Japan’s interest in Bitcoin is growing and Value Creation, a real estate company listed on the Tokyo Stock Exchange, just purchased 8.02 bitcoin.

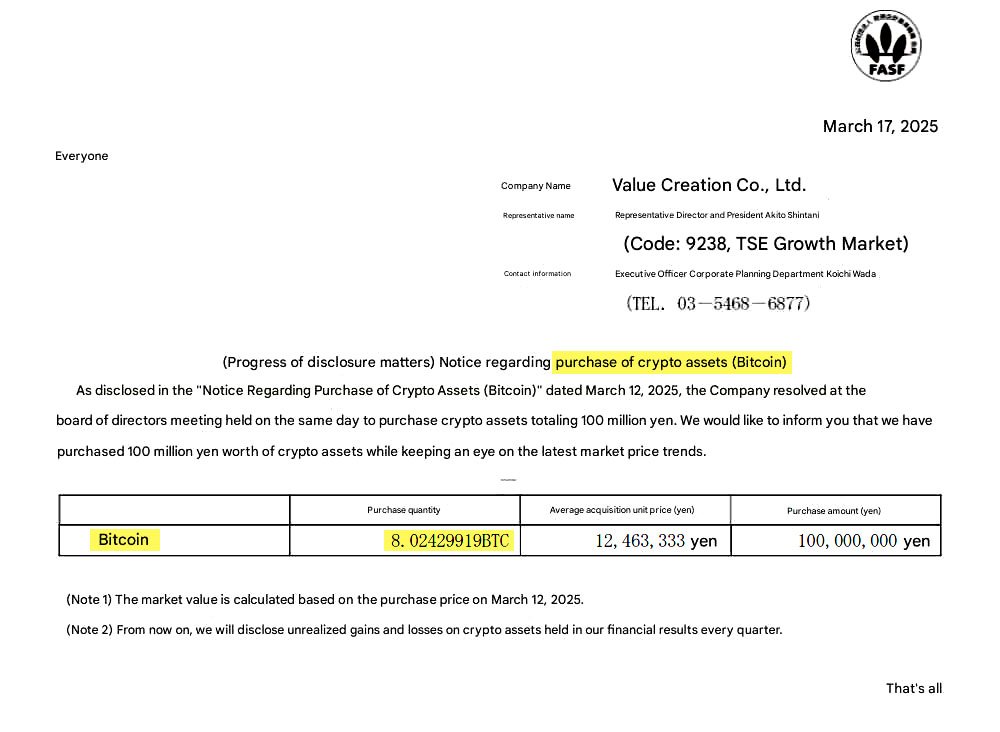

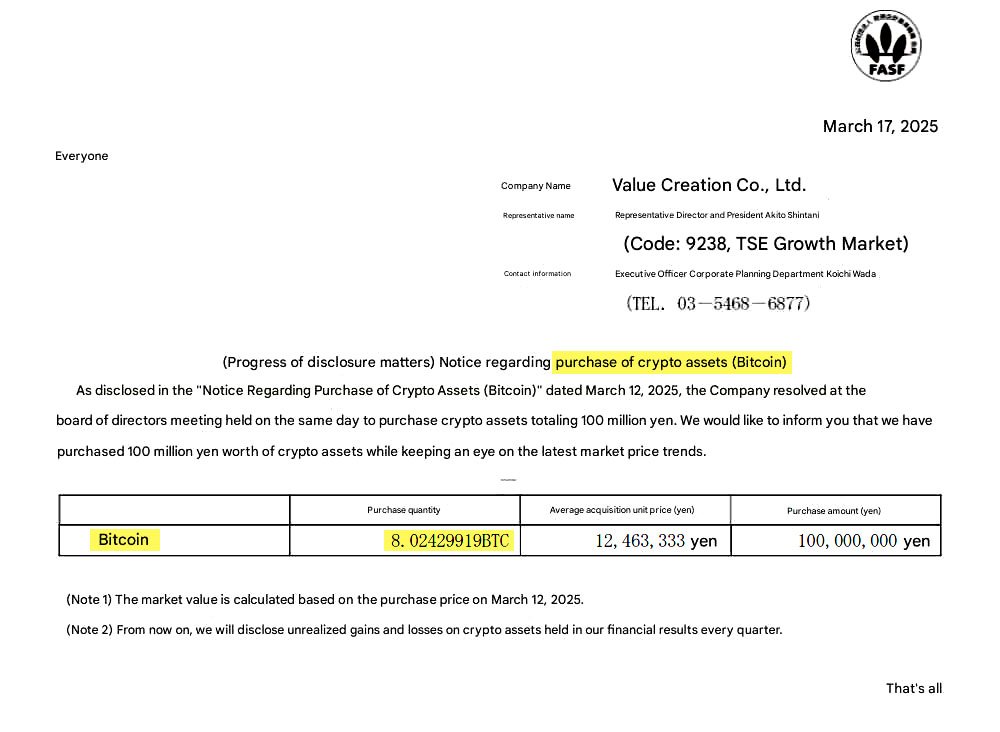

The company paid around 100 million yen (670,000 USD) to buy the digital currency at an average price of 83,110 USD per BTC. This is a big change in how traditional Japanese companies view bitcoin, treating it as a financial asset.

The Value Creation board of directors approved the bitcoin purchase on March 12 and the acquisition was completed on March 17.

The company, which focuses on real estate and digital transformation, previously had reservations about investing in digital assets. But after reevaluating the potential of bitcoin, Value Creation decided to go for it.

“Crypto assets are now appearing worldwide as digital currencies,” the company said.

“It is now clear that Bitcoin is no longer just a speculative asset. It’s establishing value. And it will continue to grow despite short term fluctuations.”

After the announcement, Value Creation’s stock price jumped 67% to over 1,600 yen before correcting to 1,397 yen, showing investors’ confidence in the company’s financial future.

Value Creation is not alone in its bitcoin investment strategy. Other Japanese companies are also buying in:

- Metaplanet, another Tokyo listed company, has set a target to buy 21,000 BTC by 2026. The company has already raised 26 million USD through bond issuances to fund these purchases.

- SBC Medical Group, a healthcare services provider, plans to buy 1 billion yen (6.7 million USD) worth of bitcoin to hedge against inflation and diversify its assets.

- Remixpoint, a former digital asset exchange operator, invested 3.2 million USD in bitcoin earlier this year.

- Gumi Inc., a mobile game studio, bought 1 billion yen worth of bitcoin in February 2025.

Japanese companies are following a global trend of corporations and institutions diversifying their financial assets with bitcoin.

One of the main reasons companies are buying bitcoin is because it’s being seen as ‘digital gold’. With traditional currencies facing inflation and economic uncertainty, businesses are seeing bitcoin as a hedge against financial instability.

Related: US Treasury Cites Bitcoin as “Digital Gold” in FY 2024 Q4 Report

A Value Creation representative cited major financial institutions like BlackRock as proof that bitcoin is now a real asset. “Institutional support is growing,” the representative said, “Bitcoin is not just speculation, it’s a financial instrument.”

Japan has been a pioneer in Bitcoin adoption.

It was one of the first countries to legalize bitcoin as a form of payment and its regulatory environment has fostered responsible growth in the industry. With more Japanese companies buying bitcoin, Japan is becoming a key player in the global Bitcoin space.