In May, key trends in crypto centered on institutional interest in Bitcoin and Ethereum ETFs, driven by positive regulatory developments.

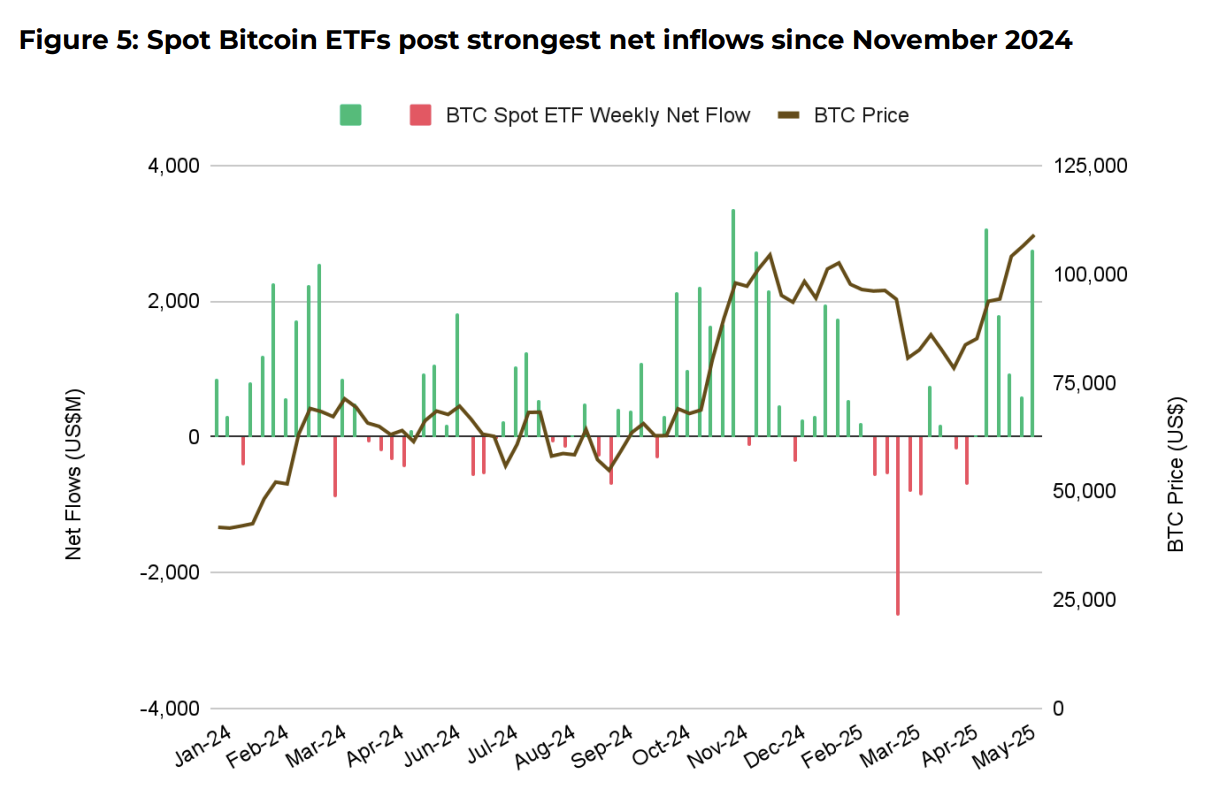

Strong inflows into Bitcoin (BTC) and Ethereum (ETH) exchange traded funds coincided with Bitcoin reaching a new all-time high in May. According to a Binance Research report, released on June 5, crypto markets remained resilient despite volatility triggered by uncertainty around U.S. trade policy.

Heightened volatility led to nearly $1 billion in liquidations following the trade agreement between the U.S. and the U.K. An additional $183 million in liquidations occurred after the U.S. announced a tariff pause on the European Union.

Despite the large volume of liquidations, interest in Bitcoin ETFs remained robust. These products attracted $5.2 billion in net inflows, the highest level since November 2024. Notably, these inflows coincided with Bitcoin hitting its all-time high of $111,970 on May 22.

ETF inflows were largely supported by positive regulatory momentum. In the U.S. Senate, the GENIUS Act gained traction, proposing the first stablecoin regulation framework in the country. The report also cited growing regulatory support for stablecoins in Hong Kong.

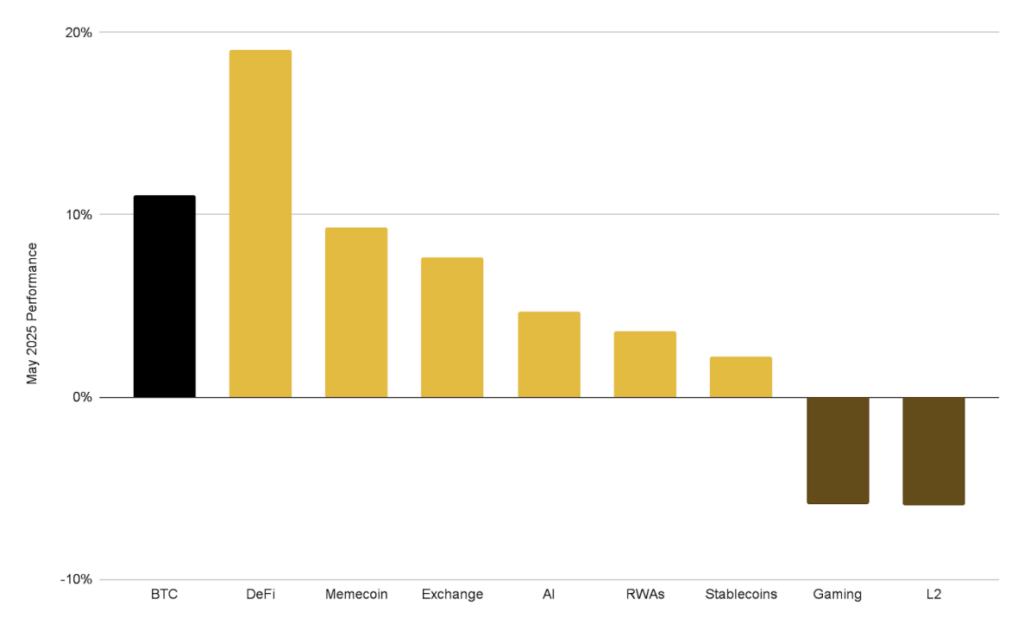

DeFi outperforms Bitcoin: Binance Research

Among ETF products, BlackRock’s iShares Bitcoin Trust (IBIT) led the field, attracting nearly 100% of the total net inflows in May. In contrast, Grayscale’s GBTC saw $320 million in net outflows, indicating a potential winner-takes-all trend.

DeFi was the only major sector to outperform Bitcoin in May, recording 19% growth versus BTC’s 11.1% gain. Additionally, total value locked in DeFi protocols reached its highest level since early February.

Bitcoin also experienced a surge in demand from corporate treasuries. As of May, 116 public companies held 809,100 BTC. Bitcoin’s all-time high, along with favorable regulatory developments, has intensified corporate interest. Companies like Trump Media reportedly invested billions in BTC to enhance investor appeal.