Key Takeaways

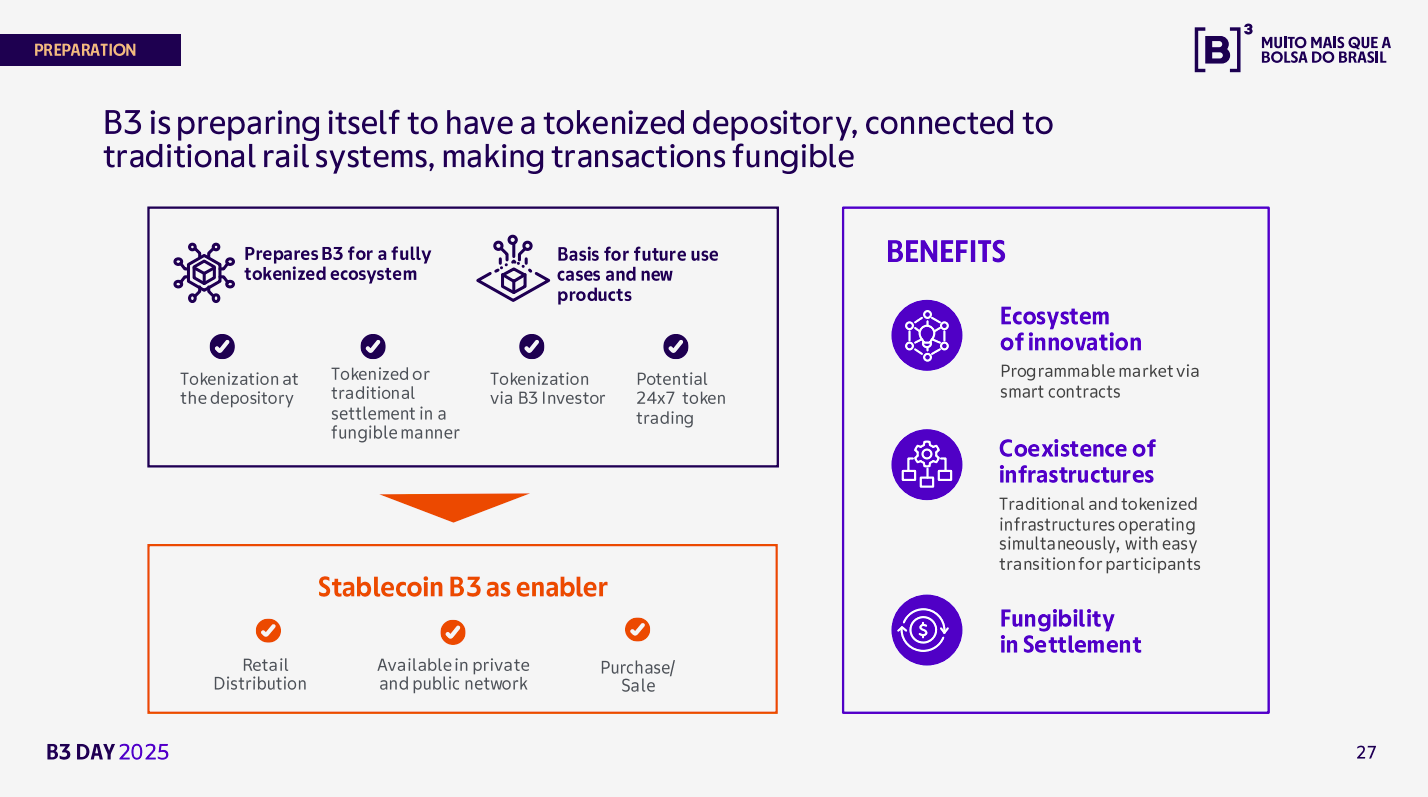

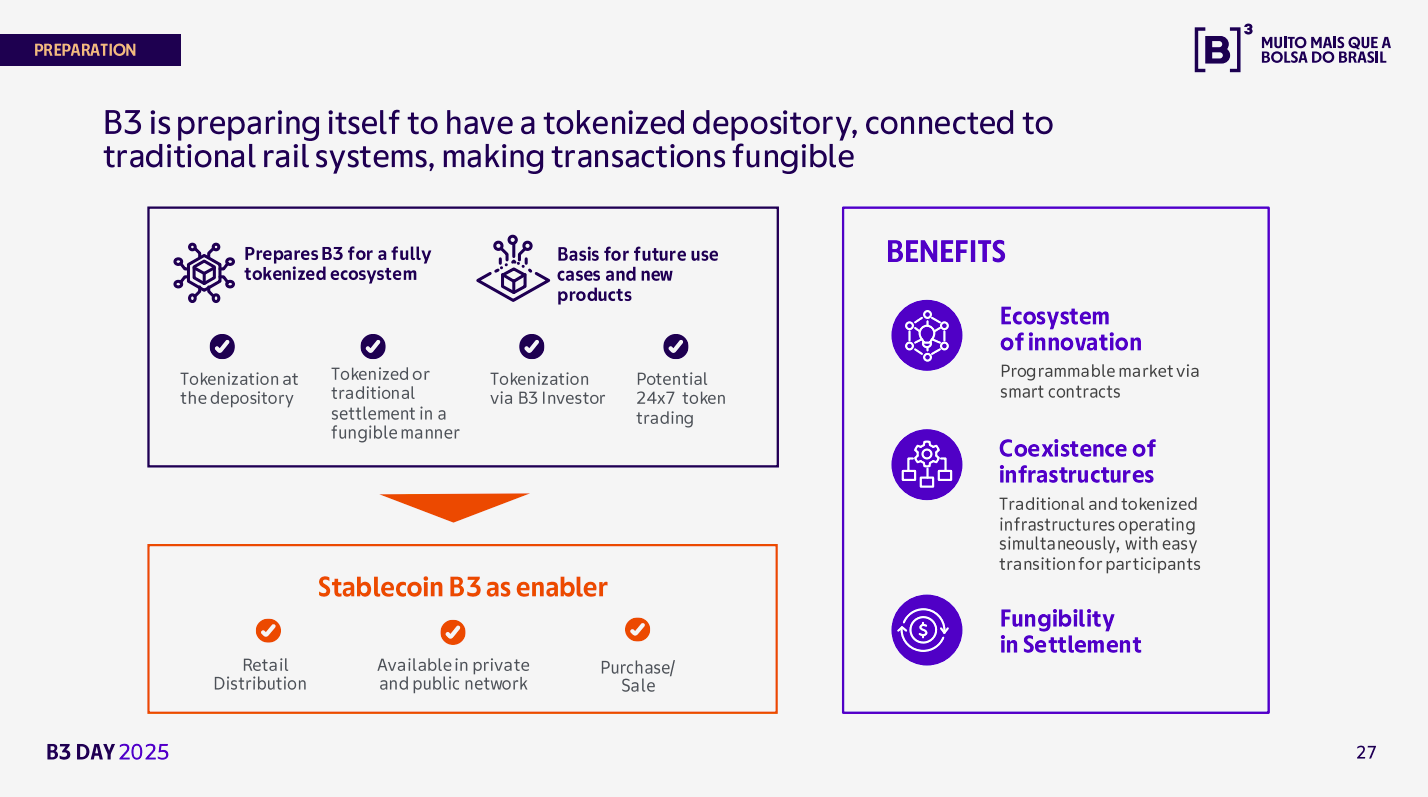

- Brazil’s main stock exchange B3 will launch a tokenization platform and stablecoin in 2026.

- The move signals B3’s strategic expansion into blockchain-based digital asset infrastructure.

Share this article

Brazil’s main stock exchange B3 plans to roll out a stablecoin and a tokenized depository next year, said Luiz Masagão, VP of Products and Clients, at B3 Day 2025.

B3 will use its stablecoin and depository as pillars of a unified tokenized asset strategy. The platform will integrate with traditional systems so transactions can move across both environments.

“The great value of having this tokenizer connected to the traditional depository is that the tokenized assets in this infrastructure are fungible with traditional assets. That is, all the liquidity that exists today in our central trading books will be able to be used by those who also have the token,” Masagão said.

According to Masagão, B3 envisions the future of the tokenized economy as being driven by a shared innovation ecosystem built on its infrastructure. He added that the exchange plans to open access to protocols, SDKs, and other foundational tools, enabling market participants to develop and scale new tokenized solutions.

On B3’s planned stablecoin, the exchange expects it to meet market demand for a secure, independent asset to support liquidity, collateral, and potentially around-the-clock trading within the tokenized infrastructure.

“The B3 stablecoin fills a gap in the digitalized economy market, with the end of the Drex by the central bank,” Masagão noted.

Drex is Brazil’s central bank digital currency (CBDC). The central bank began testing the currency on the Drex platform in late 2023 but decided to retire the blockchain-based platform this year and shift its focus to a new infrastructure.

“We don’t force the entire ecosystem of brokers to adapt to 24/7 liquidation, but whoever wants to do it will be able to do it through a fully tokenized infrastructure and be able to enjoy the liquidity of the traditional market,” Masagão highlighted.