After President Donald Trump targeted China, Mexico, and Canada with long-threatened import taxes, the crypto market fell on Feb. 1 in a risk-off action. Bitcoin’s price fell by 5%, which has rippled its way into altcoins.

Effective Feb. 1, the U.S. will impose tariffs of 25% on imports from Canada and Mexico and 10% on Chinese goods, adding further complexity to the current trade wars.

As a result, over the past 24 hours ending on Feb. 3, Bitcoin (BTC) has experienced a notable decline amid a market-wide sell-off. The cryptocurrency fell by over 5%, reaching a low of approximately $91,200 before rebounding to around $94,000 as of this writing.

Despite this recovery, BTC remains roughly 13% below its all-time high of $109,000, and trading volume has surged by more than 200%, suggesting considerable selling pressure or market panic.

Additionally, the overall global crypto market cap has dropped nearly 12% during the same period, settling at about $3.15 trillion.

It’s worth noting that following President Donald Trump’s inauguration on Jan. 20, Bitcoin and other altcoins saw a significant price increase. However, since that peak, recent developments—including new tariff policies—have contributed to a drastic decline in market sentiment and asset values.

Given Bitcoin’s recent price crash, it has had a cascading effect on altcoins. In the last 24 hours, Ethereum (ETH) has fallen by nearly 20%, Ripple (XRP) by 22%, Solana (SOL) by 8%, and Binance Coin (BNB) by over 15%.

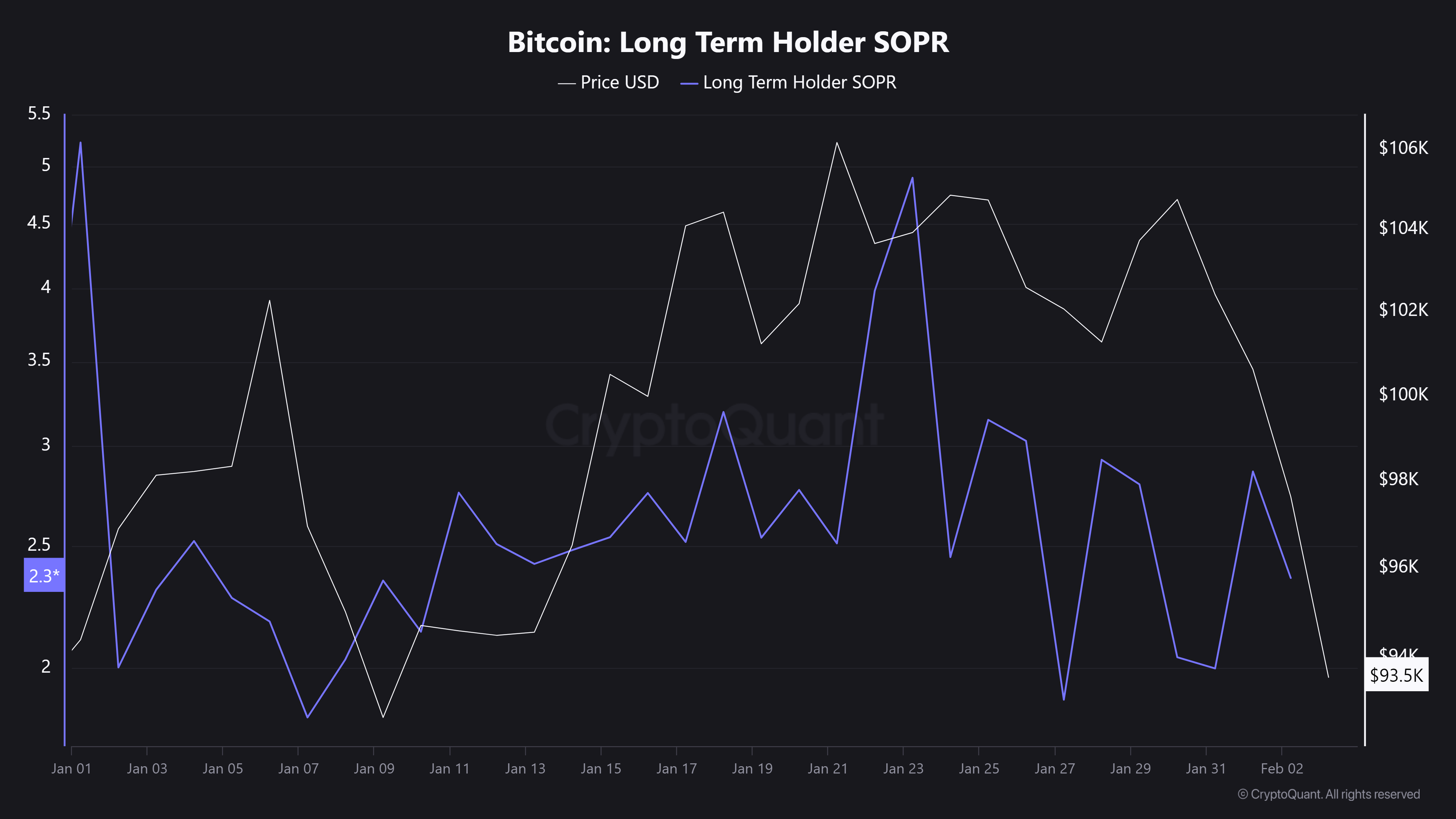

Rising trading volume alongside price dips often signals strong selling pressure or market panic, as more traders offload their assets. This pattern suggests that long-term investors are now selling their coins at lower profits than their purchase price—or even at a loss year-to-date—as illustrated by the Bitcoin: Long Term Holder SOPR chart.

Such behavior often indicates capitulation among long-term holders, a phenomenon common during bearish market trends and corrections. Experts, including BitMEX CEO Arthur Hayes, have even warned that a “financial crisis” may be on the horizon.