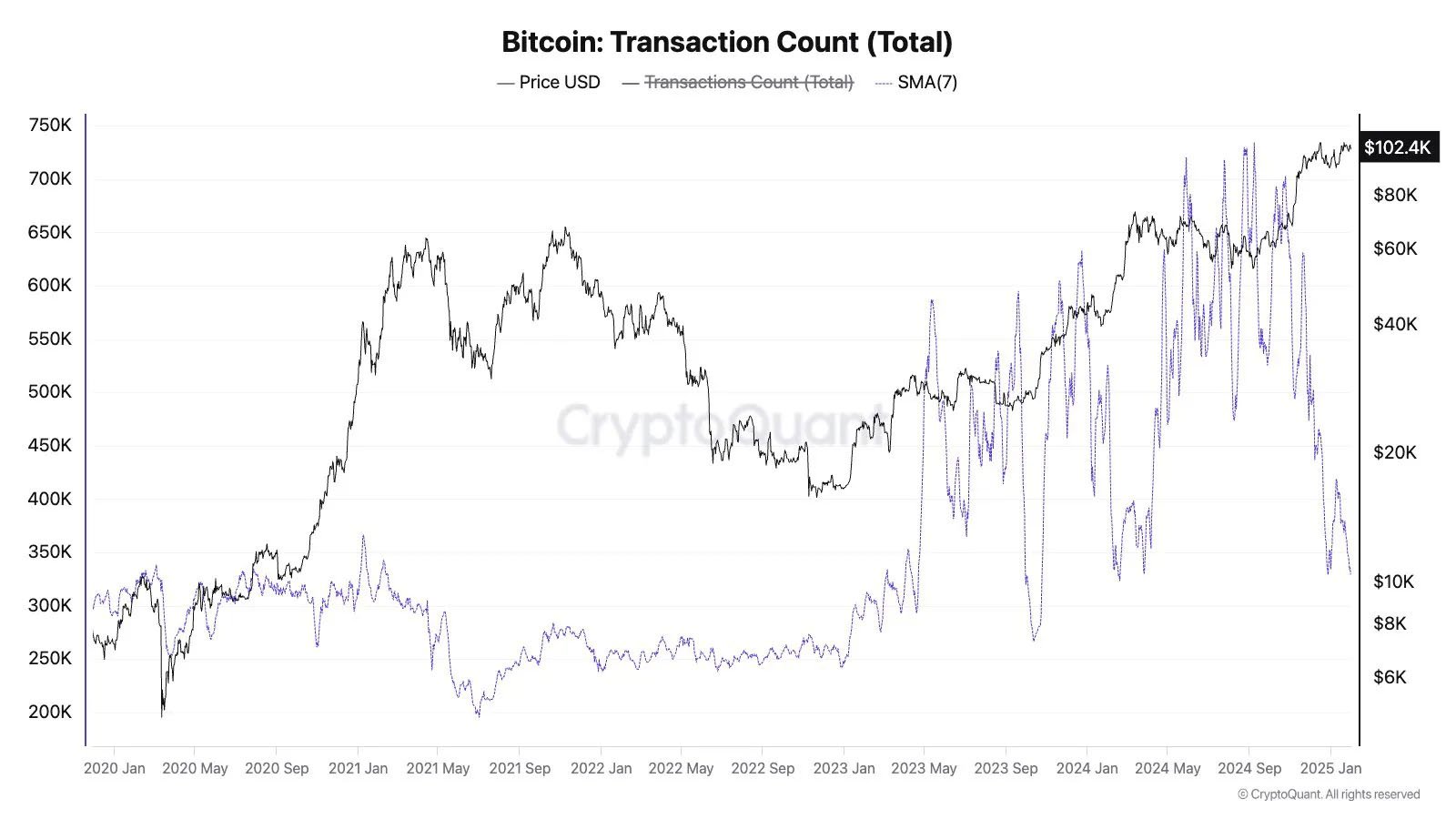

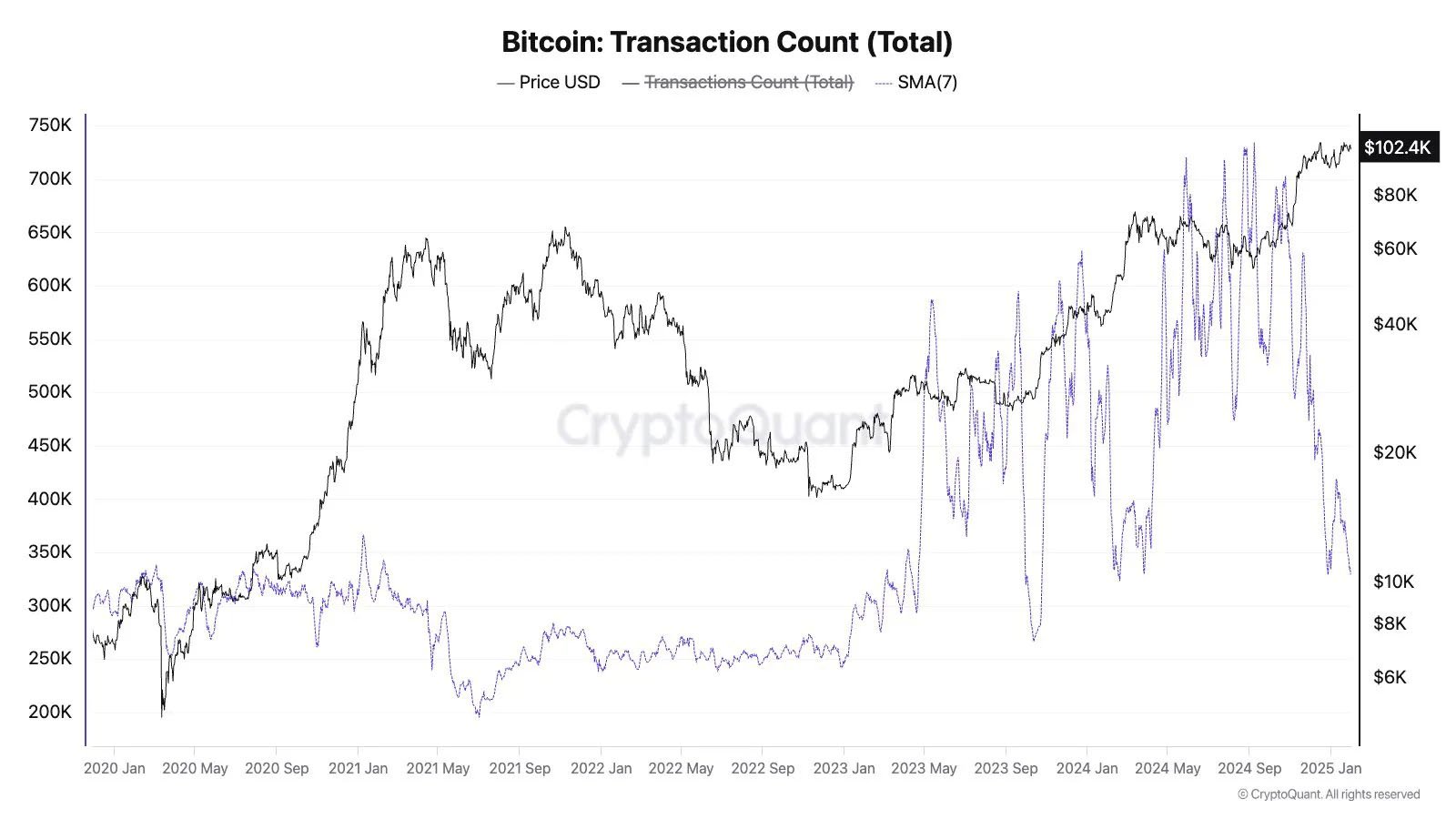

Bitcoin’s network activity has reached its lowest in 3 years, with transaction volume plummeting and the mempool becoming almost empty. This big drop has lowered transaction fees and is making miners less profitable.

Many miners might now wonder if Bitcoin mining can be pursued as a profitable venture.

Over the last few months Bitcoin’s transaction count has been going down. According to CryptoQuant, Bitcoin’s daily transactions are now around 400,000, down from 810,850 in November 2024. That’s 3 months of continuous decline in network activity.

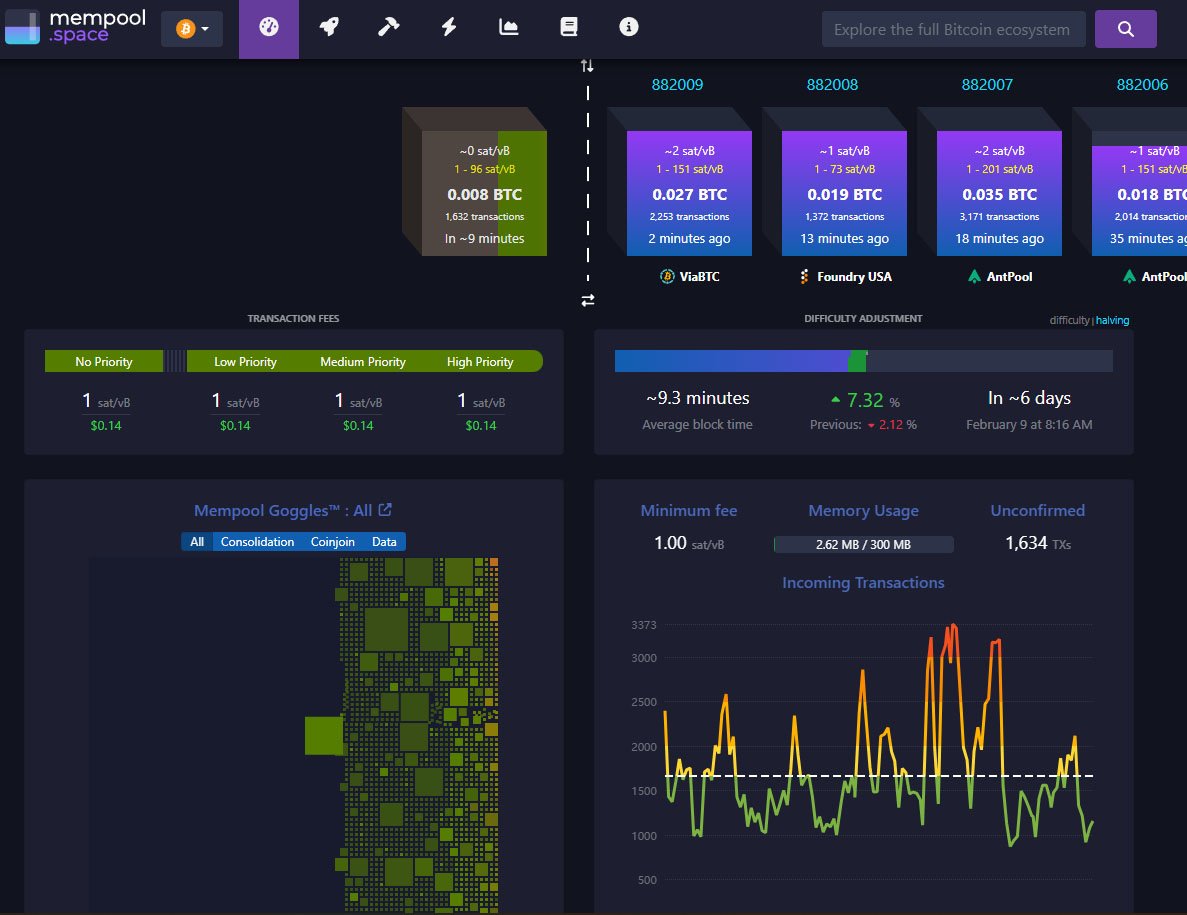

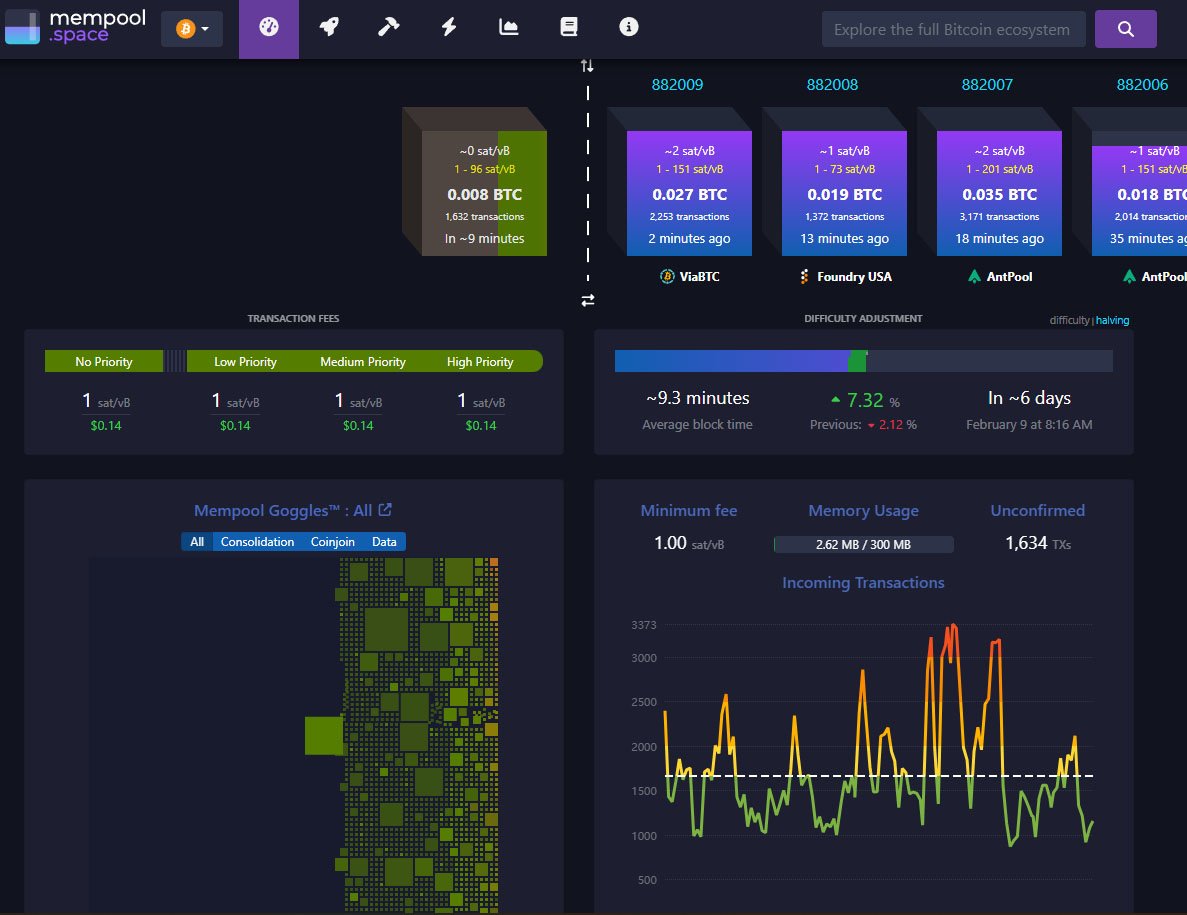

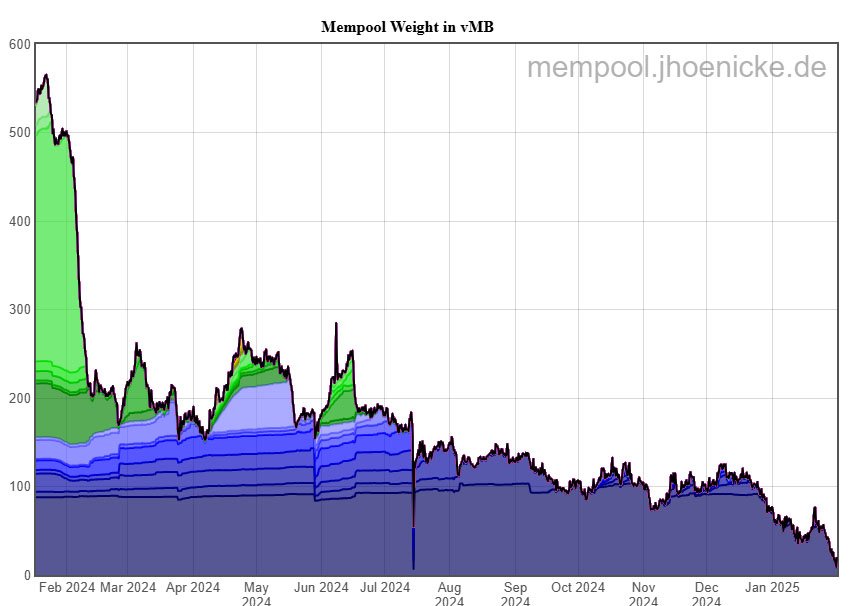

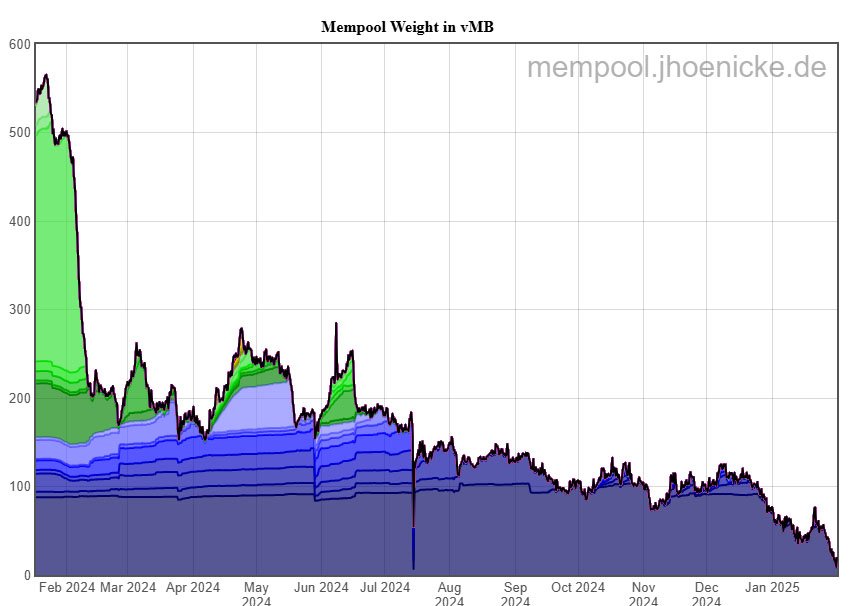

This reduction in new transactions has caused the backlog of unconfirmed transactions in the mempool to shrink.

In late December 2024, Bitcoin’s mempool had around 250,000 unconfirmed transactions. Now it’s down to less than 2,000. Several blocks have been unfilled, meaning there weren’t enough transactions to fill them.

With fewer transactions to be processed, Bitcoin’s transaction fees have dropped drastically.

According to mempool.space, fees are now as low as 1 sat/vB. That’s a big shift from previous months when network congestion was causing high fees. This is good news for users making transactions, but bad news for miners.

Related: Bitcoin Network Fees Plummet to Record Lows Impacting Miners

Miners earn from block rewards and transaction fees, and with fewer transactions, their income has decreased. Currently miners earn around $4,000 per block from transaction fees which is much lower than during peak network activity.

Experts point to several reasons for the decline in Bitcoin transactions:

- The ‘HODL’ Mentality: Many bitcoin holders are HODLing their BTC instead of spending it. Security expert Jameson Lopp said, “The number of unspent transaction outputs (UTXOs) is sharply declining, implying a reduction in distribution to individual wallets.”

- The Lightning Network: The Lightning Network allows users to make transactions off-chain, reducing the need for on-chain transfers.

- Economic Factors: Global economic uncertainty is affecting Bitcoin trading and spending habits. Trump’s recent tariffs on Mexico, Canada and China have led to trade wars concerns and bitcoin’s price dropped below $100,000.

- Declining Interest in BRC-20 Tokens and Runes Protocol: Last year new token standards like BRC-20 and Runes protocol were causing high transaction activity. But as the hype faded, transactions went down and network usage declined.

For miners, this is a problem. The industry was already struggling due to the 2024 halving which reduced block rewards from 6.25 BTC to 3.125 BTC. Now with transaction fees at all time lows, profitability is even harder to achieve.

Some mining companies are looking for alternative revenue streams.

Several U.S. based Bitcoin mining companies are exploring the idea of selling computing power for artificial intelligence (AI) and high performance computing workloads to offset lower earnings from Bitcoin transactions.

Bitcoin’s slowdown raises big questions about future of mining as an industry. Lower fees make Bitcoin transactions more affordable for users but they also reduce miners incentive to secure the network. If this continues, large scale bitcoin miners could face serious problems.