The Nintendo Direct April 2, will see Nintendo drop its first big console in nearly a decade. The Nintendo Switch 2, expected in 2025, carries a heavy legacy.

With over 150 million units sold since 2017, the original Switch is a tough act to follow. The stakes are dominance in gaming, which is the lifeblood of Nintendo’s revenue.

Me watching the Switch 1 presentation in 2017 vs Me watching the Switch 2 direct in 2025 pic.twitter.com/Dr2A9WomI0

— Sharky! |

SWITCH 2 (@SwitchSharky) March 23, 2025

So far many gamers are pessimistic: “I think we are going to be let down big time by Nintendo,” one X user said. “The reality is that dev costs keep increasing and games keep taking more and more time to complete. Their new R&D building is delayed to 2028.”

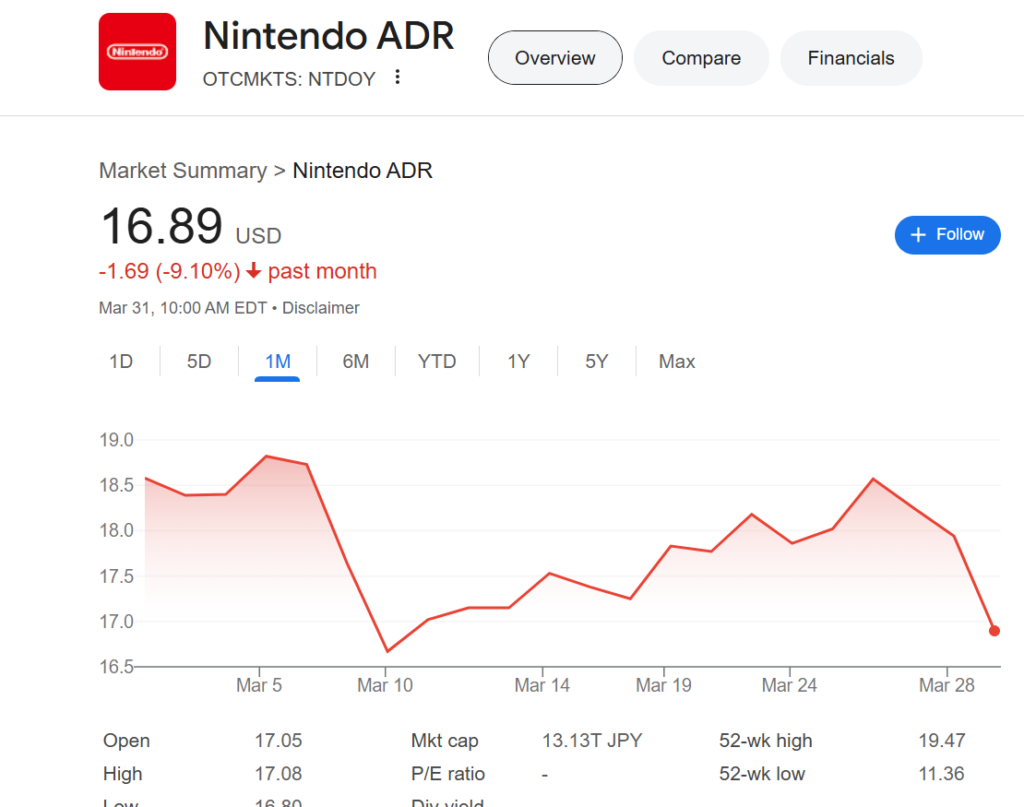

Should you be buying Nintendo stock or shorting it before tomorrow’s announcement?

Should You Short Or Buy Nintendo Stock Before Nintendo Direct April 2?

Historically speaking, you should short Nintendo stock. Every other console release has been a commercial failure for Nintendo since the GameCube.

- GC (flop)

- Wii (success)

- Wii U (flop)

- Switch (success)

- Switch 2 (?).

The macro stage is set for upheaval as Trump unveils his tariff plan Tuesday, sending shockwaves through global markets. On the brighter side, Nintendo’s Switch 2 seems assured of long-term success.

GC was a failure because it was outright hostile to third-party developers. WiiU was a failure because it was horrifically underpowered and branded, which confused parents into thinking it was just an expansion for the Wii and not its own thing.

Right now, the Switch store is easily the friendliest of the big 3 to third-party and indies (perhaps to a fault, given the deluge of slop), and Switch 2 seems to be toning down gimmicks, if anything. The only way we see Switch 2 flopping is if they don’t distinguish it enough (i.e., not enough of a hardware bump) or completely drop the ball on new first-party titles.

Already confirmed games:

- Mario Kart 8 Switch 2 Edition

- Metroid Prime 4

- Super Mario Odyssey 2

- Assassin’s Creed: Shadows

- Pokémon Legends: ZA

- MGSD: Snake Eater

Hopes:

- Master Chief Collection

- Breath of the Wild Trilogy

Why the Nintendo Switch 2 Matters

The Switch reshaped gaming like nothing before. Its dual-home and portable design killed two consoles, the Wii and DS, and built one of history’s most profitable hardware lines. Sales hit $100 billion. Investors couldn’t get enough.

But success can corner you. Sony and Microsoft can afford hardware stumbles. Nintendo can’t. Its dreams rest on its innovations.

It’s also important for the GameFi sector, with companies like Sui, which will soon launch the SuiPlay0X1, a Switch-like device.

The Stakes for Success

For Nintendo, failure isn’t an option. With no backup console to fall back on, the Switch 2 must hit it out of the park. Its debut will directly impact whether the company can sustain the momentum it has built over the past decade.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The Nintendo Direct April 2, will see Nintendo drop its first big console in nearly a decade. The Nintendo Switch 2, expected in 2025 carries a heavy legacy.

- It’s also important for the GameFi sector, with companies like Sui, which will soon launch the SuiPlay0X1, a Switch-like device.

The post Nintendo Direct April 2: Should You BUY or SHORT Nintendo Before Tuesday? appeared first on 99Bitcoins.