Key Takeaways

- The OM token from MANTRA crashed by 90% on Sunday.

- The crash allegedly wiped out over $10 billion in market capitalization, with claims that the team held 90% of supply.

Share this article

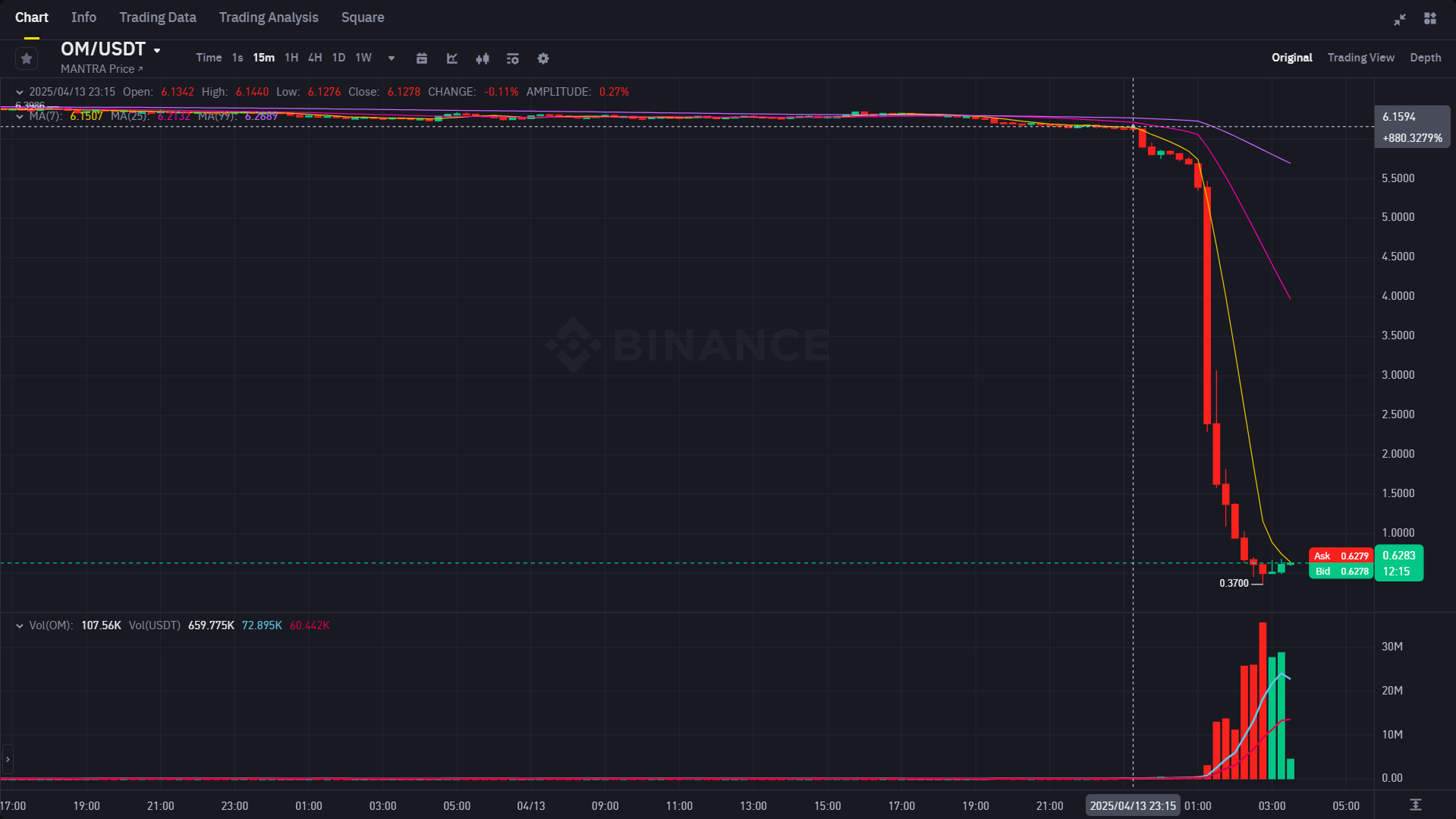

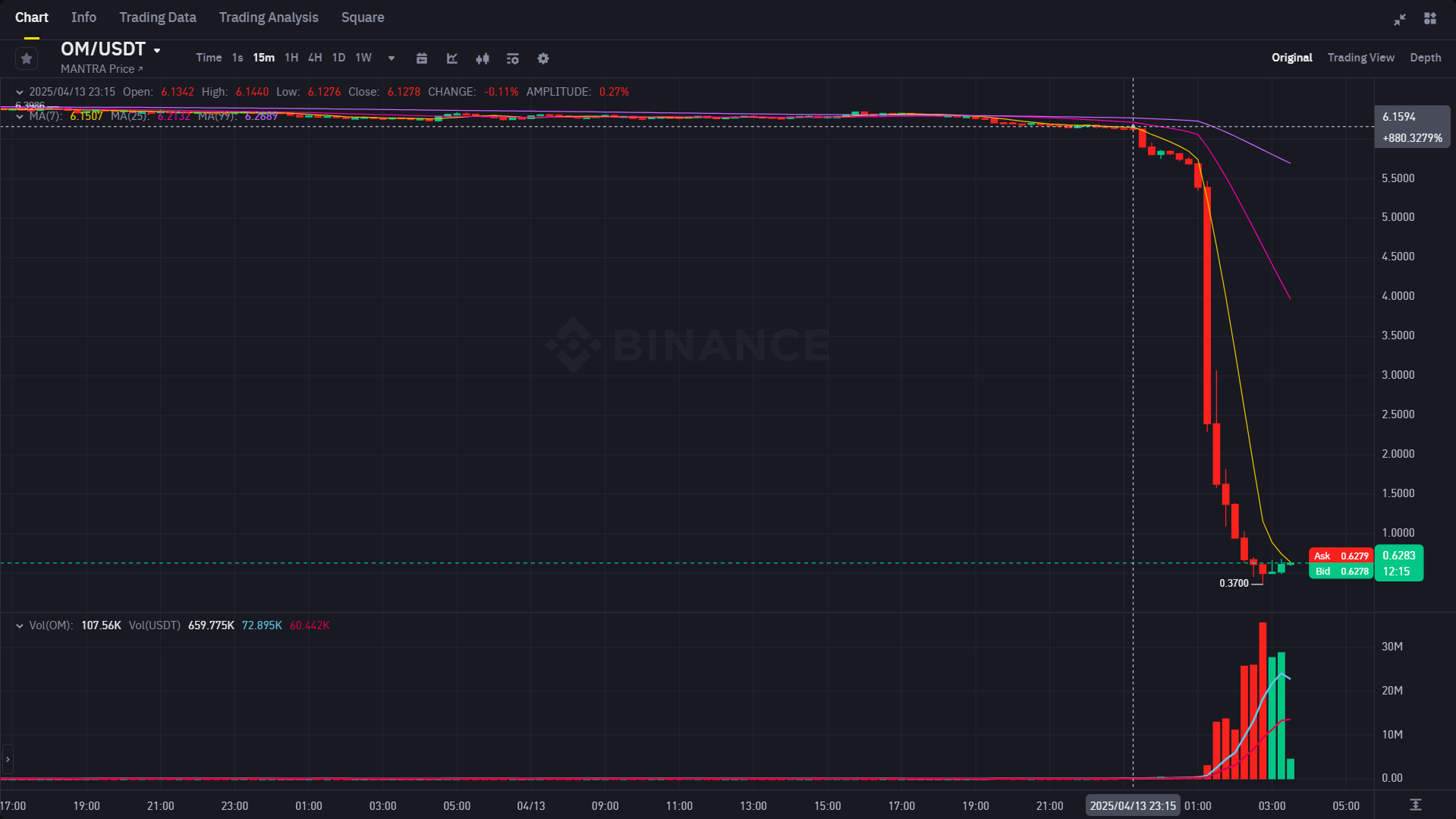

OM, the native token of the MANTRA ecosystem, nosedived as much as 90% in just four hours, erasing billions in its market value, according to data tracked on Binance.

OM’s price crashed from above $6 to $0.37 on April 13, wiping out nearly all of its gains since its meteoric rise from $0.0158 in January 2024. The token reached a peak at $9 earlier this year.

At the time of reporting, OM traded at above $0.6, down approximately 93% from its all-time high.

Although the reason for the steep drop is not yet confirmed, speculation points to the project team potentially unloading their tokens.

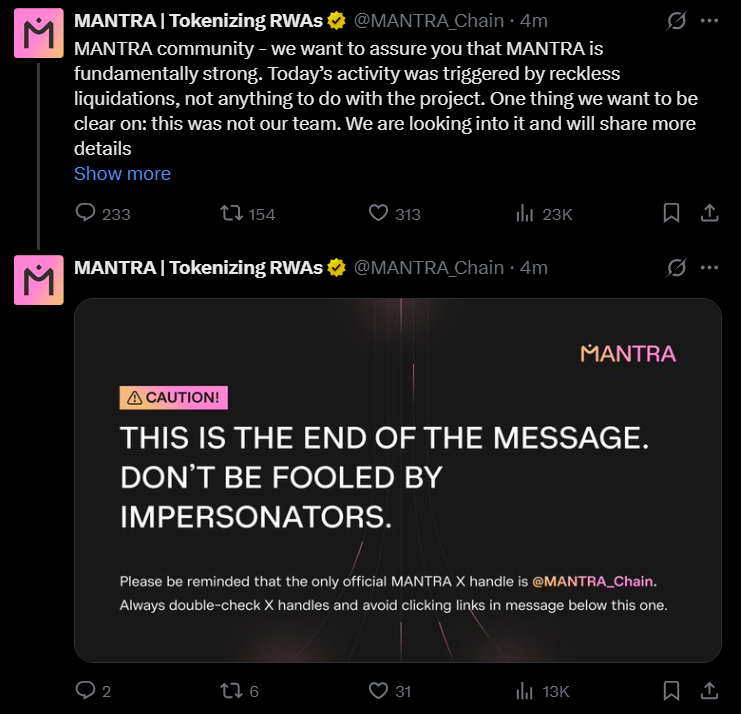

MANTRA denies involvement, pointing to massive forced liquidation

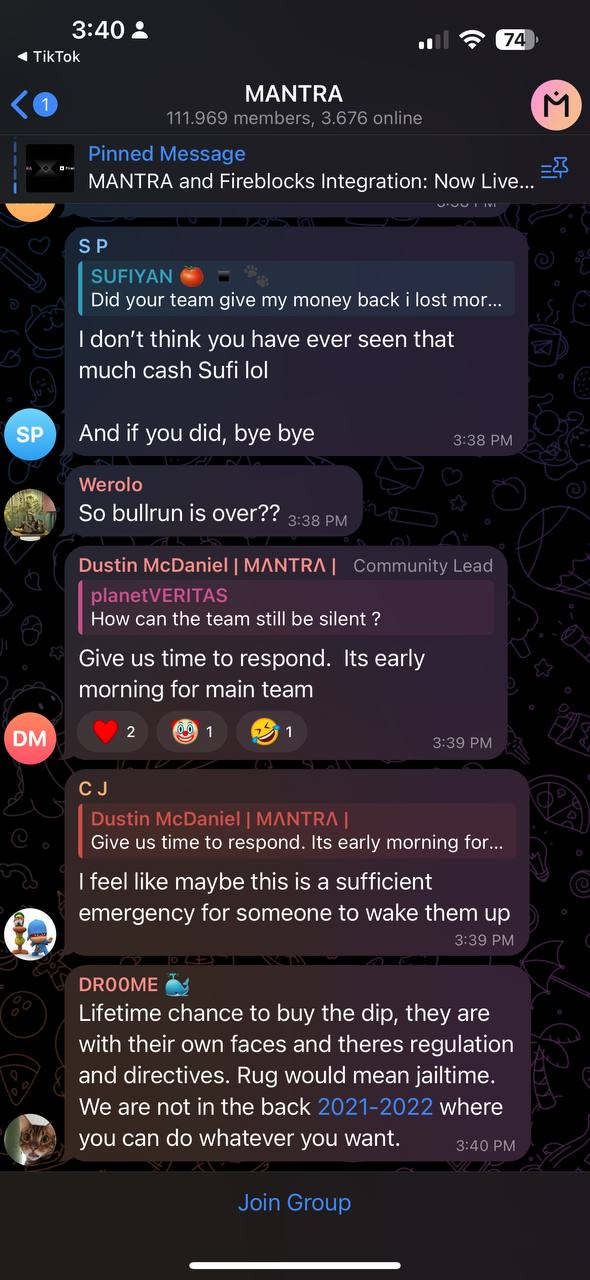

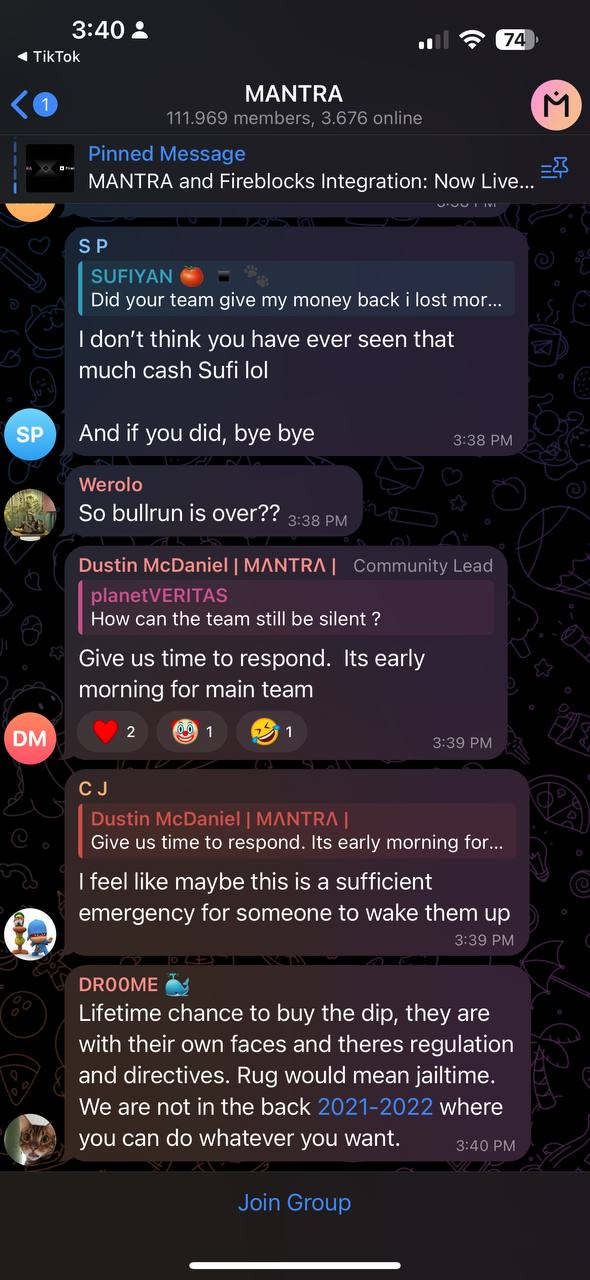

Dustin McDaniel, MANTRA’s community lead, addressed on the project’s Telegram channel that the core team is aware of the community’s concerns and is working on a response. The project’s Telegram group is currently closed to new members.

MANTRA has denied involvement in the OM token’s 90% crash, blaming “reckless liquidations” for the sudden drop. In an official statement, the team said the sell-off was not triggered internally and pledged to share more details soon.

In a live X Space after OM’s collapse, MANTRA co-founder John Mullin called the situation “unprecedented,” citing massive forced liquidation on an undisclosed exchange.

“I literally woke up about 30 minutes ago into this,” Mullin said. “It’s honestly unprecedented and we’re still figuring out exactly what’s going on, but I can tell you, we’re still here and we’re gonna sort it out.”

“From my understanding, it seems like there was a massive force liquidation on an exchange over the weekend,” Mullin said during the Space. “I won’t name the exchange yet, because we’re starting to get exactly why they did what they did.”

He explained that the exchange “took over a bunch of different positions and completely just closed them out,” though the reasons behind that move are still under investigation.

MANTRA is a key player in the real-world asset (RWA) tokenization space. The project has gained attention through partnerships with Google Cloud and Dubai’s DAMAC Group.

This is a developing story.

Share this article