What’s a realistic Monad Crypto price prediction for 2026? Crypto is quietly becoming boring in the best possible way.

Despite a rough, Grinch-like end to the year, regulators are easing up, payment rails are being tested in the real world, and infrastructure projects are starting to matter more than hype narratives.

That shift is a critical context for any serious Monad crypto price prediction heading into 2026.

Monad Crypto Price Prediction for 2026? Monad’s Price Pain Hides Real Ecosystem Progress

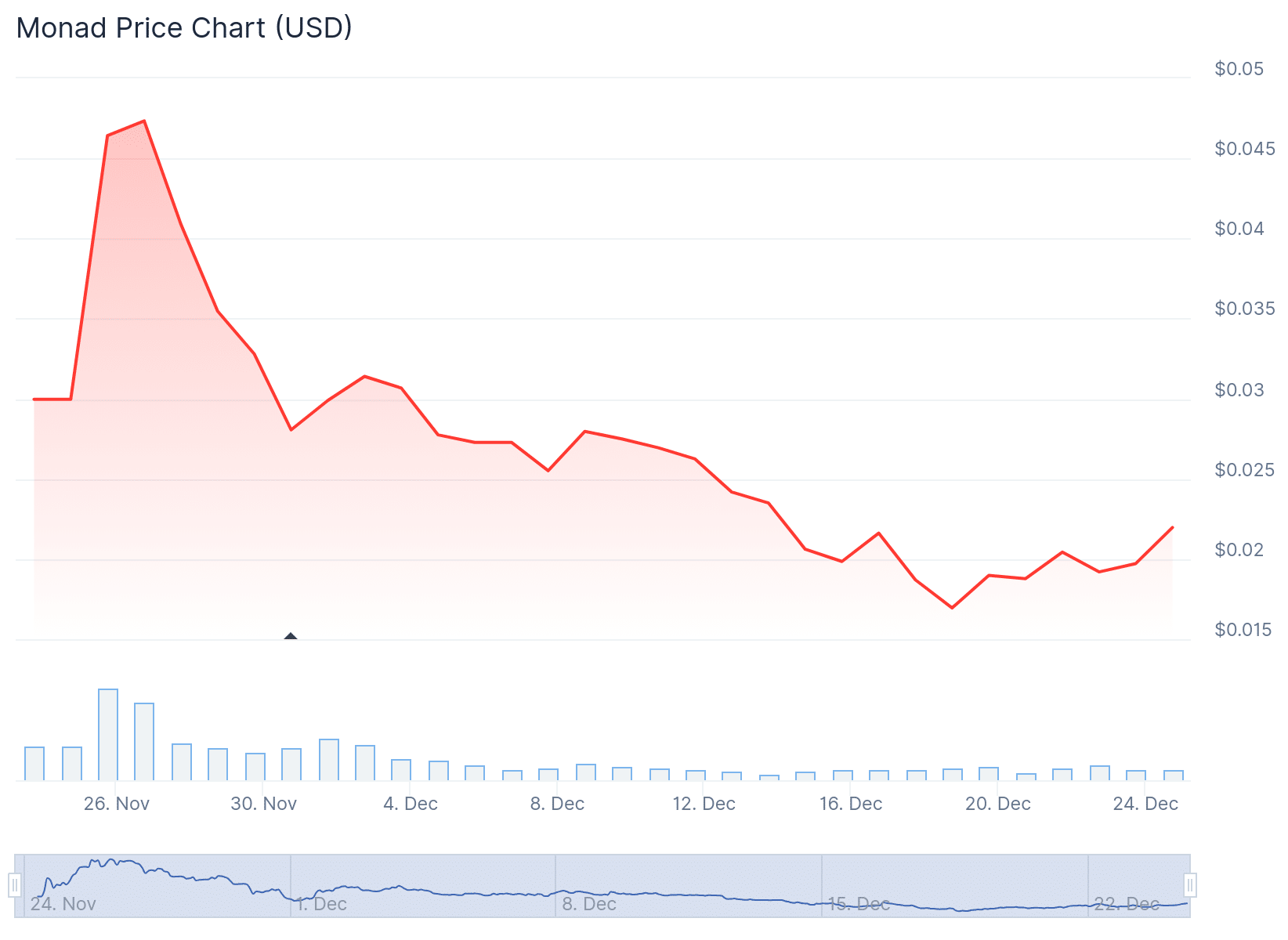

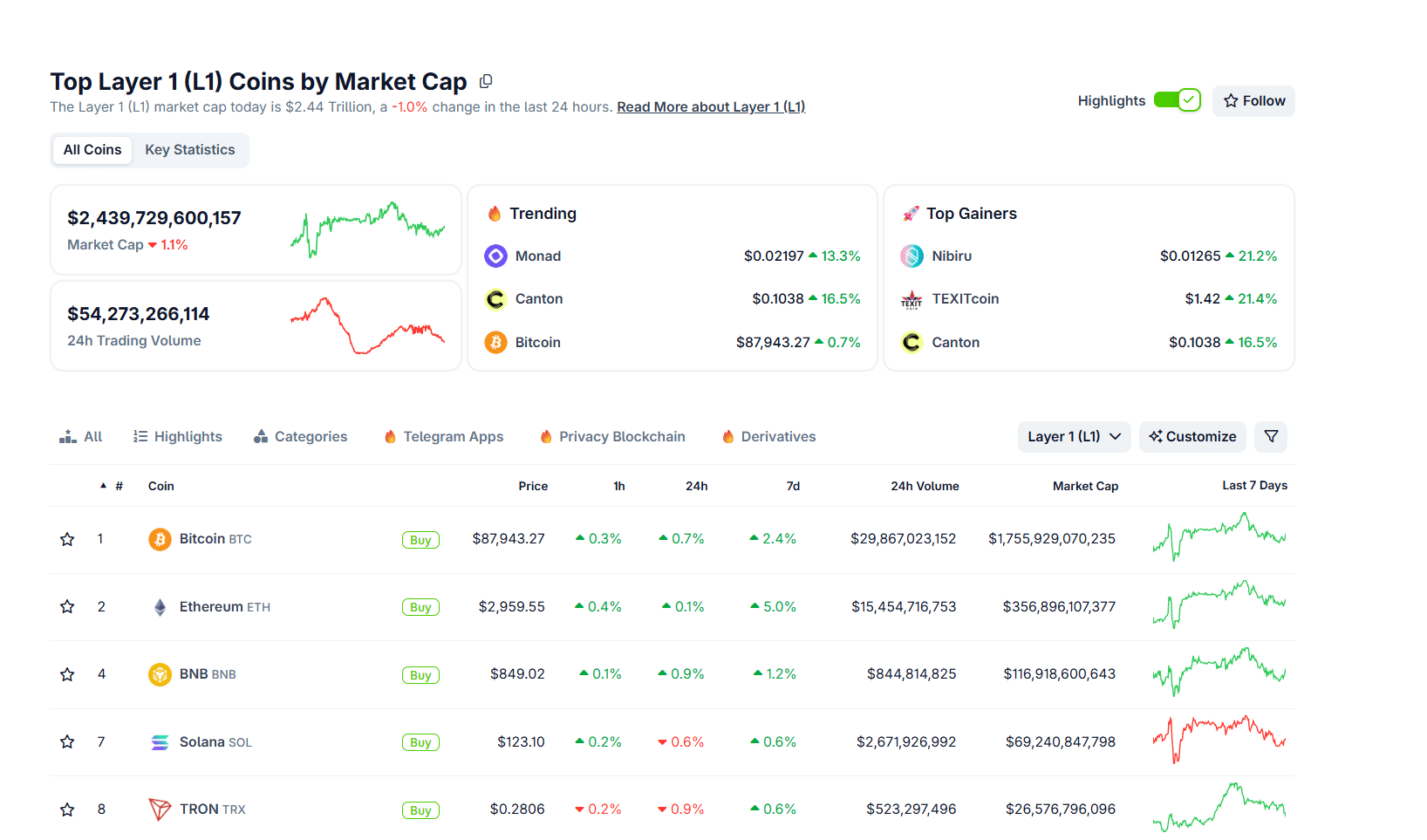

Monad has not been spared by the market, down 26.9% on the year, but recently making sizeable gains being up 12% over the last day to $0.02192.

Roughly 3.3 Bn tokens entered circulation, triggering classic post-airdrop selling pressure that quickly rebounded.

Yet price alone does not tell the full story. Monad has continued integrating core infrastructure, including support for USD1 stablecoin and the launch of staking via Bybit. According to CoinGecko data, Monad’s market capitalization sits near $237 Mn, a level that reflects weak demand but not outright capitulation. An RSI near 41 suggests sellers are tiring without buyers fully stepping in.

There is always a bull market somewhere!

The Monad wealth effect is about to begin, strap in!$Mon pic.twitter.com/2nHm5TjaDw

— Jovin

(@JovinSKN) December 24, 2025

From a fundamentals lens, this is the phase where long-term positioning is quietly built. If you’re like me and have seen this movie before, this is the uncomfortable, boring and nearly exciting part, often where the best entries are made.

What Does The Data Say For Monad Crypto?

CoinGecko data also shows that across Layer-1 and infrastructure tokens, realized losses peaked in mid-2025 and have since flattened. Capital is no longer stampeding for the exits.

FRED shows US real rates easing into year-end, while the dollar index logged its weakest annual performance since 2017. Historically, that environment favors long-duration risk assets once supply shocks fade.

2026 Outlook: Where Does Monad Fit In?

If regulation keeps settling and stablecoins keep slipping into daily payments, the upside tilts toward infrastructure. Chains like Monad are positioned to capture that flow. We need an altcoin season eventually, right? We’re not coping… I think.

The key risk is dilution. Token supply dynamics still matter, and any Monad crypto price prediction must factor in unlock schedules and demand growth.

A conservative 2026 scenario sees Monad reclaiming the $0.05 to $0.08 range if ecosystem usage expands and post-airdrop supply is absorbed. A more aggressive case, tied to sustained DeFi and payments adoption, pushes that to $0.20. But this is not a meme trade. It is a patience trade.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Key Takeaways

- Over $3 billion has already been siphoned out of crypto in 2025, driven largely by supply-chain exploits that exposed weak infrastructure. .

[key_takeawayMonad has not been spared by the market, down 26.9% on the year, but recently making sizeable gains. [/key_takeaway]

The post Monad Crypto Price Prediction for 2026 as Regulation, Payments, and Security Collide appeared first on 99Bitcoins.