Stocks climbed toward record highs on Monday as investors looked past tariff tensions and focused on upcoming tech earnings.

The Dow rose 220 points (0.52%), while the S&P 500 and Nasdaq gained 0.58% and 0.75%, respectively.

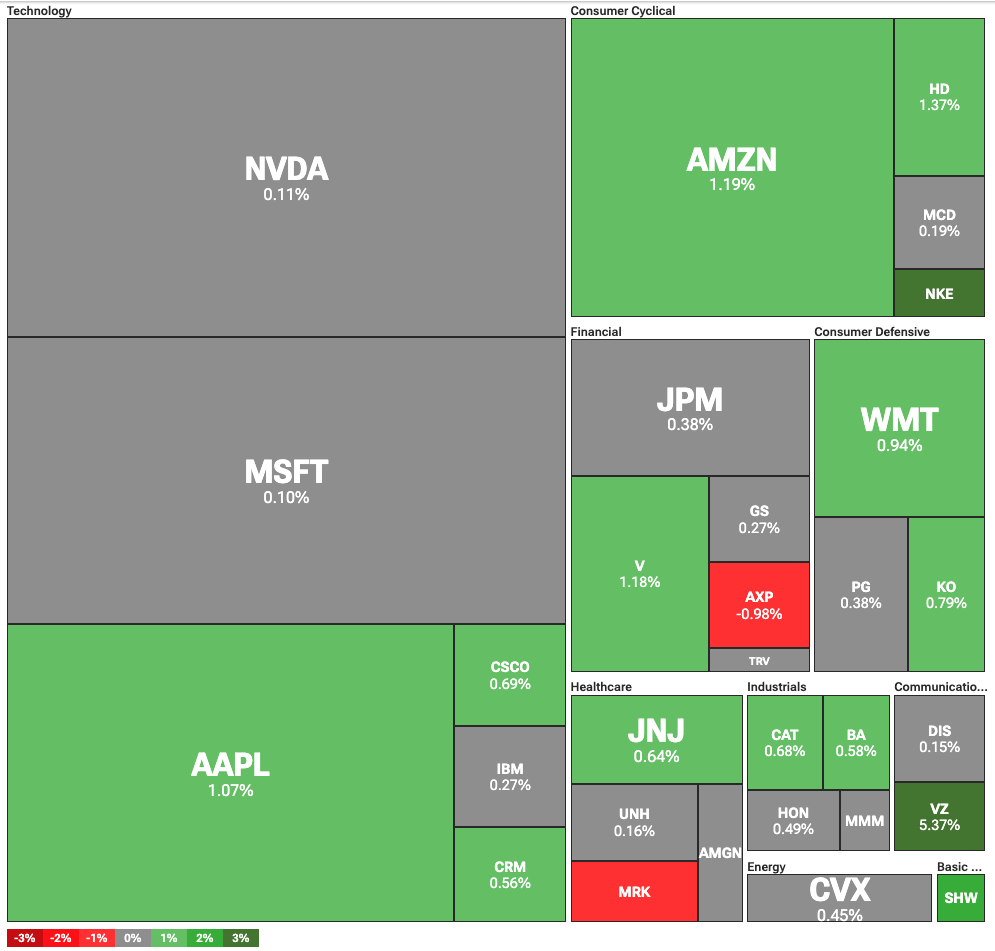

Traders are piling into tech shares ahead of key results from Alphabet and Tesla, both set to report on Wednesday. Optimism is high—but so are valuations, drawing warnings from economists who see signs of a growing AI-fueled bubble. Apollo’s chief economist, Torsten Slok, said valuations for top S&P 500 firms, such as Nvidia, Microsoft, and Apple, now exceed their peaks from the dot-com era.

Traders are bidding up tech stocks ahead of key earnings reports. Notably, both Alphabet and Tesla will release their earnings on Wednesday, the first among the major tech giants this quarter. Strong results could validate the market’s optimism and high valuations.

Still, the market’s focus on the AI sector is increasingly drawing comparisons to the 1999 tech bubble. Torsten Slok, the chief economist at Apollo Global Management, stated that the AI bubble could be even worse than the dot-com bubble.

Slok explained that the top 10 companies in the S&P 500 are now more overvalued than they were in the 1990s. Specifically, he compared the P/E ratios of major firms such as Nvidia, Microsoft, and Apple, and found they were higher than at the absolute peak of the dot-com bubble.

EU readies response as trade war escalates

Moreover, traders remain concerned over U.S. trade policy, as tensions with the EU escalate. The European Union is preparing for a trade reprisal if it doesn’t get a deal with the U.S. “If they want war, they will get war,” WSJ quoted one German official referencing the trade negotiations.

This is a response to President Donald Trump’s escalating demands toward the EU and other trading partners. Earlier, Trump pushed for a 20% minimum tariff on EU goods, up from 15% proposed earlier. On the other hand, the EU aims to obtain a 10% baseline tariff, with special consideration for certain industries.