Key Takeaways

- Shareholders want Dell to embrace Bitcoin, but the SEC rules proposal can be dropped.

- Dell argued the proposal concerned ordinary business operations and should remain under management’s control.

Share this article

The US SEC has granted multi-billion dollar tech firm Dell Technologies permission to exclude a shareholder proposal that would have required the company to evaluate Bitcoin as a potential treasury reverse asset, according to a recent letter issued by the agency.

The proposal, put forward by the National Center for Public Policy Research (NCPPR) in January, sought to have Dell’s board conduct an assessment of whether adding Bitcoin to the company’s balance sheet would serve shareholders’ best interests.

The Washington-based think tank, which also called on major corporations like Meta, Amazon, McDonald’s, and Microsoft to adopt Bitcoin, pointed to Dell’s early embrace of the cryptocurrency, rising inflation, and mounting institutional interest, including BlackRock’s recent endorsement of a 2% Bitcoin allocation, as key justifications for its initiative.

However, Dell appears to be steering clear of the Bitcoin conversation among corporates for now.

After receiving a shareholder proposal from the NCPPR, the tech giant, through its legal representatives at Hogan Lovells, sent a letter to the SEC requesting permission to exclude the proposal from its 2025 proxy materials.

Dell argued that decisions about cash management and investment strategy should remain under management’s control and are too complex for direct shareholder involvement.

The company also stated that the proposal risked micromanaging the company by suggesting a specific financial outcome, here Bitcoin investment, and invoking fiduciary responsibility to justify it.

The SEC sided with Dell, stating it would not recommend enforcement action if the company omits the proposal from its 2025 proxy materials. In its response, the agency said the proposal falls under ordinary business operations, thereby affirming Dell’s position.

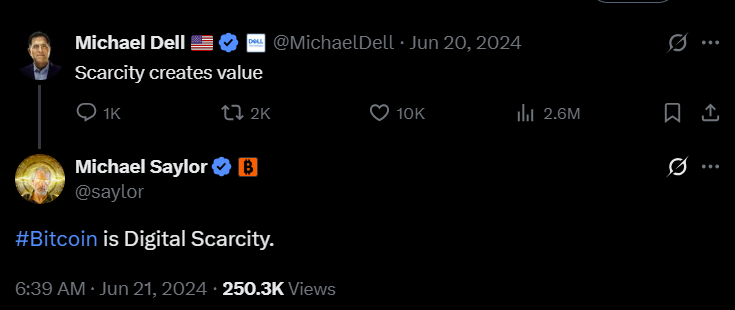

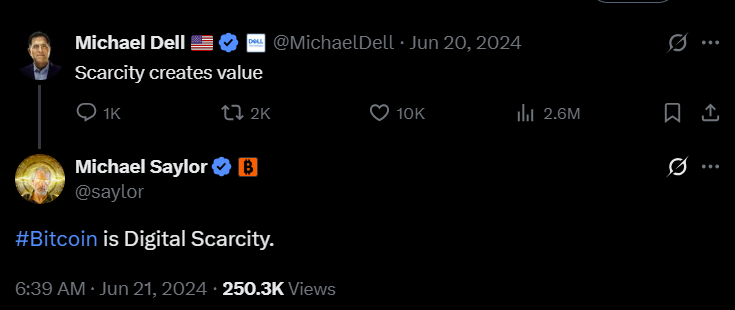

Michael Dell, CEO of Dell Technologies, previously raised speculation about investing in Bitcoin after he tweeted a Cookie Monster meme eating Bitcoin last June. He also engaged with the theme of ‘scarcity creates value’ alongside commentary from Strategy’s Michael Saylor.

In April, McDonald’s legal team also received confirmation from the SEC that the company could exclude NCPPR’s Bitcoin proposal from its next annual shareholder meeting.

Compared to McDonald’s and Dell, Microsoft appeared more receptive to the idea of Bitcoin as a treasury asset.

Although the Bitcoin proposal was ultimately voted down at the 2024 annual meeting, the company allowed it to go to a vote and even gave Saylor the opportunity to present his case directly to the board.

Share this article