featured bull markets due to scarcity.

Halvings could shut down less efficient miners as Bitcoin mining revenue halves, leading to temporary hashrate dips. It usually takes weeks for the cryptocurrency market to recover, and by then, survivors have gained market share and can invest in better hardware.

In addition to these, the major impact that affects investors is price volatility. Based on historical events, the halvings of 2012, 2016, and 2020 saw initial dips followed by rallies. Even the 2024 event strengthened Bitcoin’s dominance, with sustained demand which drove value higher.

When Is the Next Bitcoin Halving?

The next Bitcoin halving is scheduled for block height 1,050,000. At this point, the block reward will drop from 3.125 BTC to 1.5625 Bitcoin per block. As for estimated dates, projections place it in April 2028. However, specific estimates vary slightly due to fluctuating block times averaging 10 minutes. But as of December 23, 2025, approximately 829 days or 120,870 blocks remain.

The Impact of Bitcoin Halving on The Market

Bitcoin halving reduces new BTC supply by halving miner rewards, creating a supply shock that, if demand holds steady, historically precedes price appreciation. This scarcity mechanism has driven bull cycles following events, though its effects vary with market maturity.

These events primarily impact the broader cryptocurrency market by tightening Bitcoin supply, which often sparks BTC-led rallies that lift altcoins (other cryptocurrencies other than BTC) through increased liquidity and investor optimism.

As the dominant asset (50-60% market cap), halving-driven BTC surges lead to altcoin season phases. The altcoin season is a phase where altcoins (any crypto besides Bitcoin) see significant, rapid price surges, often outperforming Bitcoin.

This happens as capital rotates from BTC into riskier, high-reward altcoins. Altseason is primarily marked by a drop in Bitcoin’s market dominance and huge gains across many different cryptocurrencies.

It usually occurs during or after a Bitcoin bull run when money flows out of Bitcoin into smaller tokens. This causes explosive growth for many projects. Once 75% or more of major altcoins outperform BTC over a sustained period (say 90 days), it could signal altseason.

Common Myths About Bitcoin Halving

Bitcoin halving myths often stem from hype around its scarcity effects, but many overlook market complexities and protocol design. Common misconceptions include guaranteed price surges and miner ruin, all of which are debunked by historical patterns and Bitcoin’s adaptive mechanics. Here are some myths about halving events.

- Halving guarantees immediate price pumps: Halvings correlate with rallies due to reduced supply, but causation is unproven as prices rise from demand, adoption, and macro factors like ETFs, not the event alone. Past cycles saw pre-halving pumps and post-dips before gains.

- Bitcoin miners get instant profits or ruin: Rewards halve, pressuring inefficient operations to exit, but survivors upgrade hardware and rely more on fees. This is because profitability is tied to Bitcoin price and efficiency, not instant windfalls.

- Network security declines: Hashrate may dip temporarily, but difficulty adjusts automatically to maintain 10-minute blocks, drawing in efficient miners and strengthening the network long-term.

- Mining Bitcoin becomes unprofitable after a halving: While the immediate reduction in block rewards can challenge less efficient miners, the ecosystem adapts. Miners prepare for this event by upgrading to more energy-efficient hardware, finding cheaper energy sources, and diversifying income streams through transaction fees.

Conclusion: Why Bitcoin Halving Matters

Bitcoin halving matters because it is the core mechanism enforcing Bitcoin’s scarcity and deflationary nature. The events create supply shocks that historically precede bull markets. It reduces miner selling pressure and inflation rates, while shifting reliance to transaction fees for network security.

In addition, halvings catalyze market cycles, lifting BTC dominance and altcoins through liquidity flows, miner consolidation, and efficiency gains. Since more BTC halvings are expected in the coming years, these future events will continue shaping adoption, sustainability, and the ecosystem’s maturity.

FAQs

Yes, eventually. Bitcoin halving will not stop abruptly but will continue until block rewards reach zero around the year 2140. At that point, the protocol’s fixed supply of 21 million BTC will be fully issued, leaving miners to survive solely on transaction fees.

Based on the programming of Bitcoin network, halvings will continue for 28 more events after the four completed (2012, 2016, 2020, 2024), totalling 32 cycles until rewards near zero around 2140.

Halvings are generally bullish in the long term because supply shocks reduce new BTC issuance, historically sparking bull runs amid scarcity and demand. One major example is the post-2020 surge of 541% in a year. While halving is bullish in the long term, the market often experiences short-term volatility or dips before the pump.

Yes, halvings ripple to other cryptocurrencies as BTC dominance often dips post-event. This dip usually triggers what is called altcoin season or alt season, where capital rotates into altcoins like Ethereum, Solana, XRP, and other crypto assets.

It is better to buy BTC before or immediately after a halving. This is in anticipation of a sudden price increase in the months that follow. However, neither timing guarantees success. One effective way historically has been dollar-cost averaging. When done three months before and after halvings it optimizes risk-adjusted returns.

While this has worked in the past, avoid the FOMO of pre-halving peaks or post-correction dips. Instead, do your own research to ensure your decision is informed. Also, only invest money you are willing to lose, as the crypto space is highly volatile and can go against you at any time.

For miners, halving cuts down rewards by 50%, squeezing margins and forcing inefficient miners to exit or upgrade. This causes temporary hashrate drops that recover as efficient operations dominate and fees rise, but Bitcoin price gains often offset losses.