Analyst and trader Michaël van de Poppe is flipping bullish on digital assets following a massive crypto market correction.

Van de Poppe tells his 770,900 followers on the social media platform X that altcoins have experienced a “capitulation” as crypto assets worth billions of dollars were liquidated amid the imposition of tariffs on Canada, Mexico and China by the US.

On what to expect for the crypto market following the substantial correction, the widely followed analyst says,

“Bear markets and trends end in these types of days.

Massive, illiquid wicks to the downside.

Quick bounce upwards, and rally after.”

According to the widely followed analyst, the deep correction is reminiscent of the crypto market crash in March of 2020 when Bitcoin (BTC) fell by around 60% of its value in days amid the Covid-19 pandemic. Altcoins also plunged substantially at the time.

But after the correction, Bitcoin and crypto ignited a multi-year uptrend.

“This feels a lot like the COVID-19 Black Swan crash, as the markets have witnessed a more than 50% wipeout on altcoins.

We all know what happened after, and I think that’s the same thesis here.”

Approximately $2.27 billion worth of crypto has been liquidated over the past 24 hours, per cryptocurrency futures data platform CoinGlass.

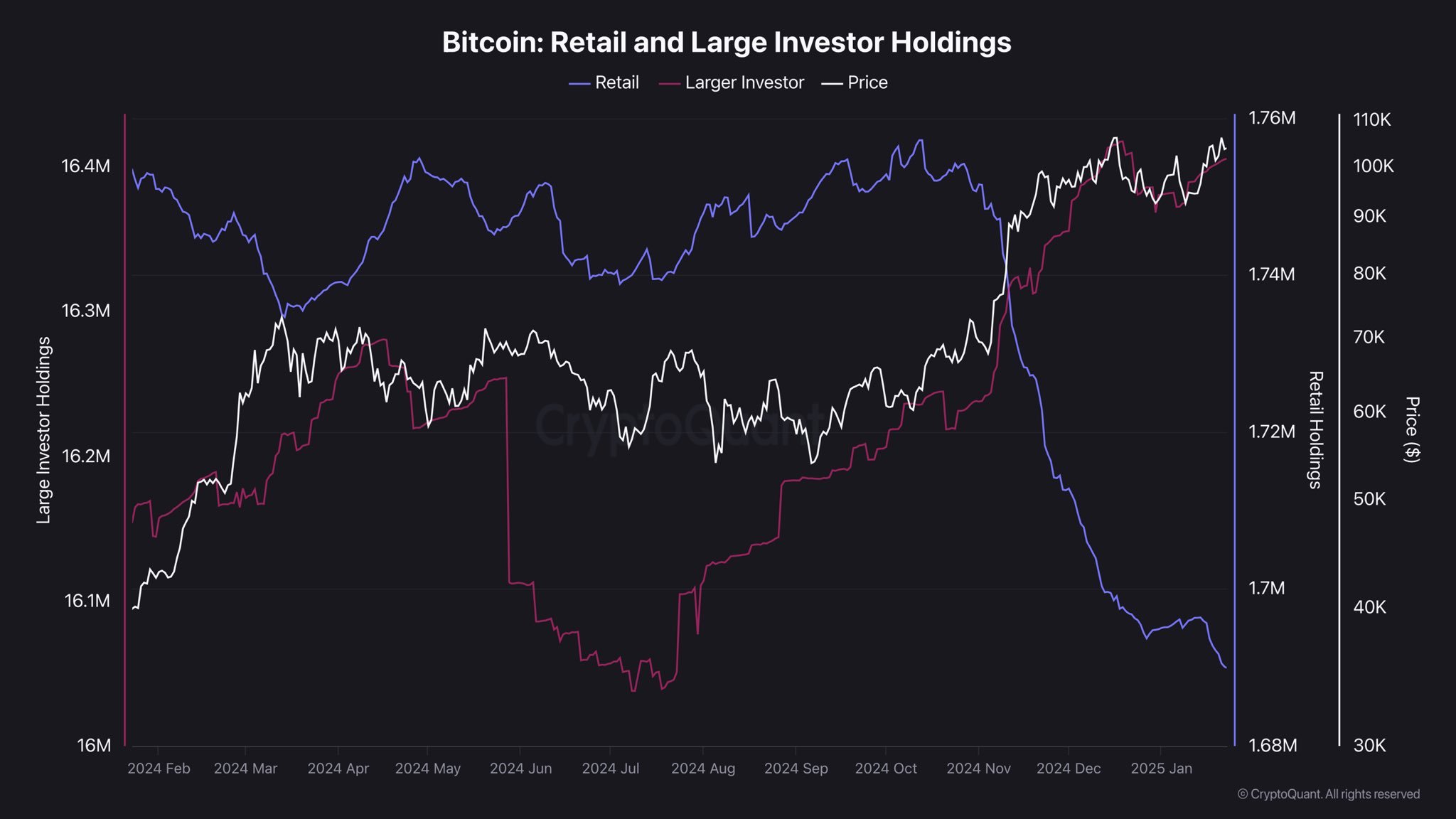

Going forward, Van de Poppe says retail crypto investors should adopt the strategies employed by deep-pocketed investors.

“During times of panic and uncertainty, market makers and whales accumulate more from retail.

Retail investors have been selling.

Large investors have been buying.

Be like a large investor: buy Bitcoin and altcoins and hold.”

Bitcoin is trading at $101,103 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney