The U.S. Securities and Exchange Commission (SEC) has rescinded Staff Accounting Bulletin No. 121 (SAB 121) a rule that had been deterring banks from offering bitcoin custody services.

This is a big deal for the entire digital assets space, and now traditional financial institutions can get more involved with Bitcoin.

SAB 121 was introduced in March 2022 during Gary Gensler’s tenure as SEC Chair.

It required financial institutions to record digital asset assets held for customers on their balance sheet as liabilities. The rule was meant to address bitcoin custody risks especially in the event of bankruptcy.

But the rule quickly became a lightning rod for criticism.

The Bitcoin advocates and financial industries argued it was too onerous and would prevent banks from getting into the Bitcoin space entirely. SEC Commissioner Hester Peirce, a long time critic of the rule, called it a “pernicious weed”.

The policy was also opposed by lawmakers. House Financial Services Committee Chair French Hill called SAB 121 “misguided,” saying, “Holding reserves against the assets held in custody is NOT standard financial services practice.”

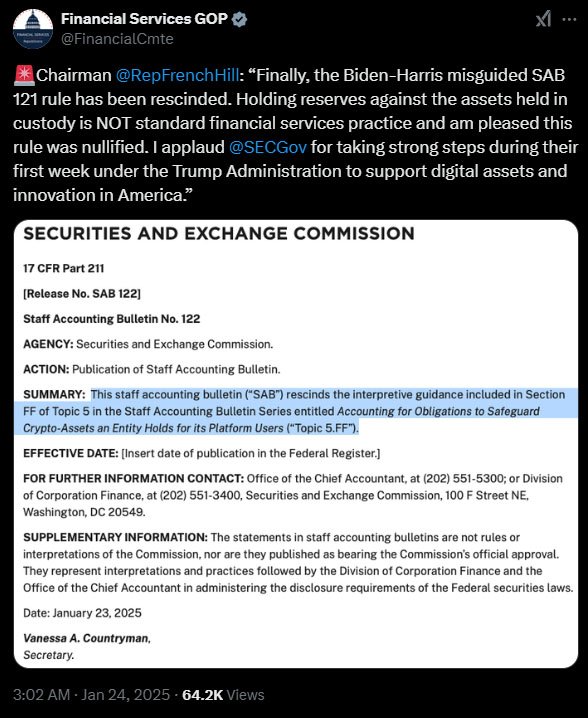

And now, as of January 23, 2025, SAB 121 is repealed with a new SEC leadership. Acting SEC Chair Mark Uyeda, appointed by President Donald Trump, was the one who pulled the trigger.

Uyeda has been opposed to SAB 121 for a long time and called its removal a step towards a more collaborative and innovation-friendly Bitcoin regulation.

In a humorous tweet, Hester Peirce bid SAB 121 farewell on social media, saying, “Bye, bye SAB 121! It’s not been fun”.

Senator Cynthia Lummis, a Bitcoin-friendly lawmaker, called SAB 121 “disastrous” for the banking industry and a roadblock to innovation in the digital assets space.

The rescission of SAB 121 is part of a broader effort to create a more balanced Bitcoin regulatory environment. Under Gensler’s leadership the SEC has relied on enforcement actions to regulate the Bitcoin space without providing clear guidance.

This has been criticized as inconsistent and innovation stifling.

Uyeda and other new leaders at the SEC are moving away from this enforcement heavy approach. Instead, the agency has created a new task force led by Peirce to develop clearer and more practical regulatory frameworks for the industry.

Banks and other financial institutions can now offer bitcoin custody services without the baggage of SAB 121. This will speed up mainstream adoption of Bitcoin.

Now regulated banks and financial institutions can be custodians for bitcoin, so they can safely manage and store digital assets. This should improve security and trust, especially for people who don’t want to manage their own digital wallets.

Institutional custody will also reduce the risk of losing private keys and provide more financial inclusion for those who don’t want to deal with hassles of digital wallets. This, of course, comes with the downside of reduced privacy.

But the decision ultimately falls on the people, and its nice to have both options available.

While the Bitcoin community is generally happy, not everyone is. Some say the more traditional banks get involved in bitcoin custody the more it goes against the decentralized principles of the scarce digital asset.