Key Takeaways

- Brazil has introduced the first-ever XRP spot ETF, debuting on the B3 stock exchange.

- The ETF, managed by Hashdex, is set to track XRP’s price using the Nasdaq XRP Reference Price Index.

Share this article

The world’s first ETF that tracks the spot price of XRP, Ripple’s native crypto asset, officially debuted on Brazil’s main stock exchange B3 on April 25, according to a press release from Valor Econômico.

The fund, dubbed Hashdex Nasdaq XRP Fundo de Índice, or Hashdex Nasdaq XRP FI, is managed by Hashdex and administered by Genial Investments Securities Brokerage SA. Genial Bank SA is the ETF’s custodian.

The global asset manager secured greenlight from Brazil’s Securities and Exchange Commission (CVM) to launch the XRP-tied fund in February. The approval came after the securities regulator approved Hashdex’s spot Solana ETF last August.

Following regulatory approval, the fund entered into a pre-operational phase. During this phase, it was not yet actively trading but was undergoing preparatory steps.

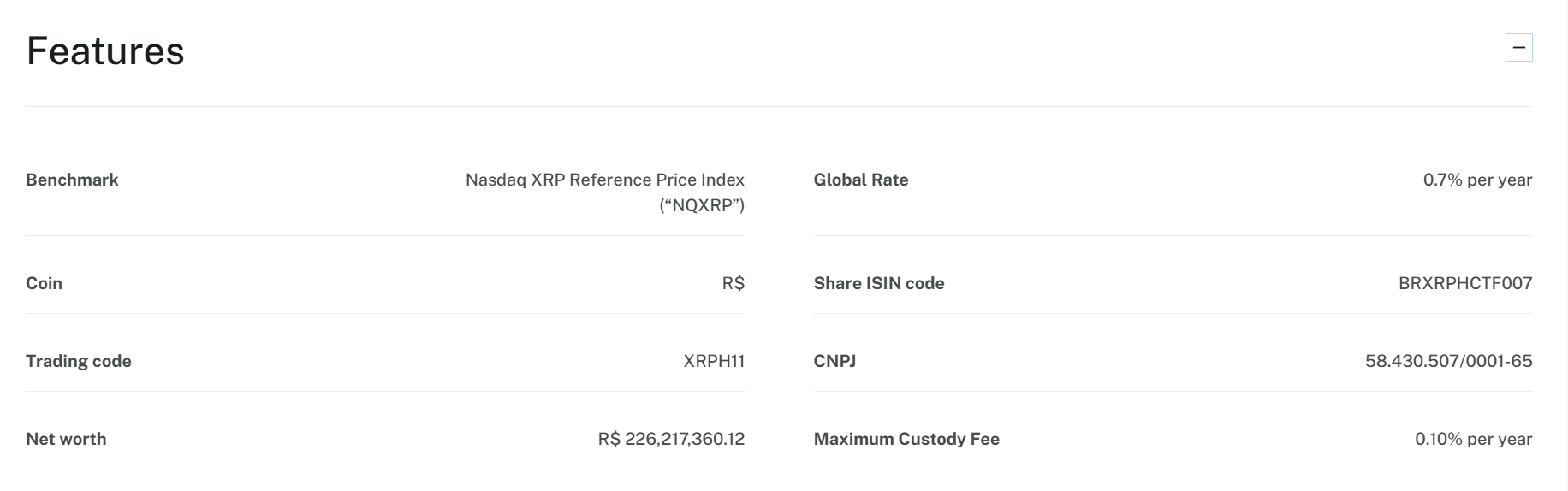

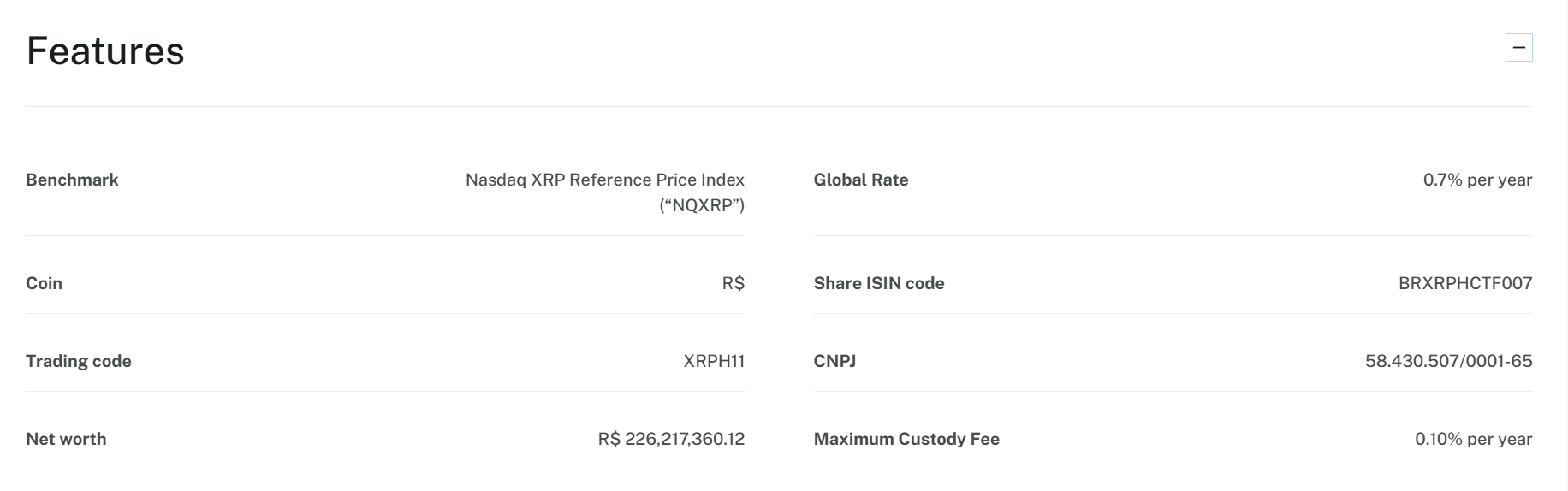

The ETF, now trading on B3 under the ticker XRPH11, replicates the XRP Reference Price Index (NQXRP), which tracks the spot price of XRP across major crypto exchanges, according to the fund’s documents.

The fund will invest at least 95% of its net assets in XRP and related digital assets, securities, or futures contracts linked to the index. As of the latest data, XRPH11’s net worth is nearly $40 million.

The ETF’s fee structure includes a maximum global fee of 0.7% annually for administration, management, and distribution, plus a maximum custody fee of 0.1% per year. No structuring fees apply to the fund.

With the launch of XRPH11, Hashdex has expanded its ETF lineup on B3 to nine products, said Samir Kerbage, CIO of Hashdex.

He added that the new fund is part of Hashdex’s mono-asset ETF group, which also includes BITH11, ETHE11, and SOLH11. These funds target sophisticated investors like institutions who want to develop crypto strategies on B3.

As Brazil debuts the world’s first XRP ETF, the US is expected to approve funds that track the world’s fourth-largest crypto asset soon.

If approved by the SEC, spot Solana and XRP ETFs could draw up to $14 billion in investments, as estimated by JPMorgan analysts.

Share this article