Key Takeaways

- Ethereum’s price surged nearly 50% to over $2,700 after the Pectra upgrade.

- Abraxas Capital acquired 211,030 ETH valued at approximately $477 million post-upgrade.

Share this article

Ethereum rallied nearly 50% to over $2,700 after the Pectra upgrade and is now around 6% below what it held when Eric Trump publicly promoted the asset, TradingView data shows.

The president’s son voiced bullish sentiment toward Ethereum in a Feb. 3 post, tweeting, “In my opinion, it’s a great time to add $ETH. You can thank me later.” He later edited the statement to remove the last sentence.

His post came on the heels of a market-wide selloff tied to President Trump’s tariff proposal, during which Ether lost more than 15% over February 2 and 3, bottoming out at around $2,300 at the time.

Despite brief recoveries, the downturn intensified amid mounting fears of escalating trade tensions and inflation, following Trump’s early April announcement of sweeping tariffs. On April 7, Ether briefly fell below $1,400—its lowest level since November 2023.

The current price rally is fueled by the activation of the Pectra upgrade on May 7, renewed bullish sentiment driven by positive developments in US-China trade relations, and rising institutional accumulation.

Pectra introduces a suite of Ethereum Improvement Proposals (EIPs) designed to enhance staking efficiency, wallet usability, and layer 2 scalability. This helps lay critical groundwork for Ethereum’s next phase of network growth.

The upgrade represents a pivotal step for the platform, advancing user-friendliness and enabling systematic, programmable staking. Ethereum has surged more than 40% in the five days since the upgrade went live.

On the institutional front, UK-based investment firm Abraxas Capital has acquired 211,030 ETH, valued at approximately $477 million, over the past six days, according to data from Arkham Intelligence.

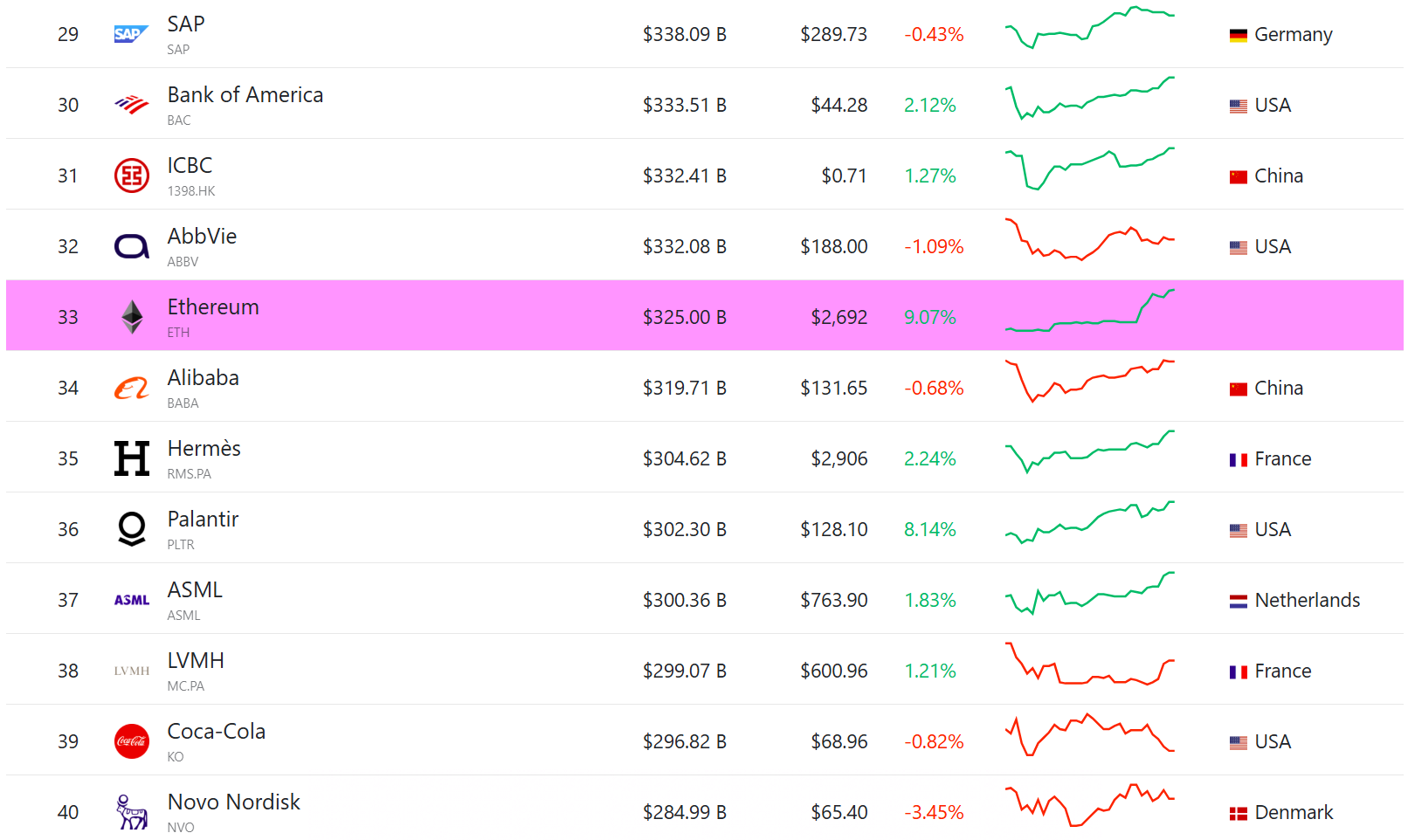

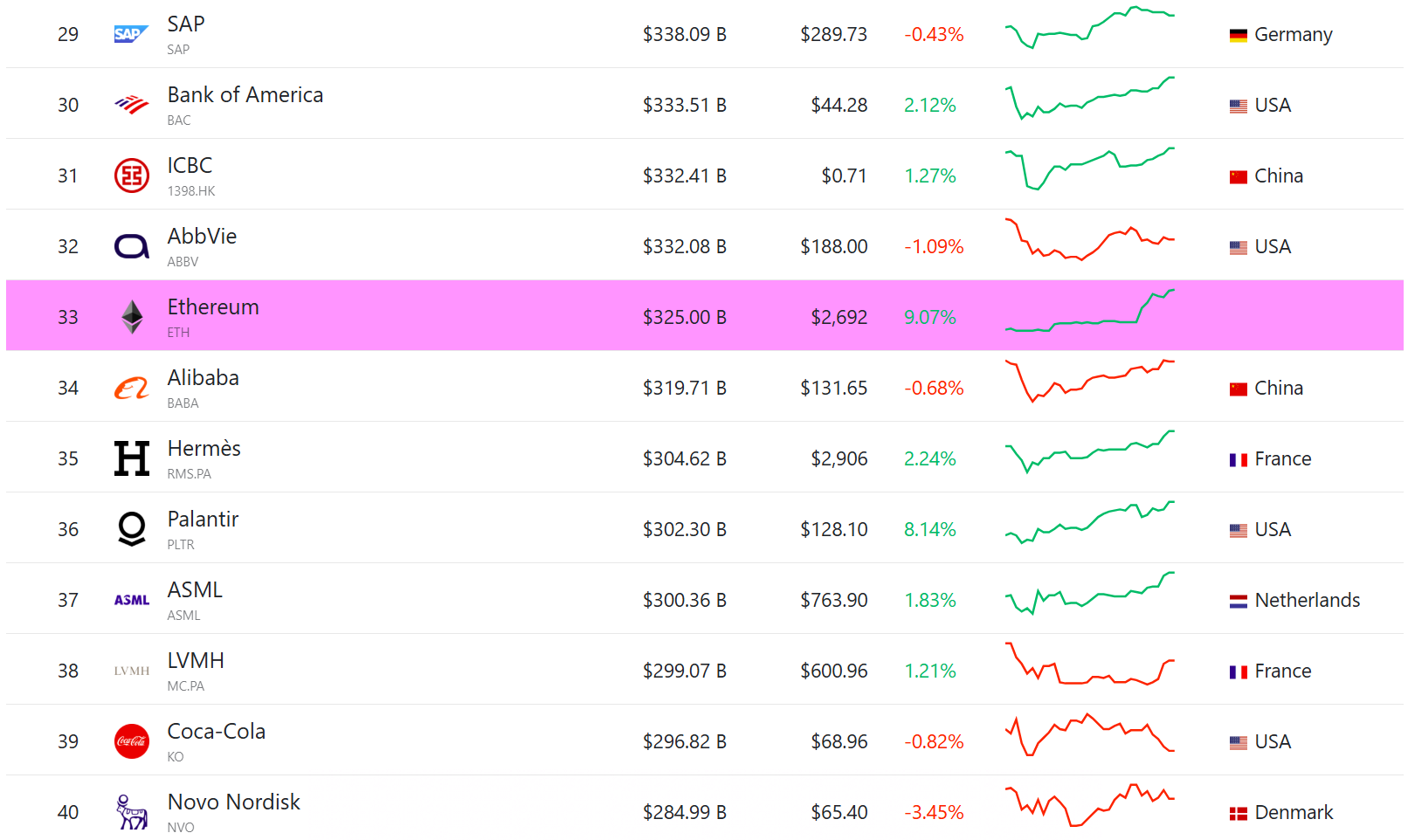

Ethereum surpasses Alibaba and Coca-Cola in market cap

Ethereum has again exceeded Alibaba and Coca-Cola in market capitalization to rank as the 33rd most valuable asset, after its price jumped over 40% in five days post-Pectra upgrade, CompaniesMarketcap data shows.

Ethereum’s market cap now stands at roughly $325 billion, surpassing Coca-Cola’s valuation of around $297 billion and Alibaba’s $320 billion.

On Monday, the second-largest crypto asset briefly overtook Alibaba with a market cap of $308 billion, but the Chinese tech giant regained the lead after its stock surged roughly 6%, lifting Alibaba’s market cap to over $317 billion, per Market Watch data.

Share this article