Key Takeaways

- Strategy purchased 7,390 Bitcoin for $555 million at an average price of $103,498.

- The company aims to hold $42 billion in Bitcoin by 2027, accumulating 576,230 BTC so far.

Share this article

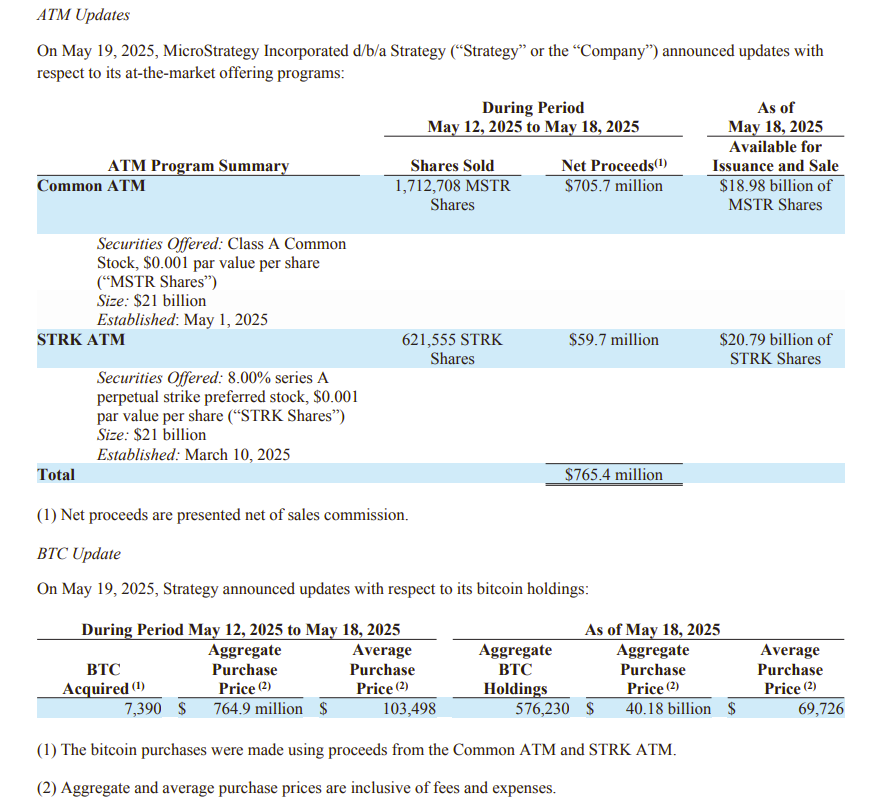

Michael Saylor’s Strategy on Monday disclosed it had purchased 7,390 Bitcoin between May 12 and 18, investing around $765 million in the acquisition. With this move, the firm has boosted its Bitcoin holdings to 576,230 BTC, currently worth over $59 billion.

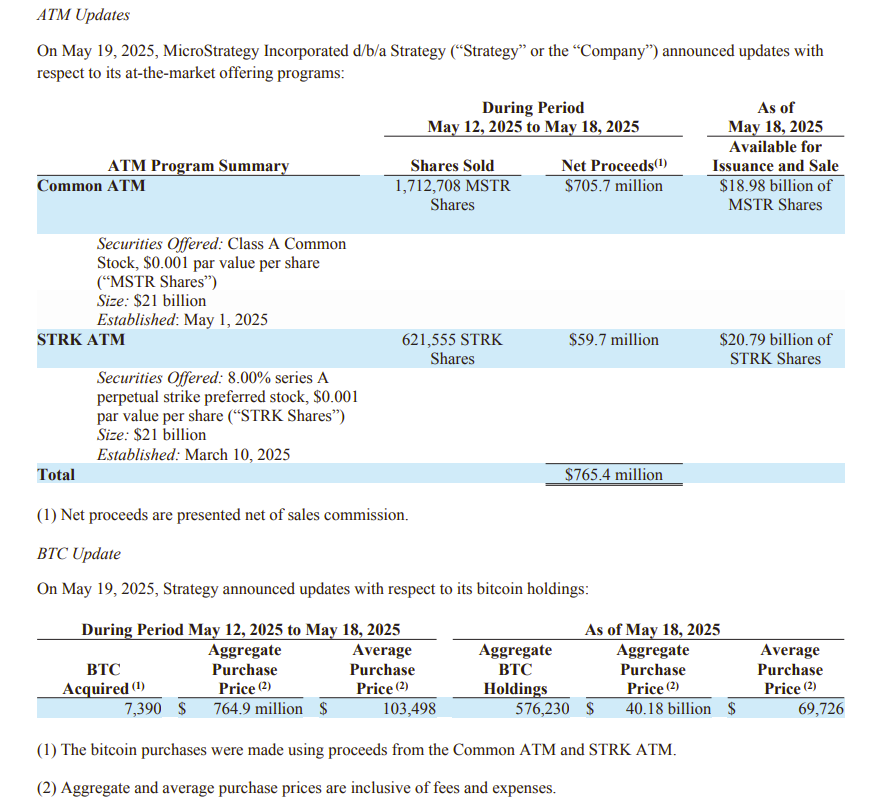

The software firm financed its latest Bitcoin acquisition through capital raised from its Common ATM equity program and a Series A perpetual convertible preferred stock issuance, according to a Monday filing with the SEC.

During the previous week, Strategy sold approximately 1.7 million MSTR shares and more than 621,555 STRK shares, generating over $765 million in net proceeds.

The company still holds over $18.9 billion in MSTR shares and around $20.7 billion in STRK shares that remain authorized for future issuance and sale. It aims to accumulate $42 billion in Bitcoin by the end of 2027, regardless of market conditions.

As the largest corporate holder of Bitcoin, Strategy now controls over 2.7% of the total BTC supply, followed by MARA Holdings and Tether-backed Twenty One, the newly established Bitcoin-native firm.

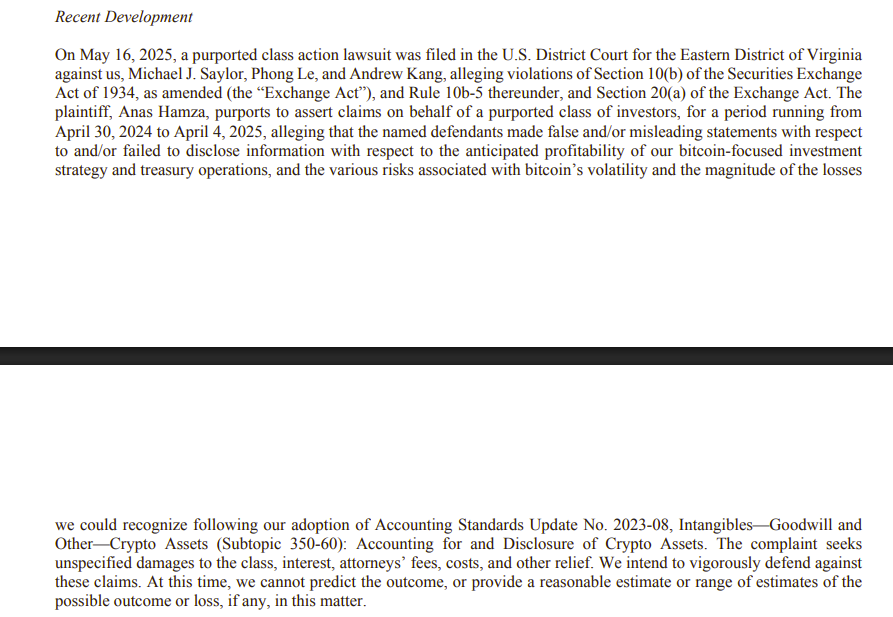

In today’s SEC disclosure, Strategy also said that it is facing a class action lawsuit filed on May 16, 2025, in the US District Court for the Eastern District of Virginia.

The suit alleges that Strategy and its executives made misleading statements and failed to disclose risks related to its Bitcoin strategy and new crypto accounting rules.

The firm said it would fight the lawsuit but noted that it is unable to predict the outcome or quantify potential losses for now.

Share this article