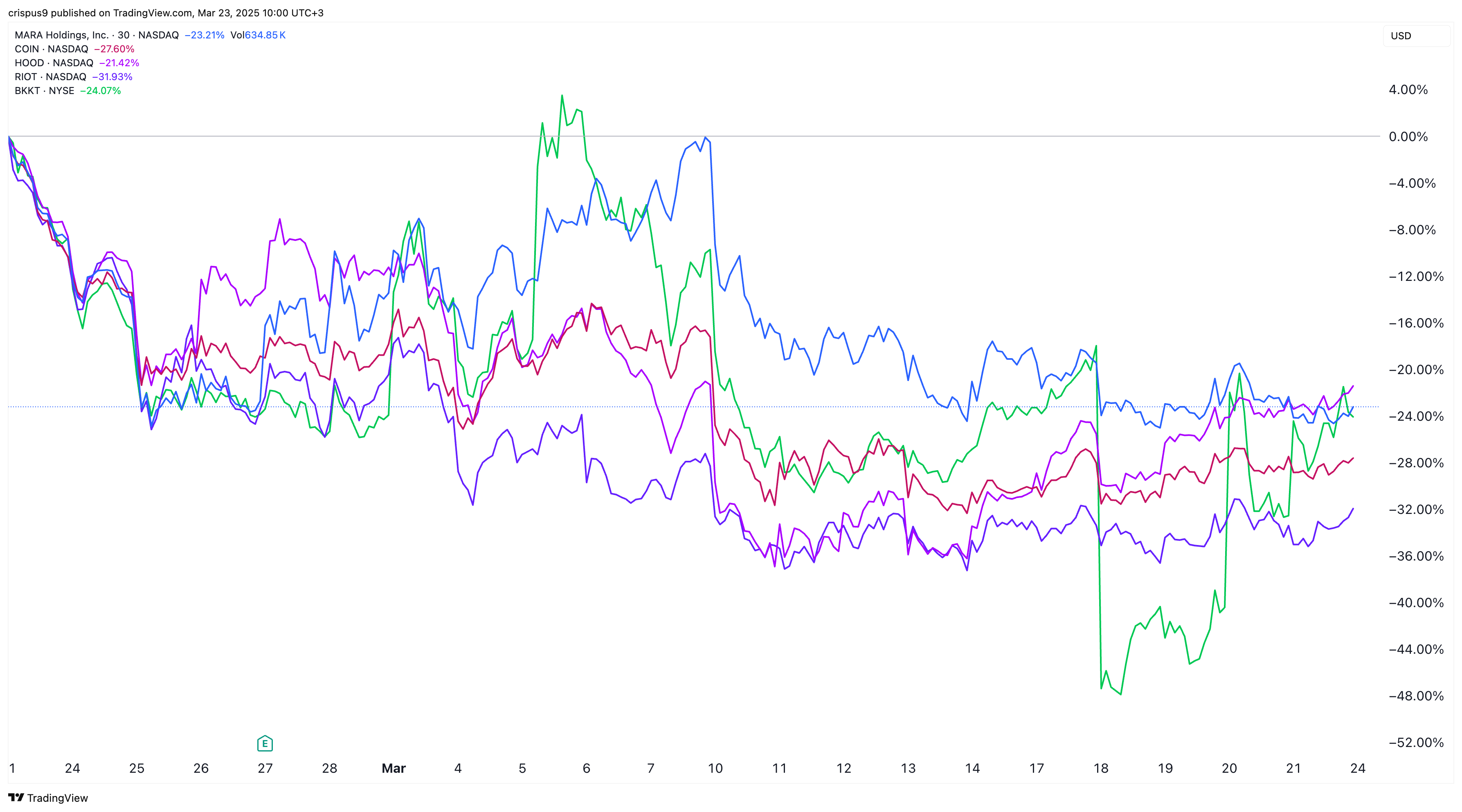

Crypto stocks are caught in a brutal free fall, mirroring the market-wide slump in Bitcoin and altcoins.

Coinbase, the biggest crypto exchange in the U.S., has crashed from nearly $350 per share in November to $190. This decline has brought its market cap from $86 billion to $48 billion—a $38 billion wipe out.

Michael Saylor’s Strategy, has also shed billions of dollars in value. Its market cap dipped from a high of $106 billion last year to $79 billion today. The company, formerly known as MicroStrategy, has continued to accumulate Bitcoin and now holds 499,226 Bitcoins in its balance sheet.

Robinhood stock crashed from $66.85 earlier this year to $45, erasing $18 billion in value. While Robinhood is known for providing retail trading, it has become a major player in the crypto market. It hopes to play a bigger role in the sector when it completes its BitStamp acquisition later this year.

Bitcoin (BTC) mining stocks have also plunged as the struggling BTC price hurts margins. Mara Holdings, formerly known as Marathon Digital, has lost over $4.6 billion in valuation. Other similar companies like Riot Blockchain, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf have also shed billions in valuation.

Bitcoin, altcoin prices plummet

These crypto stocks have dropped because of the ongoing decline of Bitcoin and other altcoins. According to CoinMarketCap, the market cap of all cryptocurrencies has dropped from over $3.7 trillion in 2024 to $2.7 trillion today.

Bitcoin has dropped from $109,300 in January to $85,000 at last check. Most altcoins have done worse. For example, Solana meme coins have shed over $18 billion in value as their combined market cap sank.

Crypto prices and crypto stocks have dropped despite the Trump administration’s pledge to be highly supportive of the sector via initiatives like a Strategic Bitcoin Reserve.

The Securities and Exchange Commission has also enacted some friendly policies and ended most of the lawsuits in the industry. It has ended lawsuits brought on companies like Coinbase, Ripple Labs, and Kraken.

Whether these crypto stocks bounce back remains to be seen. Crypto analysts have a mixed outlook on the industry. Some observers expect Bitcoin’s price to recover, with Standard Chartered predicting it will hit $500,000 over time.

Ki Young Ju, CryptoQuant’s founder, estimates that the crypto bull run has ended, noting that all indicators were bearish.