BTC USD and the wider markets are bracing for a busy Thursday of economic releases. August ADP Nonfarm Employment, Initial Jobless Claims, the ISM Services PMI, and the S&P Global Services PMI are all due. These reports will shape expectations for whether the Federal Reserve moves forward with a September rate cut.

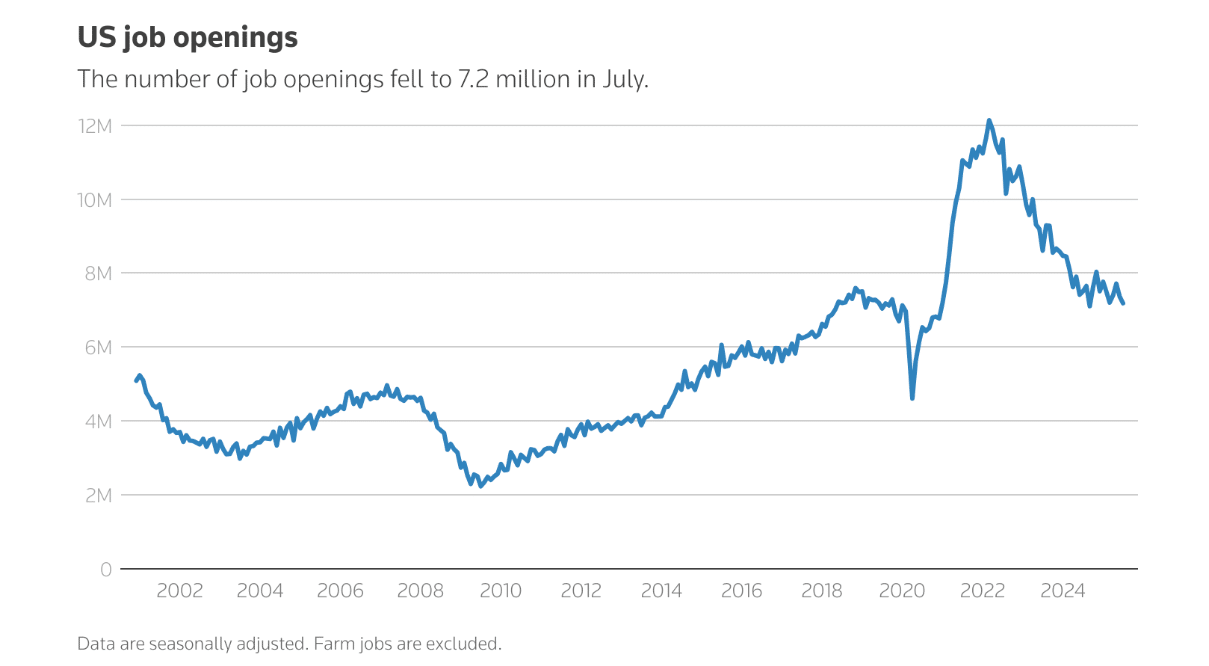

The anticipation follows weaker labor market signals and a stunted crypto market and BTC ▼-0.16%. The JOLTS report showed job openings fell to 7.18M in July, missing forecasts of 7.38M and marking the lowest reading since 2021.

“The jobs number showed that we are seeing more of a slowdown in the labour market in the US,” said Shaun Osborne, chief currency strategist at Scotiabank. “For the first time since 2021, there are more unemployed people in the US than available jobs and that is a big change in the outlook.”

DISCOVER: 20+ Next Crypto to Explode in 2025

Will BTC USD Hit New ATHs or Crash Below $100k? Bond Yields React to Labor Market Slowdown

So if you’re following at home, here’s what’s coming out from the US today:

- August ADP Nonfarm Employment Change (Jobs indicator)

- Initial Jobless Claims (Weekly snapshot of layoffs)

- ISM Non-Manufacturing (Services) PMI (Released Wednesday… it wasn’t good)

- JOLTS (Job Openings and Labor Turnover Survey), and it was already flagged as sluggish

This weak US economic data helped reverse a global bond sell-off and left crypto stagnant. The yield on 30-year Treasuries slipped 6 basis points to 4.90%, while UK gilts fell from 5.75% to 5.60% after hitting post-1998 highs.

Andy Brenner, head of international fixed income at NatAlliance, said rising layoffs and weaker job openings “got my attention, and the market’s attention.”

This rebound comes as global debt issuance ramps back up, with the UK issuing a record $14B in 10-year gilts. Analysts warn that the fresh supply and sticky inflation could reintroduce volatility.

On the DeFi side, stablecoin market cap rose 42% year-on-year, showing investors still want to hedge against rate-driven volatility. Solana and Ethereum TVL each gained +20% over the past quarter, while smaller chains lagged. This underscores how liquidity prefers blue-chip cryptos and scales in uncertain conditions.

DISCOVER: Top 20 Crypto to Buy in 2025

Trump’s Tariffs Add Another Variable for the Fed

Another US data point to pay attention to is the payrolls report, which will test how the economy absorbs Trump’s global tariffs. Analysts say tariffs have already contributed to a slowdown in manufacturing. Additionally, President Trump is moving to oust Fed Governor Lisa Cook further placing US economic control in his hands.

Cost of living in the US is set to rise even further:

Only 25% of Americans now say they have a "good chance" of improving their standard of living, a record low in WSJ’s surveys dating back to 1987.

By comparison, this percentage was between 50% and 60% for several years… pic.twitter.com/gUbnd8zyhi

— The Kobeissi Letter (@KobeissiLetter) September 3, 2025

Roger Hallam of Vanguard summed up the tension: “It’s almost a perfect storm of concerns over current fiscal policies becoming inflationary, potentially more global issuance, and not enough demand.”

EXPLORE: Trump Crypto Moves Made $5Bn in 2025: How To Get Rich in Crypto Trump-Style?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- US jobs data, bond yields, and Trump’s tariffs are shaping expectations for a September Fed rate cut. Here’s what CoinGlass and DeFiLlama data reveal about markets.

- This weak US economic data helped reverse a global sell-off in bonds and left crypto stagnant.

The post US Jobs Data and BTC USD and Bond Market Rally Put Fed Rate Cuts in Focus appeared first on 99Bitcoins.