Key Takeaways

- Goldman Sachs increased its stake in BlackRock’s iShares Bitcoin Trust to 30.8 million shares worth over $1.4 billion.

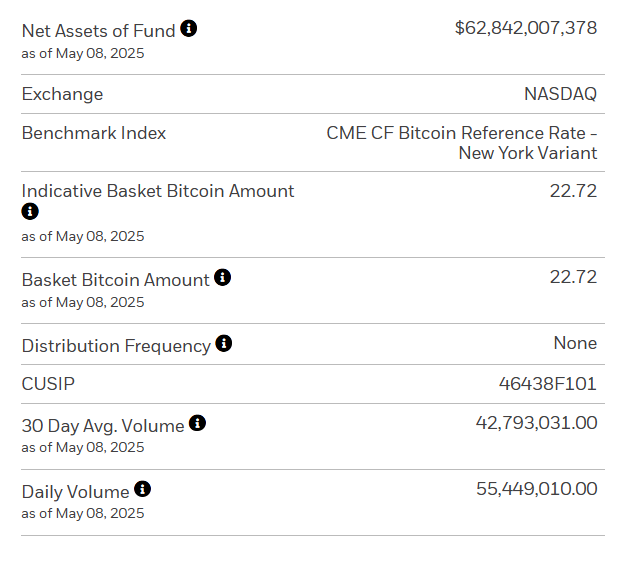

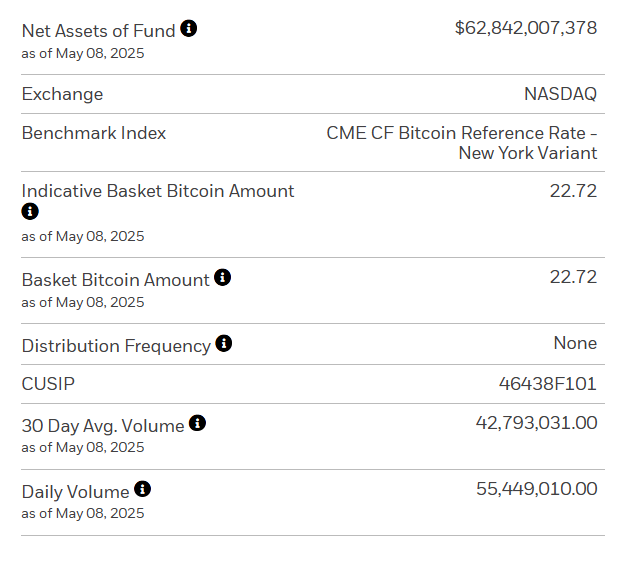

- IBIT leads Bitcoin ETFs with approximately $62.8 billion in assets under management.

Share this article

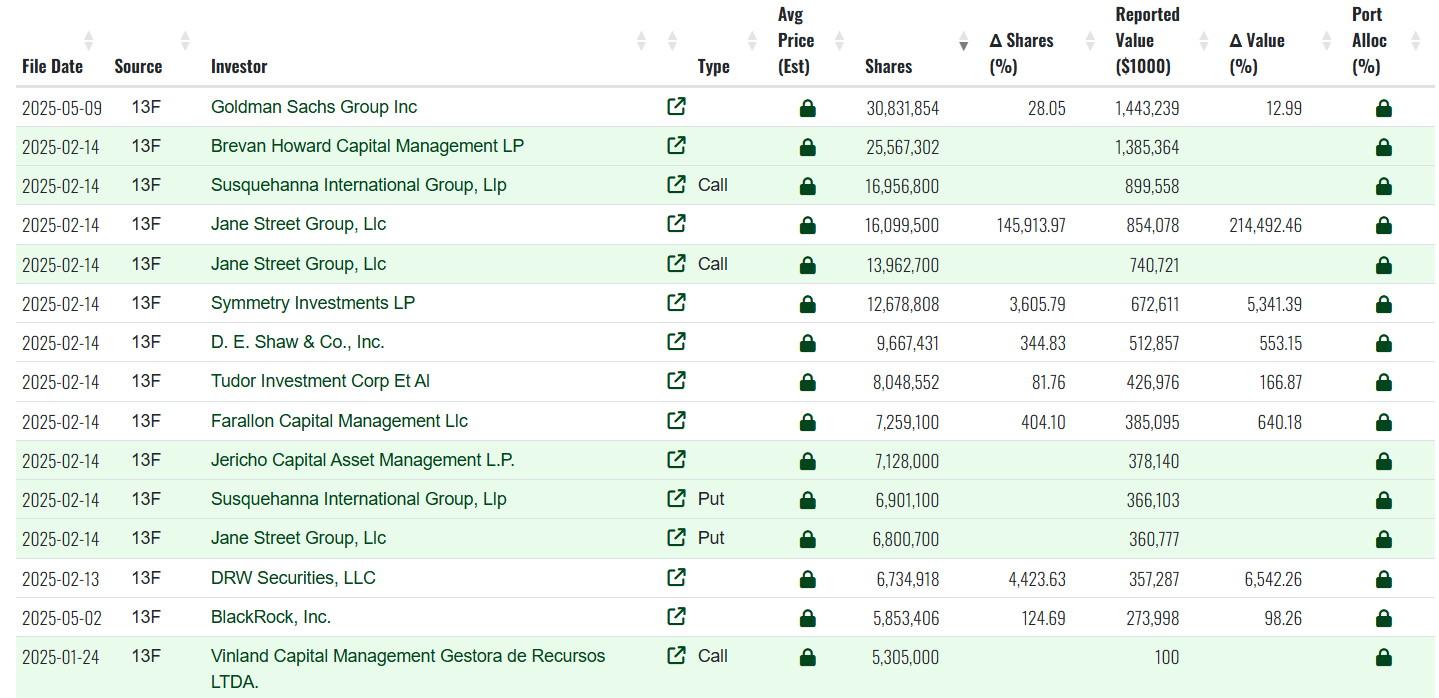

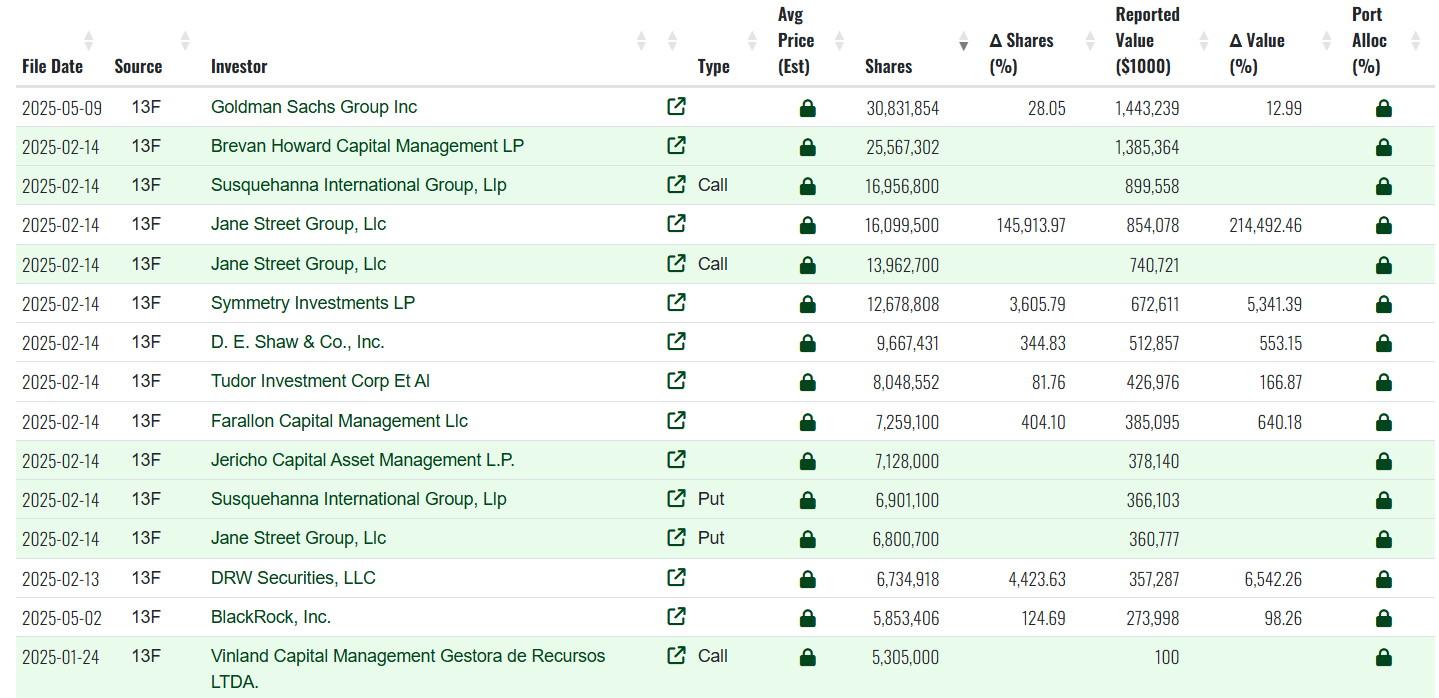

Goldman Sachs has grown its position in BlackRock’s iShares Bitcoin Trust (IBIT) by 28%, disclosing a holding of 30.8 million shares valued at over $1.4 billion during the period ending March 31, up from 24 million shares, according to a new SEC filing first reported by MacroScope.

Back in February, Goldman Sachs disclosed over $1.5 billion in US spot Bitcoin ETF holdings, including approximately $1.2 billion in BlackRock’s IBIT and $288 million in Fidelity’s Bitcoin fund (FBTC). Its latest filing shows no significant change in its FBTC position.

As of the latest data tracked by Fintel, the investment bank stands as the largest institutional holder of IBIT. Brevan Howard ranks second, holding more than 25 million shares worth nearly $1.4 billion. Other major stakeholders include Jane Street, Symmetry Investments, and D.E. Shaw & Co.

In its December disclosure, Goldman Sachs reported holding options tied to Bitcoin ETFs — including $157 million in call options (which profit if the price goes up) and $527 million in put options (which profit if the price goes down) for IBIT, along with $84 million in put options for Fidelity’s spot Bitcoin fund (FBTC), MacroScope noted.

However, in the most recent filing, none of these options appear, which means Goldman has likely closed out or allowed these contracts to expire.

IBIT remains the largest Bitcoin ETF, with approximately $62.8 billion in assets under management.

Since its launch in January, the fund has attracted over $44 billion in net inflows, and so far this week, it has logged around $674 million, per Farside Investors.

The ETF’s shares rose $1.04 during Friday’s trading session, reaching $58.66, according to Yahoo Finance data.

Share this article